Saudi Arabia needs more performance venues and better professional practices for its nascent music industry to reach its full potential, industry insiders claim.

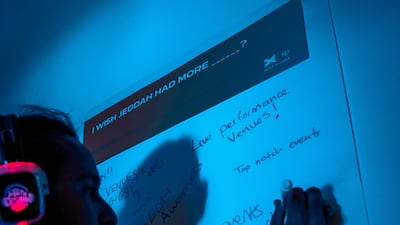

These were some of the takeaways from XChange Sound, the first of a series of discussions organised by entertainment company MDL Beast.

The inaugural event took place at Hayy Jameel in Jeddah on Wednesday and will move to Riyadh in September, before Dubai in October.

Each event brings industry professionals and talent together to discuss ways to improve and expand Saudi Arabia's music ecosystem, as well as the wider Mena region’s.

The findings from the discussions will be presented to music industry and regional government delegates at the XP Music Futures conference in Riyadh, which runs from November 28 to 30.

The workshops are the latest initiative from MDL Beast, the parent company behind dance music festival Soundstorm and electronic music label MDL Beast Records.

The company’s director of strategy Nada Alhelabi tells The National it is imperative to have these exchanges featuring seasoned and aspiring talent.

"That's because we are building and thinking about the future of the music scene," she says. "We want to think about what we need to ensure the industry here is healthy and sustainable.

"With more events popping up in Riyadh, for example, we need to ask ourselves how we can create more venues. How can we have the right licensing deals? How can talent have more opportunities to perform? This applies to the general music industry here in the region.

“So when we come to Dubai, for example, we will focus our discussions about various policies regarding music rights, copyright, publishing and all these kinds of subjects.”

Music venues bring artists together

While the discussions in Jeddah featured Saudi artists and are based on their experiences, some of the challenges and opportunities presented by the kingdom’s music scene echo those of artists in other Mena countries, such as the UAE and Lebanon.

A key point raised within the four breakout sessions is the need for more music venues catering to local artists.

"The only time we see significant increase in the followership of our artists is when they are playing live, as opposed to them simply releasing music online," says Mostafa Fahmy, marketing director from Jeddah music label Wall of Sound during the XChange Sound sessions.

"While music videos do bring some attention, it is only when people see the artist sweating on stage and doing their job they immediately connect with them and that's how fan-bases are built.”

Rapper and producer Nashmi believes music venues also serve a bigger purpose than performance opportunities.

"It's about creating a collective space where we can all gather and see different music," he says. "It is in places like these that you can meet other people with different but interesting tastes and then maybe you can collaborate together.

“These smaller venues, in my opinion, are more important than big genre-specific festivals because it brings everyone together.”

Music venues also provide more agency to independent artists as they build their careers.

“It will allow me, for example, to book a place for a single or album launch,” says hip-hop artist Lil Eazy. “At the moment I can’t create my own event because of the lack of spaces and the permits involved.

“Instead I will have to wait for a Sandstorm festival or a show at Jeddah or Riyadh Season. While I am grateful for the opportunities, this is not ideal.”

Studying the music business

XChange Sound also had discussions about an apparent "lack of professionalism" inherent within the Saudi music industry, especially when it comes to artist management.

The delegates agreed wholeheartedly with the notion that such positions should be handled by those with industry knowledge.

"Rule number one: never hire family members or friends just because they are close to you," Nashmi says.

Asim Jaan, the manager of Saudi RnB singer Hamza Hawsawi, called for music business management to be studied as a course in universities and academies.

"It's a field that requires specific and important skills. We are talking about handling negotiations, being good with numbers, the ability to work under pressure, being patient and spotting future opportunities," he says.

"On top of that, you are also dealing with creative people who can often be moody. They need support and encouragement. So there are a lot of ingredients to the role.”

While these salient points will be factored into the programming and masterclasses of the XP Music Futures conference later in the year, artists are encouraged to be more proactive in the meantime.

This is what pushed Saudi hip-hop dancer and choreographer Khadija Alsheikh to come to XChange Sound.

“I wanted to connect with other people here and see how I can contribute to the culture and move it forward, because at the end of the day this is really what it is all about,” she tells The National.

“On a personal note, my goal is to incorporate more music into what I do as a dancer. So I wanted to come here and meet other musicians and producers and when I feel confident to step out of my comfort zone and begin that part of my creative journey, I know who I can reach out to.”

Keep on pushing

XChange Sound ended with live sets by two of Saudi Arabia's most seasoned electronic music acts: DJ Vinyl Mode and electronic music producer and vocalist Fulana.

"It is unbelievable what is happening here in Saudi because we are seeing a lot of our dreams coming to reality," said Vinyl Mode, real name Mohannad Nassar, before his performance. "But at the same time, we still have to keep building and we need to work.

"We waited for so long for the music to emerge from the underground to where it is now. But now that we are here, what are we going to do about it? How are we going to structure it? As Saudi artists we can’t just be sitting at home and hoping for things to happen.

“We have to keep working and pushing."

More information on XChange Sound is available on the XP Music Futures Instagram account.