In Learning from Gulf Cities, the exhibition of urban photography that recently opened at New York University Abu Dhabi, the show's curators insist that rather than being exceptional, the cities of the Arabian Gulf are merely particularly extreme examples of widespread global trends. If that is the case, then similar rules would also seem to apply when it comes to Makkah, the city on the other side of the Arabian Peninsula that occupies an exceptional place in the hearts and minds of 1.8 billion Muslims worldwide.

With an estimated population of 1.5 million, Makkah is the product of forces that combine the local and the global, modernity and tradition, and the sacred and the profane, in ways that are ostensibly unique. More than 1.8 million Muslims performed Hajj in 2016 and, according to the Kingdom of Saudi Arabia’s Vision 2030 plan, more than 15 million Muslims are expected to perform Umrah annually by the year 2020 and more than 30 million by the year 2030.

Last year, more than 8 million visitors performed Umrah during the holy month of Ramadan alone.

The result is not only landmark projects such as the Abraj Al Bait, a cluster of seven skyscrapers that culminate in the 601-metre-tall Makkah Royal Clock Tower, but the development of informal settlements that are estimated to house approximately 40 per cent of Makkah's total population, large numbers of whom are pilgrims who have remained in the city and now constitute a significant proportion of migrant labour.

Both sides of this remarkable urban transformation have been recorded by the Saudi artist and photographer Ahmed Mater since 2008, in a series of works that are about to go on display in an exhibition at the Brooklyn Museum.

"What started as a desire to show only the changes taking place has ended with a full and exhaustive depiction of a site that can be accessed only by those of the Islamic faith," the artist explains in statement that accompanies Ahmed Mater: Makkah Journeys.

“This collection of images, with their diverse and extreme points of reference, represents the deliberately experimental, meandering, and serendipitous nature of my journey to the heart of Makkah. They are testaments to the cultural and political conditions of contemporary Saudi society.”

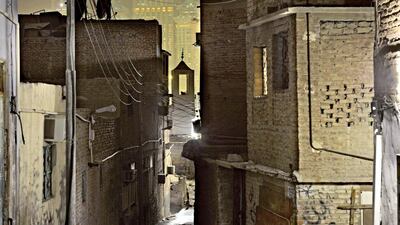

Featuring large-scale photographs from his 2016 project Desert of Pharan: Unofficial Histories Behind the Mass Expansion of Makkah, the exhibition also includes more intimate portraits of the city's diverse inhabitants, workers and migrants, who are drawn from more than 80 nationalities, while chronicling the influx of wealth that is transforming the city.

As is so often the case in the history of urban photography, it is often the seemingly extraordinary visions of a culture that end up being the most enduring and formative, and it seems that Mater’s photographs will come to define how the public see and understand Makkah at this pivotal moment in its history.

As Makkah is inevitably transformed in the coming decades, Mater’s haunting shots of the city’s traditional backstreets will surely perform a similar role to the images of old, pre-Haussmann Paris that were created by the photographer Charles Marville in the 1860s, which simultaneously captured the disappearance of one way of life and the emergence of others.

“I need to be here, in the city of Makkah, now, experiencing, absorbing, and recording my place in this moment of transformation, after which things may never be the same again,” states Mater, a trained physician who abandoned his career in medicine to become a full-time artist.

“It has become important for me to identify with this place and to understand how this constellation of change, as well as the forces that are shaping it, will affect the community of which I am a part.”

In documenting its specific patterns of wealth and luxury, migration and labour, the artist shows that even in this most unique of cities it is the familiarity and commonality of the urban experience that is the true revelation. Extreme, yes. Exceptional, certainly, but Mater’s vision of Makkah is also undeniably humane.

Ahmed Mater: Makkah Journeys runs at the Brooklyn Museum from December 1 to April 8. For more details, visit www.brooklynmuseum.org

__________________________

Read more:

NYUAD exhibition shows the global influence of the Gulf's cities

Art Jameel launches major commissions programme for new, Dubai-based works

Not alone, but first: Saudi women curate British contemporary art

__________________________