The dramatic new trailer for the latest James Bond film No Time To Die has finally been released after the film was pushed back amid the coronavirus pandemic.

No Time To Die, which was originally meant to hit cinemas in April 2020, is reported to be Daniel Craig's last outing as 007 and rumours abound as to who the actor's replacement could be in the future.

Although Bond fans have some time to wait until they see the latest instalment in the long-running spy franchise, the highly anticipated two-and-a-half minute trailer has been released to much international fanfare this week.

So, here's all there is to know about James Bond No Time To Die.

When will 'No Time To Die' be released in cinemas?

No Time To Die has been set for release on Friday, October 8, in the US, and Thursday, October 7, in the UAE, according to MGM.

At first the film had been pencilled in for a 2019 release, however this was postponed owing to production issues and fans were told to wait until April 2020 to see their favourite super-spy in action.

But the film was then further delayed, three more times, after the Covid-19 pandemic hit and affected the industry worldwide.

Previously, fans were told No Time To Die would be released in November 2020, then April 2021 and then November 2021 – before the release date was finally moved to October 2021.

Who's in the cast of 'No Time To Die'?

The film features an unsurprisingly stellar line-up, with the aforementioned Craig reprising his role as James Bond, for what is expected to be the fifth and final time.

Ana de Armas joins the cast as Paloma, while the Oscar-winning Rami Malek plays the villainous Lyutsifer Safin.

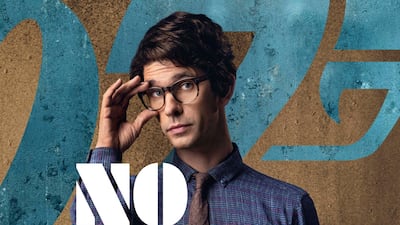

Lea Seydoux returns as Dr Madeleine Swann, as does Ralph Fiennes as M and Ben Whishaw as Q.

Lashana Lynch joins the cast as Nomi, a secret-service agent who has taken up the 007 title.

Christoph Waltz, Naomie Harris, Jeffrey Wright and Rory Kinnear also return.

No Time To Die is directed by Cary Joji Fukunaga after Danny Boyle dropped out, while the script has been written by Fleabag's Phoebe Waller-Bridge.

What does the trailer tell us?

It's fair to say the No Time To Die trailer has left us with more questions than it has answers – namely over the future of the beloved spy.

Not only is this film Craig's swansong as Bond, but the trailer has opened up the possibility that it could even be Bond's last film as 007.

The two-and-a-half minute trailer opens with a montage of Craig as Bond over his previous films as 007 – from Casino Royale to Quantum of Solace, Skyfall and finally 2015's Spectre – showing us some of Bond's memorable moments over the past 15 years.

However, the trailer then cuts to today and, in a scene that is surely designed to get Bond fans up in arms, we are shown a clip in which Craig's face is not recognised by facial recognition software as 007.

Crucially, however, Lynch has been cast as 007 – so who knows what the future holds for her character and James Bond.