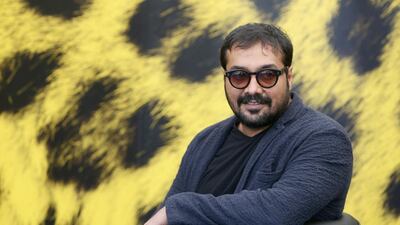

Fresh from his newly released and controversial co-production Udta Punjab, Anurag Kashyap is happy to see his next directorial venture, Raman Raghav 2.0, release today without any cuts.

As a screenplay writer, actor, director and producer, Kashyap has proved his versatility time and again in a career that spans almost 20 years. Some of his best works include Satya (1998) and Talaash: The Answer Lies Within (2012), to which he lent his writing skills; and Dev D (2009) and Gangs of Wasseypur 1 and 2 (2012), which he directed. His banners, Phantom Films and Anurag Kashyap Films, have produced top award-winning movies such as Queen and Lunchbox.

Starring Nawazuddin Siddiqui and Vicky Kaushal, Raman Raghav 2.0 is a crime thriller inspired by the true story of a serial killer who operated in Mumbai in the 1960s. The film was shot in 20 days on a modest budget, and debuted at the Director's Fortnight at the Cannes Film Festival in May. It is being released a year after Kashyap's big-budget venture Bombay Velvet failed miserably at the box office.

In a candid interview, Kashyap, 43, spoke to The National about his new film, the controversy over Udta Punjab and why he remains obsessed with edgy cinema.

Congratulations on winning your fight to release Udta Punjab with minimum cuts.

Thank you. But the fight isn't over yet. Udta Punjab may have been released, but there's a lot that needs to be changed. The good thing is that the industry has come together and everybody now knows they can fight for their films. We have our constitutional rights. It is the Cinematograph Act whose interpretation keeps changing with whoever comes and goes. And that's a huge problem.

How did you pick the title Raman Raghav 2.0?

I've been obsessed with Raman Raghav's character for a long time and wanted to do a film on him for 20 years. But when I finally got down to making the film – right after Bombay Velvet, which really worked very badly for me – people were scared to attempt another period film with me since it involved a huge budget. So, I decided to do a contemporary take on the character, and not a biopic – therefore the title, Raman Raghav 2.0.

Were the characters written for Nawazuddin Siddiqui and Vicky Kaushal?

I always wanted Nawaz for the original Raman Raghav, so when I adapted the script to a different context, Nawaz stayed. For Vicky’s character, I auditioned a lot of people. He completely surprised me. I also chose him over others because he brings in a certain kind of innocence to the character.

What was the most challenging part in directing the film?

To keep the actors inspired, because their roles were quite difficult emotionally and would exhaust them frequently. It was also challenging to pull off the film because we were shooting in tight conditions and extreme circumstances, and had limited days to shoot. I have been through that kind of a gruelling schedule with my earlier movies, but I was working with a team that did not have that kind of experience, so it was kind of tough.

You have a fascination for dark films.

I wouldn't say it's absolutely dark – it's grey. I write films that are character-driven, and try to get into the head of the character. I think I read Crime and Punishment at a very impressionable age, and that altered me forever.

Going by industry standards, most of your films have been made within a low budget. Do you think you make the best films in small budgets?

I’m tuned to making films with small budgets, so I know how to maximise the output.

Why do you film your actors while they are rehearsing?

Actors sometimes have a tendency to act for the camera. I’ve noticed they are most real when preparing for a scene, so without their knowledge I just keep shooting. I’ve been doing it for 16 years, so everyone knows about it. What my actors don’t know is what I’m going to do when (laughs).

What is your next project?

I'm working on three or four ideas, which are all in the writing stage. Avinash Sampath is writing the psychological horror Giddy, which I'll direct. Gangs of Wasseypur 1.5 is also being written, but I may only produce it. I'll decide which film to work on first after I get the box-office reactions to Raman Raghav 2.0.

• Raman Raghav 2.0 is in cinemas now

artslife@thenational.ae