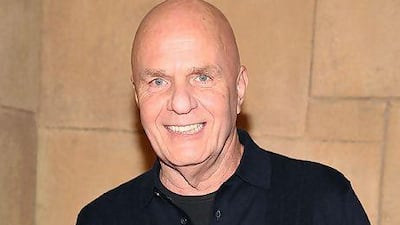

Who is he?

Known to his fans as the father of motivational speaking, Dyer grew from impoverished beginnings to become one of the leading authorities in the self-help industry. With millions of books, cassettes and CDs sold, Dyer is a much sought-after public speaker focusing on self mastery and how we are ultimately responsible for our own happiness.

The backstory

The self-help industry is littered with stories of gurus turning early trials to triumph and Dyer is no different. Born in Detroit in 1940, Dyer was abandoned by his alcoholic father. Dyer and his brother were sent to an orphanage by his mother after she could no longer take care of them.

Dyer links his empowering philosophy back to his days at the orphanage. Speaking to Success magazine in 2009, he said those times taught him the value of initiative. "I was the richest kid in the orphanage," he said. "It was very simple: When it snowed, I'd go out and shovel the walks along the street. I didn't ask for anything. I'd just go back and tell people, 'I shovelled your walk.' People would always give me money."

The rise

After completing high school, Dyer joined the US Navy from 1958 to 1962 before returning to Detroit to work as a high school counsellor. Through counselling the students in one-on-one sessions and lectures, he began perfecting his positive thinking and motivational techniques.

Dyer's public lectures caught the eye of a literary agent who convinced him to turn his ideas into a book. In 1976, Dyer published his seminal work Your Erroneous Zones, giving readers practical tips on tackling negative thinking.

Putting in the work

Your Erroneous Zones may have been a bright idea, but the public wasn't initially welcoming of the concept. To stop the book from ending up in bargain bins across America, Dyer quit his teaching job and loaded up the camper van for a year-long publicity campaign across the US, speaking at TV stations and book stores in each city stop. Once Your Erroneous Zones made it on the bestseller list, it remained for more than 60 weeks and eventually sold more than 35 million copies.

The theories

While Dyer is no revolutionary when it comes to the themes of his work, his success lies in his blend of charismatic presentation and self-made persona. Dyer's books and lectures borrow heavily from his life experiences while presenting key principles such as creating the conditions for success, developing a system of tackling negative thoughts and eradicating guilt as a motivating factor.

From the 1990s onwards, Dyer's theories took on a more spiritual bend with the books Real Magic and Your Sacred Self discussing how to harness your spiritual energy and "defining your sacred quest".

The effect

Dyer's message has influenced generations of self-help authors and motivational speakers such as Anthony Robbins and Gabrielle Bernstein. He has been interviewed by Oprah Winfrey and spearheaded pledge drives for the American public broadcasting television network PBS. An excerpt from one of Dyer's lectures was used in the 2010 Pixar animated short film Day and Night.

Muntada

Dyer's Abu Dhabi appearance is part of the Muntada lecture series run by the Sheikha Salama bint Hamdan Al Nahyan Foundation at Manarat Al Saadiyat. The free talks tackle a range of topics from spirituality, technology and social sciences. The foundation already hosted speakers including the spiritual author Karen Armstrong, the 1,000 Awesome Things blogger Neil Pasricha and the co-creator of Twitter, Dom Sagolla.

Catch Dr Wayne Dyer on Tuesday at Manarat Al Saadiyat, Saadiyat Cultural District, Abu Dhabi, at 7.30pm. A ladies-only session will be at 10.30am. For more details, go to www.sshf.ae