Property prices in Europe’s luxury ski resorts held up against the effects of Covid-19, with French destinations leading the gains over the past year, according to global real estate consultancy Knight Frank.

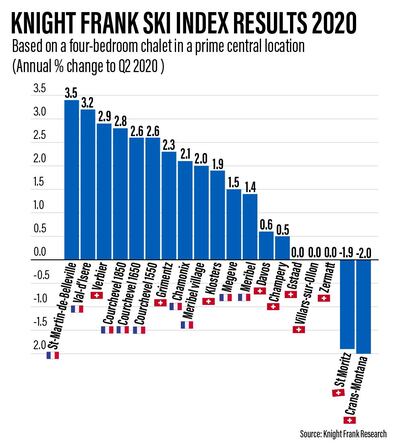

While Saint-Martin-de-Belleville secured the top spot on the Knight Frank 2020 Ski Index, with prices up 3.4 per cent in the year ended June 2020, it is one of only a few resorts to still offer development opportunities.

Last year’s frontrunner, Val d’Isere now sits in second place on the ranking, with a rise in house prices of 3.2 per cent, while Verbier in Switzerland secured third position with 2.9 per cent. The ranking is based on a four-bedroom chalet in a prime central location.

Overall the index increased by 1.2 per cent in 2020, down marginally from the 1.4 per cent seen last year, suggesting the pandemic “has had little impact on prices to date”, said Knight Frank on Wednesday.

“Covid-19 and the resulting lockdowns have significantly disrupted global real estate markets. The ski market has been no exception,” said Kate Everett-Allen, the author of the Knight Frank report.

“Homeowners are re-evaluating their lifestyles and working patterns, holiday plans are being upended and rental incomes have been depleted. But this might also be the year that the benefits of mountain living are brought into focus.”

Most ski resorts in Europe were ordered to close on March 15 this year as governments ramped up movement restrictions to contain the spread of coronavirus. It meant hotels and chalets missed out on the traditionally lucrative Easter period when holidaymakers flock to Europe to enjoy the slopes.

Refunds for holiday rentals were then issued and ski lifts froze as the containment measures took hold, said Knight Frank, with property agents resorting to drone viewings, virtual property tours and digital notary signings to shift inventory and ensure transactions could go ahead.

This led to lost sales of about 5 to 10 per cent, according to Knight Frank.

However, the rental market experienced a boost over the summer when staycationers headed to hotels close to home with Swiss hotels close to full occupancy. This later translated into a rise in property viewings and sales in July and August across the Three Valleys – Courchevel, Méribel and Belleville in France.

The pandemic has failed to derail house prices across Europe in 2020, according to a Tuesday study by global ratings agency S&P. Residential property prices will rise the most in the Netherlands, Germany and Sweden this year, despite the lockdowns and resulting drop in economic activity. Prices are also expected to rise in Belgium, France, Italy, Switzerland and the UK, even as a second wave of coronavirus hurts economies across the continent once again.

UK average house prices rose 2.5 per cent over the year to August, with residential property transactions surging 21.3 per cent in September as buyers cashed in on UK finance minister Rishi Sunak's Stamp Duty Land Tax holiday.

Aspects protecting ski resorts from a house price hit during the crisis include a limited supply of new developments in some areas and residents re-evaluating how they live and work following lockdowns.

“Prices in most French resorts are being supported by a lack of new supply as building permits become increasingly hard to obtain, which is resulting in a 5 to 10 per cent premium for new-build homes,” said Roddy Aris, Knight Frank’s head of sales in the French Alps.

Val d’Isere, has been insulated against a price shock as its high altitude still attracts buyers seeking reliable snowfall, the report found.

In Switzerland, however, high levels of stock combined with the effects of the Lex Weber law – which caps the number of second homes in a particular area at 20 per cent – is deflating prices in some markets. The smaller resorts of St. Moritz, Gstaad and Crans-Montana present non-residents with a choice of new-build apartments at lower prices, said Alex Koch de Gooreynd, head of sales in the Swiss Alps for Knight Frank.

Switzerland is also attractive to international buyers now considering the country as a permanent base because of the lifestyle it offers, the government’s handling of the crisis which secured it the accolade as the world’s safest country during the pandemic, and currency benefits.

“Along with the US dollar, the Swiss franc is the world’s go-to safe currency from which to shelter during times of uncertainty and with interest rates now negative, the appeal of Swiss property is strengthening,” said Knight Frank.

“Negative interest rates mean Swiss banks are effectively charging clients to store their capital, leading many to look to a property investment as a means of wealth preservation and income generation.”

Verbier, Switzerland’s leader on the index, is a draw for international clients looking for good schools, with some people choosing to base themselves in the Alps on a semi-permanent basis during the pandemic and upgrading their homes. Swiss residents from Geneva, Lausanne and Montreux also relocated to their second homes as remote working became the new normal.

Looking ahead, Knight Frank expects last-minute bookings to become the norm in the 2020-2021 ski season as holidaymakers wait to assess the latest travel restrictions. Rental demand may be stronger in smaller, less-crowded resorts with potentially weaker demand for shared chalets or hotels where social distancing is a challenge.

Measures that tourists can expect on their travels include fully refundable ski passes, one-way systems in resorts and savings on activities, with town councils subsidising local activities to lure in visitors. Chamonix in France, for example, has put aside €300,000 ($355,511) to offer free paragliding and white water rafting activities to tourists.

Other challenges ahead include the implications of the UK’s exit from the European Union, which will make it harder for UK nationals to hire citizens of their own country in France to clean or cook in their homes, as staff have to be employed by companies registered in the host country.

UK buyers seeking finance for an alpine home will also “have to work harder” to find a suitable mortgage says Alex Ogario, a partner at Knight Frank, as some options may disappear.

However, UK owners of Swiss properties should see less disruption as the country still remains outside the EU.