The decision by Google parent Alphabet's co-founders to step down from day-to-day running of the firm and appoint Sundar Pichai as chief executive will boost investor confidence, calm regulatory frictions and add new synergies to the group's loss-making "other bets" venture, analysts say.

Mr Pichai was appointed as the new chief executive of Google’s parent company Alphabet on Tuesday, replacing co-founder Larry Page. The firm's other co-founder, Sergey Brin, also stepped down from his role as the company’s president.

"Fresh senior executives are probably better suited to negotiations and to navigate the diplomatic tightrope than technology innovators," Neil Campling, co-head of Mirabaud Securities' Global Thematic Group, told The National.

This move has been “thoroughly planned and thought out”, he added, saying that with the founders stepping away “it should be much easier for Mr Pichai to make appropriate changes internally”.

The co-founders will remain directors of Alphabet. However, they will no longer oversee the company’s day-to-day operations.

The appointment of Mr Pichai has come as no surprise. He has worked at the firm 15 years and has been chief executive of Google since 2015.

More cynical observers might perceive the timing as a means of escape for both founders at a difficult time for Alphabet both internally and externally, said Matthew Kendall, chief telecoms analyst at The Economist Intelligence Unit.

"But these frictions have been brewing for quite some time, and the founders' absence at the helm means that Mr Pichai will be well aware of the challenges the company faces," he told The National.

“What has changed now, however, is that Mr Pichai will no longer adopt a caretaker role when it comes to Alphabet's future strategic direction.”

Established in August 2015, Alphabet was born out of a corporate restructuring of Google. The 21-year-old company then became a wholly-owned subsidiary of Alphabet and all of its shares were automatically converted into the same number of shares of Alphabet.

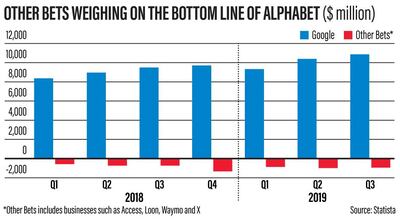

Alphabet separates Google from “other bets” that are not part of its core business. These include more than a dozen companies such as biotech firm Calico, self-driving car technology business Waymo, healthcare software company Verily, drone company Wing and investment subsidiaries GV and Capital G.

However, over the years, "other bets" has continued to weigh on company’s bottom line. In the third quarter ended September 30, "other bets" incurred an operating loss of more than $941 million (Dh3.45bn billion), whereas the core Google business remained highly profitable, generating operating income of more than $10.8bn.

Analysts say Mr Pichai's takeover could lead to a turnaround in the fortunes of the non-core businesses and also revive investors’ confidence.

"With being promoted to the top post of Alphabet, Mr Pichai would probably work on a cohesive plan for all the businesses under Alphabet to streamline policies and put out fires that the company has been in the centre of," Abbas Ali, managing editor of TechRadar Middle East, told The National.

“Without doubt … Google/Alphabet needs to take a couple of steps back to move forward.”

Google saw its slowest revenue growth in three years this year due to increased competition in advertising and stumbles in its smartphone business. The company posted $40.5bn in revenue and a net income of $7.1bn for the third quarter to September 30.

“Investors think now there is a greater chance of the other bets paying off and reaching solid financial metrics than under the direction of the founder,” said Mr Campling.

“He [Mr Pichai] has a closer attention to detail and financials and he has been responsible for deciding to shut down some previous ventures [such as the unpopular Google Glass in 2015].”

Nevertheless, industry experts say it won’t be an easy task to successfully take over the reins of Alphabet for Mr Pichai, who is credited for creating the Chrome browser and successfully taking over the Android business from its founder, Andy Rubin. A year after Mr Pichai took on Android, Google shipped 1 billion devices globally.

“His [Mr Pichai’s] decision-making and managerial capabilities will be put to the test at a time of ever-intensifying scrutiny on big tech and Alphabet's overall development,” noted Mr Kendall.

Despite stepping down, both founders still control more than 51 per cent of the company’s shares.

As of April, Mr Page held 26.1 per cent of Alphabet's total voting power, Mr Brin 25.25 per cent and Mr Pichai less than 1 per cent.