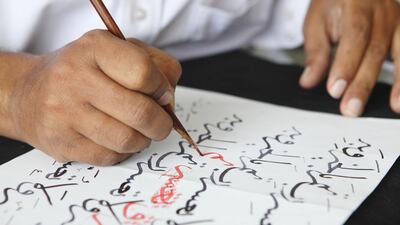

World Arabic Language Day was commemorated yesterday across the Arab world and beyond, marking the 41st anniversary of Arabic becoming the sixth official language of the United Nations. The anniversary prompted Arab writers to contemplate the situation of their mother tongue and ways of empowering it.

Dr Abdullah Saleh Al Suwaiji, writing for the Sharjah-based Al Khaleej, argued that Arabs who have not mastered Arabic miss out on a huge wealth and deny themselves a chance to savour many areas of aesthetics.

Last month, a report by the National Council warned of the “marginalisation of the Arabic language” in the UAE, and noted that the latest generation is turning away from their mother tongue and media outlets are using local dialects with foreign words in English or French. The report also pointed to the declining use of Arabic in schools, offices, media outlets and websites, with Emiratis voluntarily giving up on using Arabic.

To counter this risk, the report recommended a national strategy to preserve Arabic, including a federal law compelling all institutions – private and public – to use Arabic, boosting government funds to empower its use, improving the methods used for teaching it and enhancing Arabic teachers’ skills.

Demarginalising the language can be done by the media using standard Arabic in their programmes and writings, parents discouraging children’s focus on foreign languages at the expense of Arabic, and improving the way the language is taught. Too many Arabic teachers avoid change and innovation.

Ramzi Al Ghazwi wrote in the Jordan-based Addustour that although he doubts Arabic will follow other languages into extinction, he remains concerned about the language becoming marginalised through the use of dialects and “Arabish”, a mix of Arabic and English that is becoming trendy among the youth.

World Arabic Language Day is likely to go largely unnoticed because of the preoccupation with issues that are less pivotal to the Arab future than the language.

Bold decisions to empower the teaching and use of Arabic are needed but individuals are also duty-bound to empower it. Arab parents often brag about their young children speaking English or French although they are not as good in their mother tongue, the writer observed.

Said Al Suqaili said in the London-based Al Quds that Arabs ought to celebrate Arabic being the fifth most widely spoken language in the world.

Its continuing flair can be ascribed to its unique aesthetic traits that enabled it to perfectly express both the most delicate of human feelings and the most specialised of scientific concepts.

It was no wonder Arabic was the language of civilisation in the Middle Ages and that it is also a poetic language that lends itself to meter, rhyme and other poetic techniques to create musical and aesthetic effects.

A powerful language is a major pillar for any nation to excel and innovate, the writer noted. People who blame Arabic and slam it as sterile have never savoured its beauty or learnt its merits.

In the London-based paper Al Hayat, Dr Ziad Al Dris wrote about the often-neglected connection between the Arabic language and Islam.

The religion deserves credit for the huge benefits it has brought to Arabic, he wrote, and if it were not for Islam, nothing would have guaranteed Arabic’s survival. He noted that many once-dominant languages disappeared in a few centuries.

Despite Islamic civilisation and Arab countries going through great tribulations over time, Arabic has always managed to compete with the top languages of the world.

That said, it is not in the interest of Islam to be exclusively linked to Arabic, Al Dris wrote.

Doing so runs the risk of sending the wrong message that Islam is the faith of Arabs only, when Arabs make up only 20 per cent of Muslims.

It might also suggest that Arabic is the language of Muslims only.

Both Islam and Arabic are too vast to be restricted to such an exclusivity. The contributions of non-Arab Muslims, whether in Arabic or in their native languages including Farsi, Turkish and Amazigh, should not be forgotten.

The same goes for Christian Arabs who made great contributions to the Arabic language.

Translated by Abdelhafid Ezzouitni

aezzouitni@thenational.ae