As street protests raged in Cairo at the end of 2012 against the president, Mohammed Morsi, the Egyptian entrepreneur Waleed Rashid had an idea.

Even in times of peace, Cairo’s traffic-snarled highways and congested streets often made even the simplest of tasks a nightmare. Faced with weeks of violent protests and clashes with police, life was chaotic enough without worrying about the dry-cleaning.

So, thought Mr Rashid, what if you did not have to?

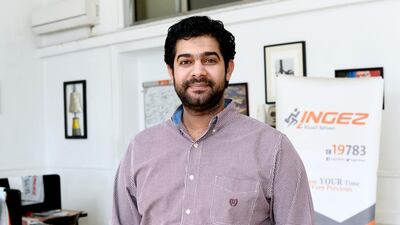

“I started Ingez in a time when the country was going through a lot of changes, we were all thinking of new and innovative ways to solve real problems,” recalls Mr Rashid. “At the time it was very hard to run errands, due to the political instability and security, and even in normal times it had always been hard in Cairo. I put all these factors together and Ingez was born.”

Fast forward two years and the start-up has more than 10,000 users in Cairo, who pay between 20 Egyptian pounds (Dh9.82) and 70 pounds for the firm's team of drivers to carry out tasks from picking up washing to delivering flowers. Last year, Ingez attracted a large investment (how large, Mr Rashid will not say) from the Cairo-based Sharia-compliant crowdfunding platform Shekra and expanded to launch a specific service for business customers. This year, says Mr Rashid, Ingez is to launch new fund-raising expand to other cities in Egypt.

Big plans — and Ingez is far from alone; by most standards Egypt's start-up scene is booming. In a list of top 10 Middle East start-ups to watch in 2015, Forbes named four Egypt-based firms, covering everything from sustainability — www.recyclobekia.com informs companies where they can recycle electrical parts — to after school education: www.nafham.com hosts thousands of free videos for Egyptian school kids to learn a range of subjects.

It also comes at a time when the Egyptian economy is performing better than it has for some time, seeing 2.2 per cent growth in 2014 and a stock market that was up more than 10 per cent over the year. There is talk of two major IPOs hitting the Cairo Stock Exchange early this year, which will further stimulate an economy hit by four years of instability.

The pound has fallen some 3.5 per cent against the dollar in the past week as the Central Bank of Egypt (CBE) loosens its grip on the currency but while economists feel it could fall further they point out it was overvalued, particularly against the Euro, thus hurting European exports.

“Over the past few years, Egypt has struggled to attract foreign capital inflows to finance its current account deficit, forcing the CBE to sell FX from its reserves and keep interest rates high to prevent the pound from falling,” says William Jackson, the Middle East economist at Capital Economics in London.

“A weaker pound would help by reducing demand for imports and boosting the competitiveness of exports.”

Since the election of president Abdel Fattah El Sisi last year, a total of US$20 billion in aid has been pumped into the country, much of it from the UAE and Saudi Arabia. Despite questions over the depreciation of the pound, confidence in Egypt’s economy is at its highest since the 2011 revolution. But while on a macro-economic level, Egypt is looking better; life is far from easy for its small and medium enterprises (SMEs). A 2014 report by Wamda Research Lab found just 20 per cent of SMEs have a loan or line of credit in the Middle East, and further that start-ups represent less than 8 per cent of bank portfolios in the region.

Of all of the countries covered in the report, Egyptian start-ups attracted the lowest levels of funding, with an average of $50,000 to $100,000 compared with about $150,000 in Jordan and upwards of $500,000 in the UAE. Across the region, 76 per cent of start up investments are worth less than $200,000.

“Access to finance in terms of equity as well as venture debt is still limited [because] the numbers of players are still small and banks consider most start-ups ineligible for financing in their current stage,” says Shehab Marzban, the Shekra founder.

His firm raises funds for early stage start-ups worth between $100,000 and $2 million, taking small firms such as Ingez under its wing and providing them with mentoring as well as an access to funds raised from investors. Shekra is keen to attract Egyptian expatriates, whose remittances are worth about 7 per cent of Egyptian GDP and is hoping proposed new regulations will encourage them to invest at home. “The core challenge to attract foreign investors is in terms of capital flow restrictions, which we are expecting to be improved over the next months within the efforts the Egyptian government, is conducting to attract investments in Egypt,” says Mr Marzban.

Another key problem for start-ups and SMEs in Egypt is access to exits, he adds, something that is a core element to many Middle East and North African markets. SMEs need to be in a position where they can either tout for acquisition from foreign firms or private equity funds or look at initial public offerings (IPOs) either in Cairo or elsewhere. At present the vast majority are simply not big enough and do not have the means.

"We also need regulation and investment climate improvement … supporting capital in and outflow. The enforceability of laws and agreements — such as shareholder agreements — are crucial to protect both investors and entrepreneurs in their ventures," Mr Marzban says.

He is hoping to see 4 per cent growth for Shekra this year, which could be even higher depending on how fast the government acts to reform the investment climate. He is also waiting to see the success of the upcoming Economic Research Forum summit due to be held in Cairo in March, as well as the 2015 elections.

Internationally, adds Adel Boseli, the managing partner at Shekra, the role of the UAE and other regional players will be important to stimulating the start-up scene across the region. After all, it is not just Egypt where the entrepreneurial scene is growing: the UAE; Lebanon, Jordan, and the Palestinian Territories have seen a huge spike in SMEs attracting investment both at home and overseas.

Shekra won Best SME Development, presented by Sheikh Mohammed bin Rashid, Vice President of the UAE and Ruler of Dubai, at the Islamic Economy Awards at the 2013 Global Islamic Summit, as well as the Ethical Finance and Initiative Award from Thomson Reuters and Abu Dhabi Islamic Bank the same year. This demonstrates the links between what is happening in Egypt and the SME and start-up boom in the UAE are strong, Mr Boseli says. “The whole ecosystem in the Middle East is growing and we can clearly see the potential if the region acts as one unit complimenting different resources from different areas; we have capital in some areas, innovation and manpower in others, and many markets all over,” he says.

“Many different players have to come together to grow the ecosystem in a healthy direction; public sector, private sector, development organisations, educational institutions and also governments.

“Hopefully, within five years, we will have solid grounds to stop brain-drain and keep local talent from leaving the region and benefit from their work and innovation,” Mr Boseli adds.

For Ingez, Mr Rashid says the major challenge was building client trust. But over the past two years, he says, Ingez has done that.

“As a start-up we faced many challenges: creating a brand that people trust was a big one. Another was mastering the operations side to make sure we deliver what we promise — a high-quality service,” says Mr Rashid. “It took us some time, and a lot of trial and error, to overcome that one.”

business@thenational.ae

Follow The National's Business section on Twitter