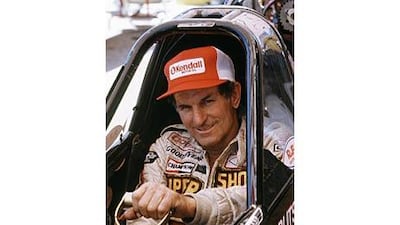

Anyone associated with drag racing owes just a little bit to Don Garlits, one of the most legendary racers and innovators in its history. Neil Vorano interrupted the 78-year-old's lunch to talk about the Yas Marina circuit and going really fast A lot can be read into Don Garlit's email reply to a request for an interview. "Call me after the Gatornationals are over on my cell, because it's the only phone I can hear from." The first part shows how much drag racing is still an overwhelming part of the septegenarian's life; the second gives a hint as to how much he has given for the sport. "I have a really hard time hearing," Garlits says over his mobile, which is a special unit for the hearing impaired, as he waits for his lunch at a Florida restaurant. The hearing ailment isn't surprising, considering he has spent almost half a century in a career that put him just inches from explosive, ear-splitting engines in Top Fuel drag racing.

Garlits, then an owner of a garage and body shop, started in the sport in 1955, building his own chassis and engine and winning his first race. He was hooked, and went professional three years later. In a career that saw him finally step out of the cockpit of the big cars for good in 2003, he earned 17 National championships and 144 major open event victories. He has accomplished more than most in the sport, but, pushing 80 years old, he still can't leave it.

"Besides running my museum [Don Garlits Museum of Drag Racing in Ocala, Florida], which is a full-time job, I have one of those Dodge Challenger Drag Pack cars that I ran in Stock class [at the Gatornationals competition last weekend]; did a 130mph, 10 [seconds] flat. It's a fun little car, keeps me out there. "I can't get away from it. But my wife asked me in 2003 - I went 323mph in one of those Top Fuel cars - and she asked me real nice not to do it anymore; it scared her. And she'd been so supportive of me all these years, and she had tears in her eyes, so what are you going to do, you know?

"But when they came out with this drag car, she said 'Honey, why don't you get one of those?' So, I did, and I'm having a good time." It's not that the man known as "Big Daddy" has anything left to prove. Besides the wins and titles, he is revered as an innovator and a milestone achiever. He was the first man to exceed 170mph in the quarter mile in 1957, then over the years became the first to pass 180mph, then 200, then 250, then 270.

He was the first drag racer to put a rear wing on his car. He was also a proponent of fire-retardent racing suits after major burns from a fire in 1960 almost took his life. And, when his transmission exploded and took part of his foot with it in 1970, Garlits moved the engine in his cars behind the driver, where it remains to this day on all Top Fuel cars for safety reasons. "I have some regrets in my career, with some races where I did stupid things to lose the race, just stupid things. But I don't regret my accidents, even the bad ones, because they helped to make the sport safer."

His contributions to drag racing have been so extensive that one of his cars, Swamp Rat XXX, rests in the Smithsonian Museum in Washington, DC. Garlits welcomes the Yas Marina circuit's attempts at cultivating the sport in the Middle East. "I love that. 'Cause, I helped support moving it to England; I was part of the team that went to England in 64; I've been to Finland, I've been to Sweden and Australia. And, my museum has the International Drag Racing Hall of Fame - it's not just national - and we just inducted Jim Read from Australia, and Sydney Allard from England is in there. "So I look at the sport as international."

motoring@thenational.ae