Dubai Investments has sold a 50 per cent stake of its wholly-owned subsidiary Emirates District Cooling (Emicool) to investment firm Actis, at a corporate valuation of $1 billion and equity valuation of $653 million, it said on Tuesday.

The new ownership structure will help the utility, which provides sustainable district cooling services, to expand its operations across the Middle East and North Africa, Dubai Investments said in a statement to the Dubai Financial Market, where its shares are traded.

The deal marks one of largest transactions in the district cooling industry in the Middle East and North Africa, the statement said.

Over the years, as the sole owner of the company, Dubai Investments focused on "re-engineering the cost of operations, invested in plant development, enhanced technological know-how and created a strategic asset that has added significant value to the UAE’s district cooling sector and we are optimistic it will grow further with Actis onboard now", said Khalid bin Kalban, chief executive of Dubai Investments.

"This divestment deal [is] ... a part of the company’s robust plans towards implementing a prudent approach to asset management, facilitating efficient recycling of capital to invest in future growth."

District cooling companies, growing at a rapid pace in the Middle East, deliver chilled water through insulated pipes to offices, residences and industrial buildings to run air conditioning systems.

They also offer increased energy efficiency and higher reliability – district cooling saves up to 35 per cent of energy compared to traditional air-conditioning systems, according to Emicool.

The size of the Middle East's district cooling sector is projected to grow at a compound annual growth rate of more than 9 per cent between 2022 and 2028, having touched the $4bn mark in 2021, research by data provider Global Market Insight found.

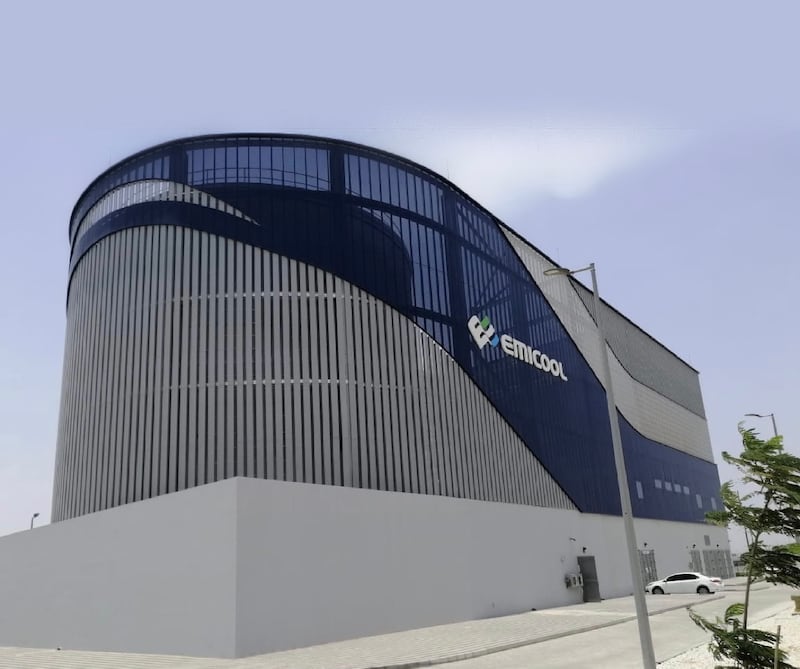

Emicool, founded in 2003, connects 2,200 buildings in the UAE, offering services in areas including Dubai Investments Park, Dubai Motor City, Dubai Sports City, Uptown Mirdif and RTA metro stations (Expo line).

Dubai Investments fully acquired Emicool after buying a 50 per cent stake in the utility from Dubai's Union Properties for $136m in January 2018 to boost its portfolio in the sector.

Actis, which invests in sustainable infrastructure and has raised $24bn in capital since its inception in 2004, said the joint venture will focus on further developing Emicool's services and customer relations.

“Actis also sees a clear opportunity for Emicool to become a regional leader in sustainable district cooling and related services," said Adrian Mucalov, partner at the company.

Dubai Investments, which has total assets of around Dh22bn, is currently pressing ahead with international expansion plans, Mr Bin Kalban told The National in February.

The company, in which the Investment Corporation of Dubai holds an 11.54 per cent stake, is “positive” about its performance this year after a strong 2021 amid the UAE’s economic recovery, he said.