Even today, Ras Sadr is hard to find on the map. A handful of villas overlooking a creek and whose neighbour is a naval base.

But a sign placed here two decades ago by Abu Dhabi National Oil Company records its significance.

“The first well to be drilled in what today is the UAE commenced spudding on 15th February 1950,” it reads.

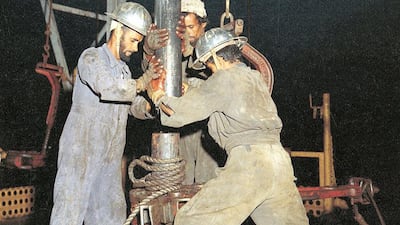

Drilling Ras Sadr was an astonishing achievement. Today, it can be reached after a 45-minute drive from Abu Dhabi on the E11 motorway. But back in 1950, it required a trek across desert and treacherous sabka – a mix of sand and gypsum – which became a quagmire with the first rains.

Tonnes of equipment was landed by barge on the beach at Ghanadhah and then hauled the final 20 kilometres using powerful Dodge Power Wagons and a small fleet of Land Rovers.

Everything needed for the operation was carried this way: from barrels of drinking water, canned food and tents for workers, to the components of the huge drilling rig and its massive hardened steel bit.

For 14 months, the drill pushed ever deeper. By April 1951, it had reached an incredible 3,962 metres – at the time, the deepest well drilled in the Middle East.

Yet there was nothing there.

Undeterred, the drilling crew moved to new location near the Dubai border. This had also been confirmed as the possible site for an oilfield by surveys first carried out in the 1930s.

The drilling crew, a mixture of largely British engineers supported by workers from Abu Dhabi, were part of Petroleum Development (Trucial Coast). This was formed by the Iraq Petroleum Company, itself created by international oil companies, including BP, Shell and Total.

Today, Adnoc employs more than 50,000 people, with over 100 nationalities represented, and has a production capacity of more than 3.5 million barrels of oil and 10.5 billion cubic feet of natural gas a day.

It was a future hard to imagine in the early 1950s.

The second well drilled also proved dry, prompting the crew to go south-west, 80km from Abu Dhabi city, to another promising location, called Murban.

The remote location tested the limits of men and machines once again but, on January 18, 1952, the Murban 1 well was finally spudded-in – the industry term for starting drilling.

At 4,000 metres – already deeper than Ras Sadr – traces of oil were found, but not in commercial quantities.

Soon after, the search for oil was greatly expanded. Changes to international law after the Second World War had expanded the rights of countries to search for natural resources many kilometres out to sea.

A new concession, Abu Dhabi Marine Areas, began operating in the Arabian Gulf and promising underwater geological surveys led to a decision to drill for oil off the emirate's coast.

A Dh60 million floating drilling rig was constructed in Germany and then towed by tug to the Arabian Gulf.

Standing on hydraulic legs in 80 metres of water and around 130km off the coast of Abu Dhabi, the Adma Enterprise began drilling in January 1958.

On March 28, at a drilling depth of 2,668m, oil in commercial quantities was discovered, transforming the future of not just Abu Dhabi but what would become the United Arab Emirates.

There would soon be more good news.

Geologists speculated that the huge undersea oilfield of Umm Shaif might well extend under land.

Drilling teams returned to Murban and – at the third attempt – in May 1960 discovered oil in quantities estimated at around 8,000 barrels a day.

These discoveries confirmed Abu Dhabi would soon become a major energy exporter.

The first shipment of oil from the offshore field was made in 1962, and from the Murban field the following year.

The disappointments and difficulties of the early years were forgotten. Advances in both geological surveying and drilling technology would lead to many more discoveries in the coming decades, beginning with a large field at Bu Hasa, 200km south of Abu Dhabi.

These discoveries, and the revenue they provided, transformed life for the people of the Emirates, bringing all the comforts of modern civilisation, along with universal healthcare and education for the first time.

The founding of the UAE in December 1971 was followed the next year by orders from the Abu Dhabi Council of Ministers to create the National Drilling Company, today known as Adnoc Drilling, the first subsidiary of Adnoc.

The company had responsibility for discovering new sources of oil and gas both offshore and on land, and the first drilling rig, AD-1, was acquired in 1973.

It has been preserved as a monument to those early achievements and can still be seen today, outside the headquarters of Adnoc on the Abu Dhabi Corniche.

Abdulmunim Saif Al Kindy (above), the former general manager of Adnoc Drilling, looks back at his time in the field with fondness.

After 46 years in the oil and gas sector, he is now Adnoc’s executive director of People, Technology and Corporate Support, as well as chairman of the Adnoc Drilling Board.

“Starting my career in Adnoc more than 40 years ago, I was fascinated by drilling operations right away,” he says.

"The work of the rig crews was hard but very inspiring. And when I was appointed general manager of NDC – now Adnoc Drilling – in 2001, it was my happiest career moment.

"Here I was, leading Adnoc's drilling arm, which to this day continues to let Adnoc unlock the UAE's hydrocarbon resources in service of the nation.

"It really is the bedrock of our national industry and has reliably gone from strength to strength over nearly 50 years."

One thing that has not changed since the first wells were drilled more than 70 years ago, is the sense of pride in those who work in the industry.

Ahmed Al Mansouri began as a “roustabout” – or deck worker – on an offshore rig as a 20-year-old in 1992.

"I came from the desert, into a different world," he says.

“You had to work with your hands and with your heart. I started at the bottom, as a roustabout. My life changed overnight.”

Soon, he worked his way up to become a driller, work he describes as "like a symphony of music".

"We drillers know this feeling, like a sixth sense. If you are feeling this music, this sense, you are a driller.”

Adnoc Drilling is now the largest drilling company in the Middle East, with a fleet of 96 rigs.

But the thrill of discovery is still as vivid as that described by Mr Al Mansouri on striking gas with the Delma Rig in 1994.

"There was so much excitement when you were drilling, waiting for that moment, holding your breath. It was like looking for gold. And when you broke through to a reservoir, you felt such pride in your rig, your company and your country."