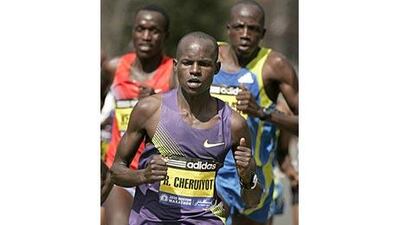

BOSTON // Kenya's Robert Kiprono Cheruiyot smashed the course record to win the Boston Marathon men's race on Monday, while Ethiopia's Teyba Erkesso captured the women's title by a few steps in a sprint finish. In favourably cool conditions with a light wind, Cheruiyot clocked two hours, five minutes and 52 seconds as he crossed the finish line, holding off Ethiopians Tekeste Kebede and Deriba Merga, the defending champion.

Cheruiyot said he wanted to stick with Merga, who broke from a large pack of runners at mid-race. "If somebody is a champion, you try to go with them," said the 21-year-old, who broke Robert Kipkoech Cheruiyot's previous course record of 2:07:14 set in 2006. The two are not related. He said he acted on the elder Cheruiyot's advice and set out on a blistering pace. "Most of the people already confuse me with Robert Kipkoech Cheruiyot, With me and Robert, we talk the same language, but in different stripes. I think people can see me and they can see him and compare."

Cheruiyot, who owns a farm back home, earned a bonus of US$25,000 (Dh91,825) for the course record on top of the $150,000 that goes to the men's and women's winners. His plans for the winnings: "I am going to buy some cows." The victory gave Kenya its 18th men's victory in 20 years. Ryan Hall led at the halfway mark before finishing fourth in 2:08:41, the fastest time for an American man. "My goal going into the race were to have fun and to run free," Hall said.

No American man has won the race since Greg Meyer in 1983. "We are training hard, but that doesn't mean we're going to hit a home run every time," said Meb Keflezighi, who finished fifth and had hopes to become the first American to win in New York and Boston back-to-back since Alberto Salazar in 1982. In the women's race, Erkesso built a big lead going into the final few miles but was reeled in by Russia's Tatyana Pushkareva, which set up a furious sprint to the finish line.

Erkesso won by three seconds in 2:26:11. Last year's winner, Kenya's Salina Kosgei, was third. The Ethiopian said she tried to drive the pace from the start, fearing that other runners had stronger finishing kicks."I knew the Russian lady was coming from behind me. 'She doesn't pass me today,' I'm thinking in my mind," Erkesso said. "I didn't believe I would win it until the very end." * Agencies