Azure waters and isolated beaches are luring the world's super-rich as private jet flights to island destinations rose almost 10 per cent in 2018, a report found.

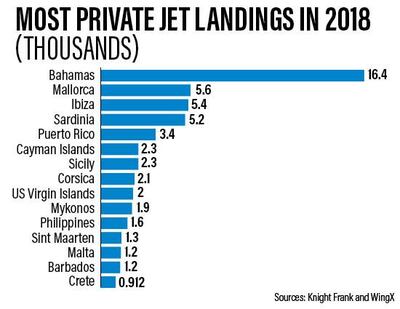

Jet-setting around the globe in private planes is becoming increasingly popular among the ultra-wealthy with the Bahamas taking the top spot for the most-visited destination, according to the study by real estate consultancy Knight Frank and aviation consulting company Wing X, which analysed 30 island locations. Rounding off the top five destinations were Mallorca, Ibiza, Sardinia and Puerto Rico.

"Despite a darkening economic outlook, wealth creation will remain a constant in 2019," the report said. "The global ultra-high-net-worth individuals' population is forecast to rise by 22 per cent over the next five years, meaning an extra 43,000 people will be worth more than $30 million [Dh110.18m] by 2023."

Of the top 10 island destinations popular with the world's ultra-wealthy, four were in the Americas and include the Bahamas, Puerto Rico, the Cayman Islands and US Virgin Islands, the report said. Private jets flew into the region nearly 30,000 times last year, making it the world's biggest hub for chartered flights.

More than two-thirds of travellers to the Bahamas originated in the US, Canada or domestically, according to the data.

In Europe, Mallorca, Ibiza and Sardinia were the popular destinations for non-commercial aircraft landings.

The Philippines, Maldives and Bali were the top destinations in the Asia-Pacific region, the report found.

Asian countries will see the biggest growth in ultra-high-net-worth people over the next five years, the 2019 Wealth Report by Knight Frank showed. India leads with 39 per cent growth, followed by the Philippines with 38 per cent and China at 35 per cent. Of the 59 countries and territories in its forecasts, eight of the top 10 countries by future growth are in Asia, with Romania and Ukraine taking the remaining spots.

Asia is now home to about a quarter of the people listed on the Bloomberg Billionaires Index, a ranking of the world’s 500 richest people.

Globally, ultra-high -net-worth people expect their wealth to increase over the next 12 months, with confidence most marked in the US, where 80 per cent expect to be better off, Knight Frank said.

A record 26 per cent of these ultra-rich people will start planning their emigration this year, and to help them, a record number of countries will offer citizenship and residency through investment schemes. Moldova and Montenegro are the latest to offer themselves as wealth havens, the report said.

Private wealth across the Middle East is centred in the major Arabian Gulf countries, with Saudi Arabia taking the top spot, followed by the UAE, Kuwait, Qatar, Oman and Bahrain, according to the report.

Construction and financial services are the two prominent sectors in the investment portfolios of Middle East private billionaires, accounting for 23 per cent and 15 per cent, respectively, said the study.

Mapping the requirements of private wealthy investors in the Middle East found that at the end of last year, there was an estimated $6.2 billion looking to be invested into commercial property, with a significant amount earmarked for the UK, the report said.