2017 has been hailed by many as the coming of age year for e-commerce in the UAE and the wider region. Emaar Properties chairman Mohamed Alabbar got the ball rolling in November last year with the unveiling of Noon, a $1 billion e-commerce venture offering 20 million items for sale in the UAE and Saudi Arabia, due for launch in early 2017.

In March, e-commerce giant Amazon acquired Souq.com, the region's largest e-commerce venture, for $580 million, prompting customers to dream about a vast range of consumer goods and services all available via a tap, click or swipe.

The arrival of Noon and Amazon on the scene in 2017 may have a seismic impact on the e-commerce sector; consultants AT Kearney expects e-commerce in the UAE to grow at a compound annual growth rate for 25 per cent per year up to 2020, with Frost and Sullivan estimating the market could be worth up to $10bn by next year.

"Anyone who executes the correct way in the next couple of years can get into the big league," reckons Pratik Gupta, co-founder of Wadi.com, an online market platform that launched with great fanfare in Saudi Arabia and the UAE in 2015.

Online shopping in the UAE is nothing new

UAE retailers such as Jacky's Electronics started experimenting with internet shopping from the late-90s onwards. These were eventually followed by early attempts at e-commerce websites including uaemall.com and hadaiya.com, the latter a tie-up between bricks and mortar retailer Jashanmal and American Express, launched in 2003.

Souq itself began life in 2005 as an auction site as part of web-portal Maktoob.com, created by Aramex founder Fadi Ghandour. The company was spun off into a standalone online marketplace in 2009 by founder Ronaldo Mouchawer, following the acquisition of Maktoob by Yahoo.

In recent years Souq has been joined by other digital retailers, including Jadopado, Mumzworld and Namshi (since acquired by Emaar Malls) in 2011, Awok.com in 2013, and Wadi.com in 2015.

Conditions in the UAE are favourable for e-commerce....

In many ways, online shopping should be a natural fit for the UAE; in addition to high levels of disposable income, the country has highly-developed transport and logistics infrastructures, with the majority of its population based in urban areas. The country's smartphone penetration is the highest in the world at 73.8 per cent, with more than 90 per cent of the population having access to the internet. What's more, its young population, a third of whom are under 25, are ideally placed to embrace e-commerce.

... but the sector remains in its infancy

In spite of recent strides, online shopping accounts for a tiny portion of retail activity in the UAE and the wider region. Figures from AT Kearney found that e-commerce contributes relatively little to the GCC's economy, accounting for just 0.4 per cent of GDP in 2015. This compared with 1.8 per cent in France and 2.2 per cent in Japan, countries with similar GDP per capita figures to the GCC as a whole.

Mall culture, cash and fears of fraud hold back online shopping

In spite of recent strides made by Souq and others, e-commerce offerings remain relatively under-developed in the UAE, often leading to disappointment from customers used to higher quality services in other countries. While Souq has grown its business to offer 8.4 million products across 31 categories, this figure is still less than five per cent of what Amazon offers.

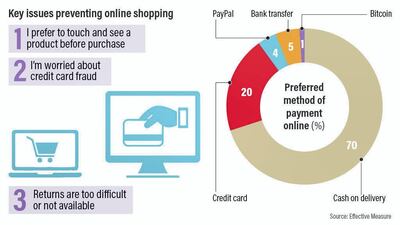

From the consumer side, e-commerce has been in part at least held back in the UAE by the enduring popularity of malls as both shopping and social destinations, making old shopping habits hard to shake. Customers around the region questioned by survey group Effective Measure found that the inability to touch and see a product before purchasing it was the number one factor putting people off buying goods online.

Unlike their peers in Europe and the US, many customers in the UAE and the wider region have so far proved reluctant to purchase goods and services online using a credit or debit card. This is driven by a continued preference for cash payments across the region, obliging online retailers having to offer cash on delivery services, and high concerns about online credit card fraud.

New entrants' scale and skill to have transformative impact

While the success of the likes of Souq and Namshi has gradually lifted awareness of e-commerce in the UAE, this year's arrival of Amazon and Noon may well provide the tipping point for online shopping in the country.

The impact of Noon in particular promises to be especially huge, given the sheer scale of its ambitions, leveraging off Mr Alabbar's stake acquisitions in regional logistics giant Aramex and regional F&B giant Americana. Noon's Dubai-based fulfillment centre in Dubai promises to be the size of 60 football fields, according to Mr Alabbar, with around 20 million products from day one, more than double the number currently available via Souq's website.

The tie-up between Souq and Amazon meanwhile is equally mouthwatering. As Mr Mouchawar commented following the deal's completion in July, "integration of Amazon's technology and global resources with our local expertise will help us to offer a great service to our loyal customers.

After the excitement, the long wait for delivery

In spite of such excitement, things have gone quiet in the UAE's e-commerce space in recent months; while Amazon completed its acquisition of Souq in July, little has changed for Souq customers, beyond being able to use their Amazon accounts to access Souq's website. While work on integration between the two sites is underway, there';s little indication of when UAE-based customers will be able to access Amazon's larger product line.

Noon meanwhile still remains on course for a launch "this year," according to Mohamed Alabbar, although its original target launch date of January is now a distant memory. The company is rumoured to have suffered a series of internal setbacks, with a significant turnover in staff in recent months. The company lost its first chief executive in April, only appointing a replacement two months later. In May, its chief technology officer, former Jadopado chief executive Omar Kassim, stepped down after a matter of weeks, saying, "I just didn't know how deep the problems ran."

Offline retailers tooling up for the challenge

The country's traditional retailers are taking advantage of such delays, overhauling their own e-commerce offerings so as not to be left behind. Lulu Hypermarket last year launched Luluwebstore, offering online grocery deliveries in Abu Dhabi. A wide range of offline retailers, including Sharaf DG, Virgin Megastore and Ace Hardware have significantly upgraded their e-commerce offerings in recent months.

Other offline retailers are embracing technology in novel ways in order to compete with the likes of Souq and Noon. Majid Al Futtaim (MAF), the conglomerate behind Mall of the Emirates and operator of Carrefour stores, earlier this year invested in Dubai-based delivery app Fetchr. leveraging the company's expertise for its Hands Free Shopping service, allowing Mall of the Emirates shoppers to leave their purchases at the mall and have them delivered to a location of their choice.