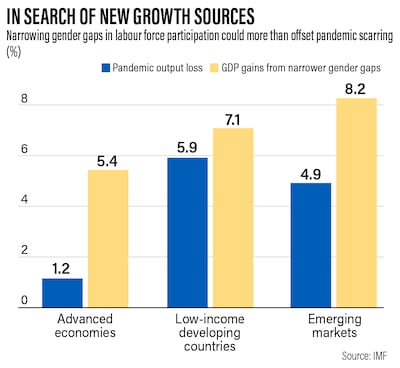

Narrowing the gap between the number of working men and women can boost emerging and developing economies' gross domestic product by about 8 per cent over the next few years, according to the International Monetary Fund.

Raising the rate of female labour force participation by 5.9 percentage points in these countries will help drive inclusive growth amid the world's weakest medium-term economic growth outlook in more than three decades, the IMF said on Wednesday.

Global growth is expected to languish at just 3 per cent over the next five years but closing the gender gap in labour force participation can help countries gain "substantial" returns.

Only 47 per cent of women are active in today’s labour markets, compared with 72 per cent of men, according to the Washington-based lender.

The average global gap has fallen by only 1 percentage point annually over the past three decades and "remains unacceptably wide".

"With traditional growth engines sputtering, many economies are missing out by not tapping women’s potential," the fund said.

"To blame are unfair laws, unequal access to services, discriminatory attitudes and other barriers that prevent women from realising their full economic potential. The result is a shocking waste of talent, leading to losses in potential growth."

Gender gaps continue to persist in education, health, work, wages and labour participation across developed and developing countries.

This is despite numerous studies that have highlighted the economic case, in addition to the basic human rights argument, for gender equality.

A report by the World Economic Forum in June showed that women will not achieve equality with men globally for another 131 years, with only tepid progress made in closing stubbornly large gender gaps, prompting the urgent need for action.

For the 146 countries covered in the 2023 index, the economic participation and opportunity gap has closed by 60.1 per cent, according to the WEF report.

Research reports consistently underscore the economic benefits of gender equality.

Reducing the current wage and employment gap between men and women may boost the GDP of developed and emerging markets by 5 per cent to 6 per cent, Goldman Sachs said in a July report.

Closing these gaps completely could result in a 10 per cent GDP boost for developed market economies, rising to 13 per cent in emerging markets, it said.

The increasing participation of women in Saudi Arabia's workforce is expected to boost the country’s economy by $39 billion, or 3.5 per cent, by 2032, if the current rate of growth continues, S&P Global Ratings said earlier this month.

Raising the rate of female labour force participation in emerging and developing economies by 5.9 percentage points equates to the average amount by which the top 5 per cent of countries reduced the participation gap during 2014 to 2019, the IMF said.

That is more than the economic “scarring” or output losses inflicted on countries by the Covid-19 pandemic, the fund's data showed.

Complementing measures to narrow gender gaps with other reforms, such as improving governance, strengthening institutions and unlocking capital for investment, will "greatly amplify" these returns, it said.

However, current policies "do not come close" to closing gender gaps.

Without a "significant step up" in policy efforts, gender gaps may in fact never close, the IMF said in a research paper earlier this month.

"Absent a strengthened and systematic policy effort, some of the current misallocation of women’s talents and abilities could persist perpetually," it said.

While countries have made progress in increasing women’s participation, economies of all income levels experienced several setbacks – a result of shocks, crises and policy reversals, according to the IMF's analysis of three decades of data.

The pandemic, for example, has eroded progress closing gender gaps, especially for women with young children.

Such setbacks hinder and often reverse progress toward gender equality, the IMF said.

As a result, gender gaps in labour force participation will narrow but never close if countries continue with current policies.

"Countries must step up efforts to break down barriers to women’s participation in the labour market – such as limited access to education, health, assets, finance, land, legal rights, and care services," the IMF urged.

"They should systematically take account of how macroeconomic, structural, and financial policy packages impact women."