Global payments technology company Visa aims to capitalise on “massive growth opportunities” in the Middle East and Africa emerging out of the region’s “heavy reliance on cash” and limited use of digital payments.

The California-headquartered firm is working to bridge the gap by bringing more digital forms of payment to the region, the company’s chief executive Alfred Kelly said.

“The region is comprised of a number of cash-heavy markets, which present enormous opportunity for Visa to promote... digital payments and drive economic growth,” Mr Kelly told The National.

In MEA, personal credit card payments totalled $166 billion (Dh609.6bn) in 2018, while total consumer payment transactions in the region stood at $1.8 trillion, according to London-based Euromoney.

Industry analysts predict a robust rise in payment cards in the coming years as consumers transition from cash to credit and debit cards. The number of payment cards in MEA will rise to 910 million by the end of 2021, from 611 million in 2015, according to London-based research company RBR.

Even developed countries like the UAE are “ripe for digital transformation”, said Mr Kelly.

“In the UAE, millennials account for 30 per cent [of the population], smartphone penetration is at 79 per cent and consumers are open to change … all factors fuelling the demand for a better alternative to cash.”

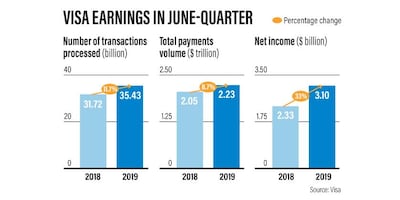

Driven by increases in payments volume and processed transactions, as well as cross-border and digital payments, Visa recorded strong earnings growth in its third quarter that ended on June 30.

The company’s net income rose 33 per cent year-on-year to $3.10bn. The number of transactions processed increased 11.7 per cent to 35.43 billion.

By region, Central and Eastern Europe, Middle East and Africa (Cemea) showed the highest growth in payments volumes globally, at over 22 per cent in the last quarter.

“Our goal is to be in the middle of as many transactions as possible. With that in mind, the UAE and broader MEA region are very important markets for Visa,” said Mr Kelly.

Mr Kelly said Visa is looking at regional investments to boost growth in the medium-term, including acquisitions to expand into new markets.

In May, Visa acquired UK-based Earthport - a company that provides cross-border payment services to banks, money transfer service providers and businesses in over 200 countries.

“With Earthport, Visa can reach over 99 per cent of consumer and small business bank accounts in 88 countries, including the top 50 markets (that represent over 90 per cent of global volumes),” said Mr Kelly.

Visa is also using artificial intelligence, data analytics and machine learning to predict and prevent financial frauds.

“Visa processed more than 127 billion transactions between merchants and financial institutions last year and employed AI to analyse 100 per cent of the transactions… each in about one millisecond,” said Mr Kelly, adding that it helped financial institutions to “approve legitimate purchases while quickly identifying fraudulent transactions”.

Visa is also enabling the roll-out of mobile wallets such as Apple Pay, Google Pay and Samsung Pay in the UAE and globally, as these companies use Visa tokenisation, a form of data security, to keep sensitive account information safe.

The global e-commerce boom is a major growth driver for Visa's business.

“E-commerce holds immense potential… in 2018 alone, global e-retail sales amounted to $2.8tn, and projections show a growth of up to $4.8tn by 2021,” said Mr Kelly.

In the UAE, e-commerce transactions are forecast to total $16bn in 2019 and grow 23 per cent annually between 2018 and 2022, the most out of any country in Mena, according to a joint study by Dubai Economy and Visa.

“Thanks to the progressive policies, growing presence of new payment players and a growing number of retailers accepting mobile wallet payments, UAE is in a great position to continue its march towards becoming a digital-first society,” said Mr Kelly.

Visa has also partnered with Dubai Silicon Oasis Authority in a $1 million investment in the Dubai Smart City Accelerator that aims to support start-ups and FinTech companies.