Smartphone shipments to the Gulf rose in the final three months of last year, driven by demand for the latest iPhone models and a rise in discretionary spending as pandemic restrictions eased and a vaccine rollout began.

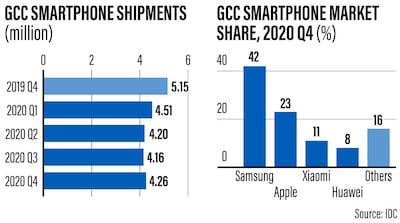

Nearly 4.26 million smartphones were sold in the three months to December 31 – a 2.3 per cent increase on the third quarter, but a 17 per cent decline on the same period a year earlier, the International Data Corporation said in its Quarterly Global Mobile Phone Tracker report.

The growth was driven by the launch of four new models in the iPhone 12 series in October, with US-based Apple recording a 55.7 per cent quarterly increase in shipments. South Korean company Samsung's smartphone deliveries fell 4.1 per cent as it faced shortages for some models, the Massachusetts-based research company said.

"Apple enjoyed strong demand for the iPhone 12 series … while its iPhone 11 series continued to perform well in the region," Akash Balachandran, a senior research analyst at IDC, said.

The launch of more expensive models also meant the total value of the GCC's smartphone market surged almost 40 per cent quarter-on-quarter to $1.6 billion.

Samsung remained the market leader in the GCC, with a 42 per cent market share, followed by Apple (23 per cent), Xiaomi (11 per cent) and Huawei (8 per cent).

Most GCC countries returned to some state of normality during the quarter, with borders re-opening for travel. This was especially true in the UAE, where the vaccine rollout began in earnest, the IDC said.

“Although consumer spending remained focused on essentials, there was a release of pent-up demand, particularly for iOS devices,” it added

Fifth-generation devices accounted for 16.5 per cent of all smartphone shipments across the GCC in the last quarter.

“Significant growth is expected in the shipments of 5G-enabled devices in 2021, particularly as they increasingly become available in mid-tier price bands among Android devices," Ramazan Yavuz, a senior research manager at IDC, said.

Saudi Arabia, the Arab world’s biggest economy, accounted for 49.4 per cent of all smartphones shipped within the GCC region. However, the kingdom suffered an overall quarter-on-quarter decline in shipments due to component and supply shortages that affected lower-end Android devices, the report said.

The UAE, the region's second-largest market, saw its share of smartphone shipments increase to 26.1 per cent during the quarter.

The region’s smartphone market is forecast to experience a 0.7 per cent quarterly decline in shipments in the first quarter of this year.

"Supply constraints will likely continue to hamper growth in the region due to chipset and component shortages across most smartphone brands in the first half,” Mr Yavuz said.

“However, with supply returning to normal and with the vaccine rollout expected to significantly reduce the possibility of additional lockdowns and spikes in Covid-19 cases, the market is set to see growth return towards the second half of the year,” he added.