Eddie Lamaa, a Lebanese-British father of three who lives in Hertfordshire, north of London, was watching TV at home with his family when footage of the massive explosion at Beirut port appeared on his screen.

Messages began to pour in from Mr Lamaa’s friends and family in Lebanon as the magnitude of the blast set in.

"I told my wife: this could have been me and my brother and sister – if my family hadn't emigrated to Britain in 1985," Mr Lamaa, 38, told The National.

Like many among Lebanon’s outsized diaspora, Mr Lamaa felt compelled to come to the aid of the homeland he left when he was only three.

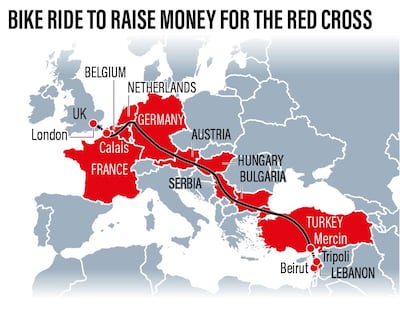

He decided to do a sponsored bike ride, mapping a 4,200 kilometre-journey by bike from Britain to Lebanon, aiming to raise £250,000 ($323,000) for the Lebanese Red Cross, through an emergency appeal launched by the British Red Cross.

He is not a gym enthusiast and had not cycled since he was a teenager.

“I wanted to do something to help and I thought that if I biked from London to Beirut hopefully this could create traction and raise money for Beirut,” said Mr Lamaa, who works in catering.

The explosion, which killed almost 200 people and wounded 6,500, devastated swathes of Beirut and quickly became a symbol of the country’s failed political and economic systems.

One week after the incident on August 4, Mr Lamaa mounted his bicycle and peddled off in the direction of Lebanon.

The 40-day journey has not been without obstacles. Twelve days in, he fell off his bike, breaking his helmet. “I saw death,” he said.

But his motivation was undeterred, as he crossed France, Belgium, the Netherlands, Germany, Austria, Hungary, Serbia, Bulgaria and Turkey.

He then hopped on a ferry with his bicycle from the south of Turkey to the Lebanese port city of Tripoli, bypassing a dangerous route through Syria.

He documented his epic journey on Instagram and Facebook, with the aim of drawing funds and support to his cause.

But in the end, he said, it was mostly his friends, family and colleagues who donated the £56,000 he raised in cash.

“Even though my family doesn’t live in Lebanon, we had a very Arab upbringing, with strong family bonds and religious values,” he said.

“If the blast happened anywhere in the world I would have felt affected, but to have it happen in the place where you were born… It’s very sad.”

Once in Lebanon, Mr Lamaa saw first hand the drastic decline in living standards following an economic crisis that began in September last year.

The explosion further exposed the failures of Lebanese authorities to respond to the country’s many crises. In the absence of a co-ordinated government response, volunteers, and charitable organisations cleared rubble and tended to the wounded and displaced.

Soraya Dali-Balta, Communications and Reporting Officer at the British Red Cross in Lebanon, believes that recovery is still a long way off.

“The impact of the blast goes beyond August 4,” she says. “Thousands of people were left with damaged homes and lost livelihoods. Their needs are huge."

The Beirut Mr Lamaa saw when he pedalled into the city on September 24 contrasted sharply with the generally affluent lifestyle among a large proportion of the diaspora.

In Lebanon, the Red Cross is seen as one of the last functioning institutions untainted by sectarianism. Mr Lamaa described the volunteers, who continue to help those in need despite working full-time jobs, as heroes.

“My journey only lasted 40 days, and now I am back in Britain with my family. But Red Cross volunteers must carry on. Some of them are making as little as $200 a month and they continue to volunteer after their shifts,” Mr Lamaa said. “These are the real heroes.”

Mr Lamaa said he saw traces of the resilience and zest for life that have been a hallmark of modern Lebanon, despite the country’s history of civil war, but he also observed despair.

Some of the Lebanese he met no longer think about enjoying life, he said. “They are thinking about how they will get their next meal.”