Japanese electronics maker Toshiba has confirmed it will exit the laptop business after transferring the remaining minority stake in its personal computer arm to Sharp.

In 2018, Toshiba sold an 80.1 per cent stake in its PC business to Foxconn-owned Sharp for $36 million (Dh132.12m). Sharp renamed the division Dynabook in January 2019.

“Toshiba Corporation hereby announces that it has transferred the 19.9 per cent of the outstanding shares in Dynabook that it held to Sharp Corporation … as a result of this transfer, Dynabook has become a wholly-owned subsidiary of Sharp,” the company said in a brief statement.

“On June 30, 2020, under the terms of the share purchase agreement, Sharp exercised a call option for the remaining outstanding shares of Dynabook held by Toshiba … and Toshiba has completed procedures for their transfer,” it added.

The company did not disclose the value of the remaining stake transferred.

The transaction marks an end to Toshiba’s 35-year run in the PC business.

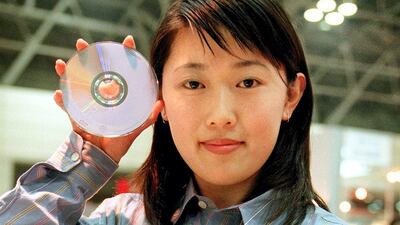

It made its first laptop, the T1100, in 1985. Weighing almost 4 kilograms, the model was initially launched in Europe with a modest annual sales target of 10,000 units and a price tag of $2,000. Despite the company's initial inhibitions, it was a huge success.

Toshiba was among the top-selling PC manufacturers in the 1990s and 2000s but its market share dropped significantly as a wave of new entrants offered cheaper and more innovative options.

At its peak in 2011, Toshiba sold 17.7 million PCs but the number shrank to just 1.4 million units in 2017, according to Reuters.

Overall, PC sales enjoyed a 0.6 per cent increase in 2019 ending seven consecutive years of decline, according to US-based research firm Gartner.

Global PC shipments totalled more than 261 million units last year, almost 1.5 million more than the same period in 2018.

Chinese tech giant Lenovo now has the largest share of the market at 24.1 per cent. It is followed by American firms HP and Dell, which had 22.2 per cent and 16.8 per cent respectively, according to Gartner’s data.

Industry analysts expect the growth in PC sales to continue in 2020 as more employees switch to working from home due to the Covid-19 pandemic.