RELATED: Will oil break the 2008 record of $147 a barrel?

Countries must intensify efforts to achieve net-zero targets as rising geopolitical tensions and soaring energy costs challenge the goal of limiting the rise in global temperatures to within 1.5°C by 2050, according to the consultancy Wood Mackenzie.

Energy market supply disruption after a global economic strong recovery that increased demand, have caused price-sensitive consumers to switch to fossil fuels, pushing back net-zero priorities, Wood Mackenzie said in a report.

About $60 trillion of capex investment is needed in low-carbon technology and infrastructure, mining commodities and abated fossil fuels to achieve net-zero by 2050, it said.

“Record commodity prices and recent geopolitical changes have highlighted the challenges in navigating the energy transition. The world is facing its biggest challenge yet in its journey towards net zero," said David Brown, head of markets and transitions for the Americas.

“To remain on course, those most exposed to global commodity markets need to double down on plans to decarbonise through electrification and other emerging, net-zero enabling technologies. Policy must be geared towards renewable growth and investment in grid infrastructure.”

Commodity markets, particularly oil, have been extremely volatile as the US and its allies intensify sanctions on Russia, the world's second largest energy exporter, after its military offensive in Ukraine.

Russia accounts for about 10 per cent of the world’s energy output, including 17 per cent of its natural gas and 12 per cent of oil. It supplies about 40 per cent of Europe's gas, while Russian crude accounts for about 3 per cent of US oil imports, equal to about 200,000 barrels a day.

Brent, the global benchmark for two thirds of the world's oil, was 1.28 per cent higher, trading at $117 a barrel at 12.09pm on Wednesday, while West Texas Intermediate, the gauge that tracks US crude, was up 1.1 per cent at $110.5 a barrel.

Soaring energy costs have prompted calls to continue investing in hydrocarbons as well as clean power to ensure global energy security.

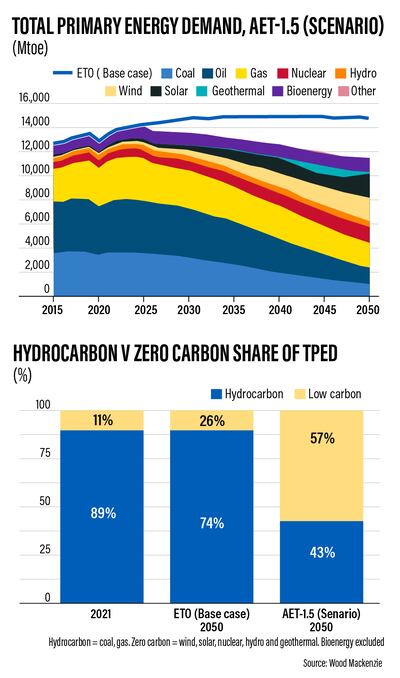

As the world continues to transition to cleaner energy, wind and solar are expected to account for 61 per cent of the power market by 2050, Wood Mackenzie said.

Hydrocarbons’ share in power demand could fall to 43 per cent in 2050 from 89 per cent today while coal and oil demand is expected to decline nearly two thirds during this period.

Increasing adoption of carbon capture and storage (CCS) and blue hydrogen could lead to the share of natural gas falling to 26 per cent, the consultancy said.

Electrification is expected to feed 48 per cent of global energy demand as use of electric vehicles picks up. Global stock is expected to rise to about 1.7 billion electric vehicles by 2050, while battery prices could fall amid increasing regulatory support.

However, an "unprecedented growth in mine supply is required to deliver the raw materials to underpin electrification of the transport sector", the report showed.

"Metals costs will endure vast price cycles as demand booms and higher carbon costs are embedded into production. End users will need to be cautious about near-term price volatility for battery raw materials caused by supply-demand disconnect or other disruptions."

In addition. Wood Mackenzie forecasts that the use of emerging technology including CCUS and hydrogen at industrial scale is important to decarbonise hard-to-abate sectors.

"Under AET-1.5, we expect the power sector to account for a sizeable chunk of low-carbon hydrogen demand. China, US, India and EU-27 are expected to make up 70 per cent of global hydrogen demand by 2050. This means a globally traded hydrogen market of $475 billion emerges,” said Prakash Sharma, head of markets and transitions in the Asia Pacific.

In order to incentivise such technology, global carbon prices need to rise, the report said.

Carbon pricing is a mechanism used to address climate change by creating financial incentives for companies and countries to lower their emissions by switching to more efficient energy processes or cleaner fuels.

Wood Mackenzie expects the global carbon price to rise seven-fold from an average of $25 per tonne of carbon dioxide equivalent today to $175/t by 2050 in developed economies and $127/t in emerging economies.

"The price implementation will be closely linked to government economic priorities and the pace of the transition in different markets," said Murray Douglas, research director at Wood Mackenzie.