It has been 16 long months since Roger Federer and Rafael Nadal last met in the final of a grand slam event. With both players in their prime it feels as if the public has been robbed of seeing arguably the best rivalry in sport at present from reaching new heights.

The 2009 Australian Open final witnessed a classic as Federer and Nadal pushed each other to the limit in Melbourne Park, with the Spaniard coming out on top of a five-set thriller. At that stage it seemed to be a passing of the torch as Nadal was on his way to usurping Federer as the world No 1, and was the holder of the French and Australia Open titles, as well as Wimbledon. The world looked as if it was his oyster.

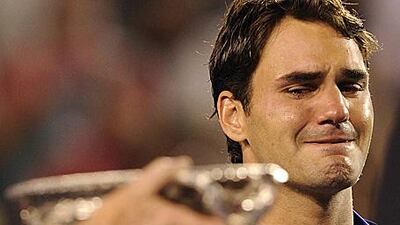

Federer was left distraught and in tears on court after his Melbourne loss and appeared to be a broken man, knowing that a younger, stronger rival was getting the better of him. But wind the clock forward 16 months to today and a lot has changed between the two. Federer is now back at the top of the rankings having won three of the last four grand slams, narrowly losing out completing the Grand Slam after losing to Juan Martin del Potro in five sets at the US Open final last September.

Unquestionably the one that meant the most to him was his first triumph at Roland Garros last year, which came at the 11th attempt. Clay is the one surface that the Swiss has never dominated on, although he has adapted his game over the years well to make himself a genuine contender. He returns to Paris to defend his crown, with the tournament starting today, and the question now is no longer is Federer able to win in Paris, but rather can he beat Nadal in the French capital?

Between 2005 and 2008 Nadal owned the French Open; it was almost his private play thing. He dominated with his brute force from the baseline, proving too good for everyone, even Federer. Indeed the way he thrashed Federer in the 2008 final, conceding only four games along the way, was one of the greatest demonstrations of clay court tennis ever seen. However, the one thing that could stop Nadal was his own health. His deteriorating knees were beginning to bother him, and it was one of the biggest sporting shocks of last year when a visibly below-par Nadal was humbled in the fourth round by Sweden's Robin Soderling to lose at Roland Garros for the very first time.

It has taken the 23-year-old Spaniard almost a year to nurse himself back to health, but despite a scare at the Australian Open, when he retired hurt against Andy Murray in the quarter-finals, he is confident he is fit and nearing his best form. He certainly didn't look to have lost a step in his straight sets win in the final of the Madrid Masters last weekend against Federer. A Federer v Nadal final in Paris for a fourth time is the most likely scenario, but will it go the same way as the other three with Nadal winning to pick up his seventh grand slam?

The one key difference from the previous occasions is that Federer is no longer desperate to win the French Open to complete his quest to win every grand slam. That monkey was removed from his back 12 months ago, it is now purely about pleasure and adding another title to his already astonishing 16 grand slams, and he is likely to cut a much more relaxed figure on court than at any previous time in Paris. The pressure, arguably, is more on Nadal this time.

Federer has the harder-looking path to the final. A possible fourth-round match with the home favourite Gael Monfils, the 13th seed, who reached the last four in 2008, while the man he beat in the final last year, Robin Soderling, could be his quarter-final opponent, stand out as potential banana skins. Nadal will rightly not fear anyone, but will be wary of having his compatriots Fernando Verdasco and David Ferrer, both superb on clay, in his side of the draw. Federer kicks off his challenge against Peter Luczak, the Australian, while Nadal begins against Gianni Mina, the 18-year-old Frenchman.

The draw was not so kind to Murray, the world No 4. The Briton, who has had a tough time on the court with mixed form since losing in the final of the Australian Open to Federer in January, has been paired with Richard Gasquet, another home favourite and former world No 7, in arguably the most attractive tie from the opening pairings. The Frenchman has fallen to 68th in the world after missing much of 2009 serving a drugs ban, for which he was later found to have been innocent of the charge. Gasquet is a formidable opponent with strong groundstrokes, but going in Murray's favour is the fact that clay is not Gasquet's strongest surface.

gcaygill@thenational.ae