India's start-up sector is experiencing a slowdown in investment activity after a record-breaking year in 2021, due to global geopolitical factors and poor stock market debuts by loss-making internet companies, according to experts.

But the long-term outlook remains bright for the sector, as India's digital sector records growth and it advances towards its goal of becoming the world's largest start-up destination.

“Sure enough there is a global overhang of the current geopolitical situation ... and an erosion in some of the tech stocks that got listed has dampened the mood a bit,” says Anup Jain, managing partner at Orios Venture Partners, an early stage venture capital fund in India. But “tech start-ups are going to be driving the Indian economy forward”.

“The rate of digital adoption across income classes is well-established and consumers are firmly behind this entire digitisation in every aspect of life,” he says.

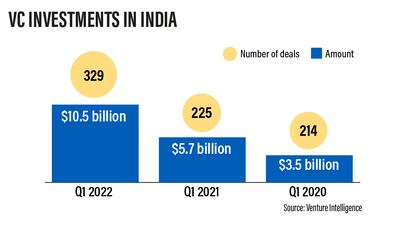

Start-ups in the country raised $10.5 billion in the first quarter of this year, which was almost double last year's investment in the same quarter, figures from Venture Intelligence show. But analysts note that this is not a clear reflection of current trends because deals are often announced months after they are closed.

VC investment into start-ups in India is already showing some signs of waning, with the funding deal value and volume down by 22 per cent and 24.6 per cent respectively when comparing February with January, research by GlobalData suggests.

“The decline in deal activity in February can be attributed to the prevailing uncertainty and market volatility and is in line with the global trend wherein most of the key markets such as the US and China also experienced subdued activity,” says Aurojyoti Bose, lead analyst at GlobalData.

Factors including Russia's military offensive in Ukraine and rising interest rates are dampening investment flows worldwide.

“Nevertheless, promising start-ups in India continue to be on VC investors’ radar,” says Mr Bose.

India is the third largest start-up market in the world after the US and China. However, its “aspiration is to be the world's number one start-up destination”, the country's commerce and industry minister, Piyush Goyal, said during an event in Abu Dhabi last week.

“India has witnessed a remarkable increase in the number of start-ups in the last few years,” says Neeraj Joshi, the founder of Pushstart, a start-up community in India, adding that it is a huge market for domestic and global investors.

Financial technology and educational technology are two areas leading the start-up boom in India, he says.

VC investment in the country hit a record high of $38bn in 2021, a report by Bain & Company found.

“There was a lot of optimism [last year],” says Amit Sharma, general partner at Cactus Venture Partners. “The liquidity was there in the market. And the digital models were picking up because of the pandemic as well.”

But this year there has been a shift.

“The capital, while available, is not available at the pace or at the ease it was available last year,” says Mr Sharma.

“I think this year, the liquidity due to the Fed rate hikes, or expectation of rate hikes, is [being squeezed] a bit.”

Investors are being more cautious and “are asking what is the path to profitability ... that said, high quality start-ups continue to get good access to capital”, Mr Sharma says.

co-founder of True Beacon and Zerodha

Nitin Sharma, a partner at early stage VC fund Antler India, says he is certainly noticing a correction.

“Last year, there were rounds getting done within weeks. At the early stage, sometimes within days, people were offering a commitment and discipline around valuations was completely lost. Now, there is certainly a correction. But it's not a crash or anything, it's still very vibrant."

Early stage VC funds, like his company, tend to take a five to 10-year view, he says.

“So, if you look at the tech ecosystem, the global story building out of India is very strong.”

Indian gaming start-up Playex, which is trying to raise investment, has noticed that conditions have tightened, but co-founder Pranay Rajput sees this as merely a temporary situation.

“We saw some caution in the investment process since global emotions were not particularly favourable for investments owing to the ongoing crisis, but the situation is improving today and start-ups and investors are once again engaged in the investment process,” he says.

Meanwhile, start-ups in sectors such as health technology benefitted from the pandemic and the accelerated adoption of digital, and are continuing to see strong interest.

“We have no qualms about raising funds,” says Harminder Singh Multani, chief executive of start-up MyDentalPlan Healthcare. “We are receiving significant interest from many investors and are carefully evaluating all offers that are coming our way.”

But some start-ups are hitting the pause button when it comes to opting for a stock market listing.

“With the markets being volatile, a lot of start-ups have decided to push [back] their listing plans,” says Mr Joshi.

Last year, a flurry of Indian start-ups went for IPOs, including Paytm, PolicyBazaar and CarTrade.

But several internet-based companies that made their debut on the stock market are now trading at values that are dramatically below their issue price.

Paytm, for example, had an issue price of 2,150 rupees ($28.30) a share. It is now trading at 570 rupees per share. PolicyBazaar and CarTrade are also sharply down on their issue price.

Stock markets in India have been affected by the geopolitical fallout of the Russia-Ukraine conflict, including rising energy prices, inflationary pressures and tightening liquidity trends. But stock brokers say that many start-ups were also heavily overvalued.

There seems to have been “a crazy valuation bubble” in the Indian start-up landscape, which is now being rationalised, says Nikhil Kamath, the co-founder of asset management firm True Beacon and stock broker Zerodha.

“The public market listing of Paytm, Nykaa, Policybazaar and CarTrade seems to have brought in a certain amount of realism in terms of the valuations and how they've corrected,” he says.

“Hopefully, this encourages start-up founders to price better and not get too swayed by just valuation but focus on the intrinsic fundamentals of the business.”

Mr Kamath does “not see any large tech IPO in the near future".

But India has “the talent and access to liquidity and the entrepreneurial spirit required” to become the world's top start-up destination, he says.

Angel investors such as Dhruvil Sanghvi are also bullish on the Indian start-up scene.

“I'm almost investing at the rate of a start-up a month and this is going to get accelerated three times. I am looking to invest in 50 start-ups this year, up from 15 in 2021,” says Mr Sanghvi, who is also the founder and chief executive of LogiNext.

“This is owing to the kind of pathbreaking products that entrepreneurs are coming up with.”

Mr Sharma at Cactus says that India has even greater potential beyond becoming the number one start-up hub.

“We do envisage a trend where the successful start-ups coming out of the Indian market will go to the global stage and drive growth from there similar to [what] the IT services industry had done in the late 90s and the 2000s.”