Beirut // Hizbollah will not be affected by US sanctions because it receives its money directly from Iran, not through Lebanese banks, the head of the Lebanese Shiite movement said on Friday.

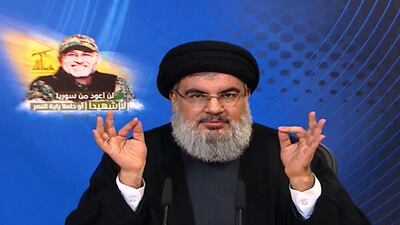

Hassan Nasrallah brushed off assertions that Hizbollah would be hurt by the sanctions on Lebanese financial institutions that work with the group in a speech broadcast by the group’s Al Manar station.

“We do not have any business projects or investments via banks,” Mr Nasrallah said, insisting the group “will not be affected”.

“We are open about the fact that Hizbollah’s budget, its income, its expenses, everything it eats and drinks, its weapons and rockets, are from the Islamic Republic of Iran,” he said.

Iran was instrumental in Hizbollah’s inception three decades ago and has provided financial and military support to the group.

In December, the US congress voted to impose sanctions on banks that deal with Hizbollah, which Washington considers terrorist group.

Lebanon’s central bank last month instructed the country’s banks and financial institutions to comply with the new measure against the group.

Hizbollah has fiercely criticised the law and accused central bank governor Riad Salameh of “yielding” to Washington’s demands.

“As long as Iran has money, we have money ... Just as we receive the rockets that we use to threaten Israel, we are receiving our money. No law will prevent us from receiving it,” Mr Nasrallah said.

The Hizbollah chief also warned that some banks were applying the law too harshly and shutting down the accounts of Lebanese charities.

Earlier this month, a bomb exploded outside the Beirut headquarters of Blom Bank, one of the country’s largest, wounding one person.

Several Lebanese newspapers known to be critical of Hizbollah said at the time the explosion was a “message” to banks complying with the US ruling.

Washington has labelled Hizbollah a global terrorist group since 1995, accusing it of a long list of attacks including the bombing of the US Embassy and Marine barracks in Lebanon in 1983.

The Lebanese group has sent its fighters into the civil war in neighbouring Syria to support president Bashar Al Assad, whose forces are also backed by Iranian troops and Russian air strikes.

The US, Arab Gulf states and Turkey back an assortment of Syrian rebel groups, some of which are also fighting ISIL.

Mr Nasrallah on Friday said his group would be sending more fighters to Syria’s Aleppo province, where pro-government forces are battling Syrian rebels on several fronts, despite the heavy losses it has suffered there.

“We will increase our presence in Aleppo,” he said in his speech to mark 40 days since the killing of Hizbollah’s top commander in Syria, Mustafa Badreddine, in an explosion in Damascus. “There can be no retreat, and no doubt.”

Mr Nasrallah said 26 Hizbollah fighters were killed in Aleppo in June.

* Agence France-Presse and Associated Press