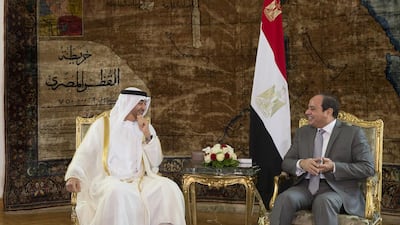

ABU DHABI // Sheikh Mohammed bin Zayed met the Egyptian president in Cairo on Thursday to take stock of regional and global issues.

The Crown Prince of Abu Dhabi and Deputy Supreme Commander of the Armed Forces and Abdel Fattah El Sisi discussed regional challenges, especially interference from foreign parties, the crises in Arab countries and risks to the region posed by terrorist organisations.

They also considered ways to enhance political, developmental and economic cooperation between their countries, reported Wam, the state news agency.

Sheikh Mohammed affirmed UAE support for Egyptians seeking stability and development, while stressing Egypt’s role in serving Arab causes.

“The challenges are tremendous and diverse, and understanding, vigilance, integration and coordination among states are important and vital to create a common Arab vision that is capable of giving the Arab joint action an additional strong push to confront all challenges,” he said. “Inter-Arab solidarity and cooperation is critical in the current phase, and the UAE is always seeking to solidify Arab joint action and views Egypt as the main pillar in that direction.”

Mr El Sisi lauded the UAE and President Sheikh Khalifa for supporting Egypt. He recognised the two countries’ need to cooperate at all levels, as the region requires strong Arab resilience to face common challenges.

“Egypt will stand by the UAE in case of any regional and foreign threats,” he said.

Sheikh Mohammed and Mr El Sisi acknowledged the importance of a concerted effort towards peace and stability, while finding peaceful solutions to crises in some Arab regions to preserve their sovereignty, territorial integrity and capabilities, Wam said.

Sheikh Tahnoun bin Zayed Al Nahyan, National Security Adviser, Mohammed Mubarak Al Mazrouie, Undersecretary of the Abu Dhabi Crown Prince’s Court, Lt Gen Juma Al Bowardi, Military Adviser to Deputy Supreme Commander of the Armed Forces, Lt Gen Isa Saif bin Ablan Al Mazrouei, Deputy Chief of Staff of the Armed Forces, and Maj Gen Staff Pilot. Ibrahim Nasser Mohammed Al Alawi, Commander of Air Force and Air Defence attended from the UAE side.

Egyptian prime minister Sherif Ismail and Gen Sedki Sobhi, Egyptian defence minister, attended from the Egyptian side.

newsdesk@thenational.ae