DUBAI // At least 10 families in the UAE are expected to file for compensation within two weeks over the Dubai-Mangalore plane crash that killed 158 people.

The move comes ahead of the second anniversary of the tragedy.

Family support groups have warned relatives they will lose their legal right for compensation if they do not file a case by the end of next month - within two years of the May 2010 air crash - according to international law.

Many families in the Emirates and India had hoped the matter would be settled in their favour before they had to file compensation suits, but that now appears unlikely.

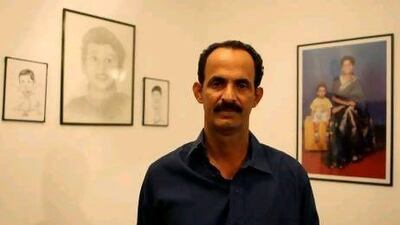

"We will be filing the papers soon," said Santosh Rai, an Abu Dhabi resident who lost his wife, 10-year-old son and nine-month-old daughter when the Air India Express flight 812 from Dubai overshot the runway in Mangalore and crashed. Only eight people survived.

"No compensation covers their lives," he said.

"No money will compensate what we have suffered and what we imagined for our future with our family. They [Air India] think the more time that passes, people will forget, but it's almost two years and we have not forgotten. We will never forgive Air India."

Air India officials in Dubai could not be reached for comment yesterday.

But the civil aviation minister, Ajit Singh, told the lower house of the parliament last month that the government-owned carrier had settled 121 cases.

"Regular meetings were being held at Mumbai and Mangalore to speed up the process of distribution of compensation," Mr Singh said, according to Indian media reports.

The Mangalore Air Crash Victims' Association has urged families to file claims without delay since the Montreal Convention sets a two-year time limit for any claim.

"We have sent notices to all family members stating that the limitation period is May 22," said Vardaraj Kayangal, the association's legal adviser. "They cannot claim for compensation after that.

"Some people have already said they will be filing a civil case."

Mr Kayangal added that some people might not approach the civil courts.

"It is a costly process," he said, adding that the carrier was believed to have paid a minimum of 2.5 million rupees (Dh180,000) and as much as 77.5m rupees to some families.

In January, India's Supreme Court issued notices to the country's government and Air India saying that it would review a petition seeking compensation of 7.5m rupees for families of the dead. The case was scheduled to be heard this month but has been adjourned.

"The matter is now posted for October 19," said Sanjay Hegde, advocate for Abdul Salam, a fisherman who went to the courts seeking to be paid according to the Montreal Convention after his Dubai-based son was killed in the crash.

The convention requires airlines to pay compensation of 100,000 Special Drawing Rights (SDR) - a mixture of currency values established by the International Monetary Fund - that is equal to 7.5m rupees per passenger to families.

Under the convention, negligence does not need to be proven. In India's first judgment since it signed the treaty in 2009, a court in Kerala last July ordered the airline to follow the convention.

But this was overruled a month later in favour of Air India, with victims asked to show "proof of loss" as they were not automatically entitled to 100,000 SDR.

"It's not the money, I want justice," said Abdul Rahman, a Dubai resident who lost his wife and nine-year-old son in the crash. "We know most people have already got compensation."

"Most of us have our papers ready. We are updating everybody and telling them they must file now."

Court cases in India normally take a long time to settle because of a huge backlog of cases.

"People were waiting and waiting for the court case to finish but how long can they wait?" asked Narayanan Kalingom, the vice president of the Mangalore Air Crash Victims' Association. He lost his brother, a Dubai resident, in the crash.

"People feel helpless and many have just accepted their claims."

pkannan@thenational.ae