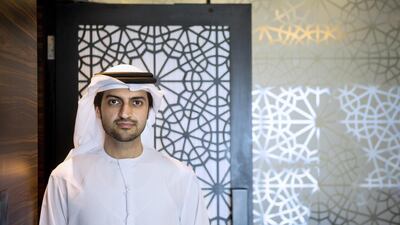

Jassim Alseddiqi says he is not a risk-taker even after closing two of the biggest central London property deals of the past year at what could be the peak of the market.

Is he worried he paid too much for the trophy assets of No 1 Palace Street and New Scotland Yard?

“I’ll tell you in two years,” smiles the engineer turned investor who runs Abu Dhabi Financial Group. If he is worried, it doesn’t show.

The two sites are among the most prized in central London, where until now it has been Qatari investors who have dominated the big ticket purchases from The Shard to Harrods.

If you can stump up as much as £60 million (Dh332m) needed to buy a penthouse at No 1 Palace Street, your nearest neighbour could be the Queen. Down the road in Victoria, the revolving sign outside New Scotland Yard has been a fixture of TV crime capers and films for decades.

Iconic buildings come with iconic price tags

“Today you cannot buy something so valuable and so unique without a premium,” says Mr Alseddiqi. “What we paid for it is its value.”

While London homes have added about £500 billion in value over the past five years, many analysts believe the party is over — especially at the luxury end of the market, which recorded some of the biggest gains.

But that has not diminished Mr Alseddiqi’s long-term faith in the market.

“It’s tough to say whether it’s the right time to buy or not. It is if you are a long-term investor but not if you are a flipper.”

Still, ADFG is unlikely to follow up its two trophy purchases in Victoria with any more acquisitions in the near future. Instead, it will focus on opportunistic investments in the UAE such as a planned US$100m acquisition of a financial services company which it is currently assessing.

“In central London we are delivering about $3bn of inventory over the next five years between all our projects. I don’t see that we will invest in another project any time soon.”

Abu Dhabi Financial Group was created in the depths of the global financial crisis and has reaped the benefits of the recovery, achieving an average internal rate of return of about 26 per cent since it started operation in 2011.

“We extract value. We find niches. We are opportunistic,” he says. “It’s hard for us to find a good deal but that’s why our returns are so high.”

It operates through six units which include Abu Dhabi Capital Management, Spadille and Qannas Investments.

Employing something of the Warren Buffett maxim of being fearful when others are greedy and greedy when others are fearful, ADFG was quick to reap the investment opportunities arising across the region as the Arab Spring and global financial crisis combined to weaken asset prices and scare investors.

He recalls: “Four years ago we were the only ones investing. We deployed around $50m buying stakes in Middle Eastern companies when everyone was sitting back watching what was happening.”

While the rapidly developing alternative investment space is considered by some as inhabiting the riskier neighbourhoods of the financial world, Mr Alseddiqi disagrees.

“I don’t think it’s fair to say we are risk-takers. On the contrary if you look at our investments, we don’t take a lot of risk.

“If we were risk-takers we would have been hit with the Swiss franc crisis, the oil crisis or the equities crisis.”

He points out that the company exited its UAE real estate investments a year ago.

ADFG’s debt and property platforms have generated handsome returns for the company since its formation four years ago.

“Companies usually come to us when they have exhausted options with banks or when they need more than the banks offer — this is where we excel. Today, markets are risk-averse or are turning risk-averse, but where you get your alpha return is in alternative debt rather than equity investments.”

Mr Alseddiqi is sanguine about the likely impact of the tumbling price of oil on either the ADFG business model or the UAE property market and wider economy.

He points out that much of the company’s investments are in countries whose economies could benefit from cheaper oil, but acknowledges there will be an impact in the UAE.

Even amid predictions last week from the S&P ratings agency that Dubai property prices could lose as much as 20 per cent this year, he believes most of the excessive leverage that exaggerated the previous property crash has been purged from the system.

“It’s not the first time oil has dropped,” he says. “This always happens in cycles and you cannot have a high oil price for a long time. As we approach 2020, real estate and hospitality assets will improve — it’s only five years away.

Mr Alseddiqi graduated as an electrical engineer and fell into a financial career in what he describes as fluke.

He says his engineer training has helped him in an industry that he says sometimes relies on projections rather than facts.

“It changes the way you analyse a pitch. Projections are not facts, they are based on assumptions,” he says.

While last year was all about announcing big plans in central London, the group will be looking to emerging opportunities in eastern Europe in the year ahead.

It plans to invest up to €200m (Dh829m) over the next two years in the region, which could rise to as much as €500m by the end of the decade.

The markets may be very different, but he says his approach will be the same — seeking out opportunities, not risks.

“It is about investing in quality deals, not quality assets,” he says. “There is a difference.”

scronin@thenational.ae

Follow The National's Business section on Twitter