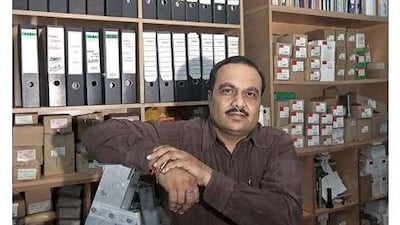

Jayesh Ravani was shocked when he applied for a business loan from a big UAE bank. In the end, the 22 per cent interest charged by the lender on a Dh300,000 (US$81,674) loan turned out to be the best deal available for his Dubai-based re-export company Oman Ocean Trading.

"Many banks were asking for more financial security or a repayment guarantee," Mr Ravani says. "It makes it difficult because business is slow for us." With demand sluggish for the tools and hardware Oman Ocean imports from China, India and Germany and re-exports across the Gulf, the high repayment rates on his loan are making life even tougher for Mr Ravani . The Oman Ocean experience is similar to that of thousands of other companies struggling to obtain reasonably priced finance to return their businesses to an even keel after the global financial crisis.

Accounting for about 85 per cent of employment in the UAE and contributing almost half of GDP, small and medium-sized enterprises (SMEs) are regarded as the lifeblood of the economy. The trouble is many traditional avenues of funding for SMEs, such as bank credit, are blocked as lenders remain cautious after the global financial downturn, even though the balance sheets of UAE banks are generally robust.

A stress test of eight local banks carried out by Shuaa Capital in July found that even under a severe crisis, the lenders' capital adequacy ratio and Tier 1 capital were still above international standards set by Basel II. "For the UAE to grow and to speed up the recovery we need to get more financing for business community," says Hamad Buamim, the director general of the Dubai Chamber of Commerce and Industry.

"Bank liquidity is strong but they are not lending to the business community and this is the same all over the world." How to spur lending to the private sector remains a conundrum for governments around the world. Lending to non-financial companies in the 16-nation euro zone slipped by 1.3 per cent in July compared with the same month last year, while the bosses of six big UK banks are to form a taskforce aimed at getting business loans moving again.

In the UAE, private-sector credit growth declined by 3.2 per cent between June last year and the same month this year, according to the latest data released by the Central Bank last week. The deceleration may arise partly from the financial challenges the country's banks have faced in the past year. Banks' asset quality took a knock from their exposure to the defaults of the Saad and Al Gosaibi groups of Saudi Arabia last summer, and the multibillion-dollar debt restructuring of Dubai World, which is yet to fully run its course.

Such financial troubles have intensified the risk aversion of lenders. Smaller businesses may be feeling the brunt of this caution more keenly. Some banks consider the risks of lending to smaller businesses as outweighing the benefits, due to a higher likelihood of start-ups and smaller firms failing, say analysts. "Some businesses may not have the appetite to seek loans yet and even if they want to they could find it hard as their risk profile may be high," says Janany Vamadeva, a senior analyst at HC Brokerage in Dubai.

Of those banks that are lending, many are charging customers high interest rates, as Mr Ravani found out to his cost. The Indian lender Bank of Baroda, which has a 90 per cent SME customer base, has seen its enquiries from small companies rise by half this year. It has set up an "SME loan factory", with staff dedicated to responding promptly to credit applications from small businesses. "SMEs have a longer-term relationship with us than corporate clients as we try to help nurture them from the beginning through their growth to become larger," says Ashok Gupta, the chief executive of Bank of Baroda in the GCC.

Almost all of a $100 million fund HSBC set up in January to support small businesses has been allocated, with the strongest demand coming from the trade, retail, and oil and gas sectors. To improve their chances of obtaining credit, small businesses needed to supply banks with sufficient information such as audited financial statements and accurate and timely financial data, says Rana al Emam, the head of business banking at HSBC in the UAE.

More banks may start to turn their attention to catering for small businesses again as the economic recovery gains pace. With the biggest challenges the industry has faced stemming from the corporate sector in the past year, Dubai chamber's Mr Buamim expects an increasing shift in focus from larger corporates to SMEs in the future. "There has always been big demand from SMEs but most of the lending has been personal loans, so not as sophisticated," he said.

"I expect in the next couple of years more focus on SMEs as, for banks, the profits outperform the risks." tarnold@thenational.ae