Private investment constitutes up to a quarter of AlUla’s total spending as the Saudi tourism destination moves ahead with development plans, a senior executive at the Royal Commission for AlUla has said.

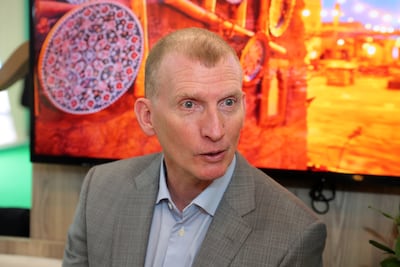

“Out of the overall budget, probably 20 to 25 per cent is private [investment],” Phillip Jones, chief tourism officer, told The National an interview, without revealing specific figures.

“More and more of the businesses that are opening across the destination are opening on their own. They're not asking for financial support."

AlUla, a heritage site with preserved tombs and sandstone outcrops, is expected to contribute about 120 billion riyals ($32 billion) to Saudi Arabia’s economy.

The Royal Commission forecasts that the population of the area will triple to 130,000 by 2035, generating about 38,000 new jobs.

AlUla welcomed 185,000 visitors last year and is forecasting 250,000 for this year, Mr Jones said on the sidelines of the Arabian Travel Market at Dubai World Trade Centre.

“We may get to a million visitors by 2030,” he said. “We don’t want to be Petra with thousands of people … our target is a premium luxury audience and we haven't deviated from that at all.”

Almost a million tourists visited Jordan’s Nabataean city of Petra, a Unesco World Heritage Site, last year as travel demand rebounded after the pandemic.

AlUla is among a number of projects in Saudi Arabia which form part of its diversification efforts.

Others include the $500 billion Neom smart city in the north-west of the kingdom, the Red Sea Project, which includes an archipelago of 92 islands, 50 dormant volcanoes, mountain ranges and sand dunes, and Diriyah, the 300-year-old city considered to be the birthplace and capital of the first Saudi state.

The “biggest challenge” is raising awareness about the destination and ensuring the “right lift” from airline partners to transport visitors to the destination, as well as making sure there is enough room supply to keep up with the rising demand, Mr Jones said.

“That's a big issue for us [especially] during our peak season, so we're adding more hotels, building more rooms, adding more inventory to the portfolio because at the end of the day we can fill all the rooms. We just need more,” he said.

In January, AlUla Development Company, which is wholly owned by the Public Investment Fund (PIF), said it was launching operations with the aim of turning the city into a global tourism destination in Saudi Arabia.

Planned developments include more than 7,500 hotel keys, 5,000 residential units, a staff village comprising more than 1,000 units, as well as infrastructure support.

Saudi Arabia, the Arab world’s largest economy, aims to attract 100 million visitors annually by 2030.

The country plans to add 315,000 new hotel rooms with an estimated development cost of $37.8 billion by the end of the decade, according to a Knight Frank report.

The planned additions would take the total stock to about 450,000 hotel rooms, with giga-projects such as the futuristic city of Neom leading the supply pipeline, the report said.

For Saudi Arabia, which has a population of about 36 million, domestic tourism would be key to the success of its future tourism and hospitality markets, the report found.