Scheduling conference calls, meetings or even a meal with a work contact really shouldn’t take an endless email thread of suggestions and counter-suggestions. Doodle is a platform that has been offering an alternative for almost a decade. Founded in 2007 with a premium-service launch in 2009, a redesign in 2011 and a buyout by the Swiss company Tamedia in 2014, it now comes in the form of a web platform and mobile app for Android and iOS.

Its strength is its reliability and simplicity.

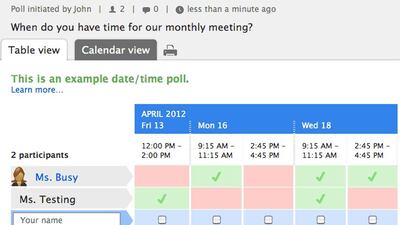

Without even signing up as a user, you can create a multiple-choice poll with dates and times, and email the link to whoever you’re trying to meet up with. The default setting limits responses to “yes” and “no”, although you can add another option for “if-needs-be”, and you can hide the results so that only administrators can see others’ availability. If you’re communicating with someone in a different time zone, time slots will automatically be adjusted, depending on the time where they are.

There’s not much integration yet with other communication and task-management platforms, but what Doodle does, it does well.

If you do decide to register for a free account, you can connect your calendar (if it’s provided by Apple, Google, Office, Outlook or an ICS feed) so that you can check when you’re free and respond to meeting requests from the same page. You can also download a mobile app – ideal for setting up and responding to polls quicker if you’re not at your desk – and create a MeetMe page, which signposts your availability to anyone who might want to schedule a meeting.

There are a couple of premium options at US$39 a year for individuals or $69 for companies. This will get you an ad-free experience, the ability to customise your pages with company branding and a few other add-ons, like automatic reminders to chase people up if they haven’t responded to your suggestions for appointment times. For most users, though, the free version will give them all the functionality they need.

Q&A: Gabriele Ottino, the acting chief executive of Doodle

What features have recently been added?

We have supported Apple’s newest iOS 10 features from day one. You can set up a poll without ever leaving your chat with our new iMessage app for iPhone. And at the end of June we acquired Meekan, a scheduling chatbot for the business-messaging platform Slack. The bot allows you to schedule meetings with a simple sentence like “Meekan, please schedule a meeting with Jessica”. Powered by artificial intelligence, it will find the best available slots automatically, book them into your calendar and send out an invitation.

Can you share any metrics on the platform’s success?

In the past year it’s been used by over 180 million unique users from 175 countries and is available in 22 languages: a truly global success story.

Do you have any updates planned in the near future?

We are working on our biggest redesign of the last five years. The web and mobile web product will have a completely new design and an even simpler process of setting up a poll. The beta version is being tested and we are planning to open it to the public later this fall, with full roll-out early next year.

How about long-term goals?

Doodle should be helping you with your scheduling anywhere you communicate and should be able to tie in additional services like easily booking a table, a flight or other. We have a lot of work left to do.

business@thenational.ae

Follow The National's Business section on Twitter