When Barack Obama was elected in 2008, it was said that he had been dealt the most difficult hand of any US President since Franklin D Roosevelt. Well, now he has a challenger. Whether it is Donald Trump or Joe Biden who prevails after Americans go to the polls today, the winner will be faced with a nation floored by the pandemic, an economy flattened by the worst recession since the 1930s, and a population riven by apparently irreparable cultural and racial division.

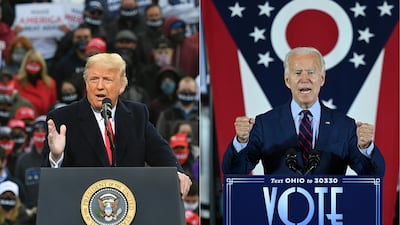

As Trump resorts to ever more unorthodox tactics to stay in power until 2025 (by which time he will be 78), and Biden (who turns that age this month) strives to fulfil a lifelong ambition of achieving the one office higher than the vice-presidency, the words “be careful what you wish for” must surely haunt them both.

Of course, this election is about much more than the rival ambitions of two very different men with two very different visions. It is about the collective health of a country that has already lost almost 250,000 lives to Covid-19. Millions more Americans have lost their jobs as a result of the economic chaos wrought by the virus.

And at a time when the nation should be pulling together with what the British would call Blitz spirit, the streets of many cities have been the setting for what appear to be the beginnings of civil strife. Little wonder that the final months of the campaign have witnessed a descent into gutter politics of the worst kind.

So, with so much at stake at home, it is perhaps asking too much of the average voter in America to think beyond its shores when they make their choice today. But the US constitution ensures – quite deliberately - that presidents have limited ability to exercise their power domestically. Much authority is devolved to state level. What's left is at the mercy of two legislatures and it is rare that both see eye-to-eye with the White House.

Therefore it is in foreign lands – not least the Middle East - that US leaders often leave their most lasting footprint. Here, Donald Trump’s record is broadly positive. His determination to stand up to the menace of Tehran has been commendable. He helped to negotiate the Abraham Accord with the UAE and Israel – potentially a seismic turning-point in the region’s history. ISIS has been tamed, if not yet put down. Sudan has been brought back into the international fold.

True, war continues to rage in Syria and Iraq struggles to rid itself of Iranian influence. The recognition of Jerusalem as Israel’s capital was inflammatory. But given that this was a President elected on the self-styled promise of ‘America First’, the isolationism that many feared would leave the Middle East abandoned has not materialised.

At this point, it is only fair to ask what Joe Biden would do differently. Would Mr Obama’s number two repeat the mistakes of his former boss’s two-term presidency and embark on an ill-advised rapprochement with Iran solely on the nuclear file and ignore its role in the region? Could he maintain the momentum of the Abraham Accord while ensuring justice for the Palestinian people? Will he ignore the long-lasting damage of appeasing militants? After a campaign in which the Democratic candidate has largely kept his counsel, preferring to watch his Republican opponent apparently talk himself out of office, the answers to these and other foreign policy questions remain elusive – although he deserves the benefit of the doubt.

It is the nature of America’s electoral-college voting system that, every four years, the future of the country is decided by a tiny minority of swing voters in swing states. Would it be an exaggeration to say that the future of the Middle East could be resting on their shoulders? Perhaps not.