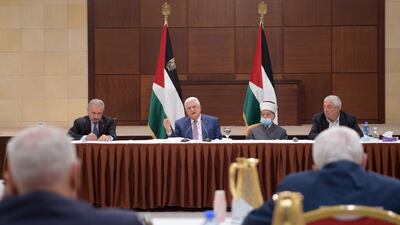

Palestinian President Mahmoud Abbas on Friday called off landmark elections amid deep divisions within his Fatah party, accusing Israel of obstructing the vote in occupied East Jerusalem.

"Facing this difficult situation, we decided to postpone the date of holding legislative elections until the participation of Jerusalem and its people is guaranteed," Mr Abbas said, just hours before the election campaign was set to get underway.

The May 22 legislative elections would have been the first in 15 years, followed by a presidential poll on July 31 in which Mr Abbas was expected to face tough competition.

"Jerusalem will not be compromised, and our people in Jerusalem will not give up their right to exercise their democratic rights," the president said in a speech broadcast from Ramallah, in the occupied West Bank.

Mr Abbas said the Palestinians had unsuccessfully sought reassurances from Israel that the vote could go ahead in the contested city.

Rival Hamas, which rules the Gaza Strip, objects to any delay and has called for a meeting to discuss holding the elections in Jerusalem without seeking Israeli permission.

“The vote, which is a constitutional and political right for Palestinian generations, has been long postponed," the Islamist movement said on Wednesday, anticipating the announcement.

"No one is entitled to waiver this basic national right in any way."

Hamas was expected to perform well in the elections due to a Fatah split, with Nasser Al Kidwa, a nephew of the late Palestinian leader Yasser Arafat, running his own “Freedom” list.

Mr Al Kidwa’s list is backed by popular leader Marwan Barghouti, who despite serving life sentences in an Israeli prison was regarded as a possible challenger in the presidential election.

Another group of candidates is led by Mohammed Dahlan, Mr Abbas’s former security chief in Gaza who is in exile.

The president’s decision over Jerusalem has been regarded as a pretext to avoid holding a vote in which he may emerge in a weaker position.

“Fatah is going into the elections on three different lists, and this is making it less confident about the results,” said Rami Saleh, director of the Jerusalem Legal Aid and Human Rights Centre.

"They are using Jerusalem in order to postpone the elections," he told The National.

In 2006 a nominal 6,300 voters cast their ballots at Jerusalem post offices with the approval of Israel, which has controlled the eastern part of the city since 1967.

The same plan was in place for the upcoming elections, the Palestinian Central Elections Commission said earlier this month, while around 150,000 Jerusalemites were expected to vote in the suburbs where Israeli officials do not operate.

Mr Saleh said voters could set up polling stations in diplomatic missions as an alternative to casting their ballots in post offices.

Nour Odeh, a candidate on the Freedom list, said Palestinians should forge ahead with the polls and if necessary make use of schools and places of worship in Jerusalem.

"Whether Israel accepts it or not, because we should not be waiting for Israeli permission to rejuvenate our political institutions," she told The National.

Israel has refused to comment on whether it would allow the vote to take place in Jerusalem, where it bans Palestinian political activity.

“Israel will not prevent elections from taking place in the Palestinian Authority,” Alon Bar, political director at the Israeli foreign ministry, told European diplomats on Tuesday.

The European Union in February requested Israeli permission to send an observer mission to the West Bank in preparation for the May elections, but never received a response, according to a statement from the bloc on April 21.

The political developments follow days of tension in Jerusalem, with clashes between Palestinians and Israeli police over their closure of a plaza used by Muslims during the holy month of Ramadan.

The unrest around the Old City's Damascus Gate prompted Gaza militants to fire three dozen rockets on Friday night towards Israel, which launched retaliatory strikes.

Friday's unprecedented move by Mr Abbas could spark a further response from Gaza, or protests in Jerusalem and the West Bank.

“It certainly will make the [Palestinians’] situation internally far more tense and precarious,” said Ms Odeh.

“This open-ended suspension of political life, after 15 years of waiting, is not a positive development by any stretch of the imagination,” she added.