Residential properties in Dubai only a short walk from metro stations have outperformed the wider real estate market in the emirate, both in terms of sales price and rental performance, according to global consultancy CBRE.

Residential units within a 15-minute walk of the emirate’s transport network that began operations in 2009 have the potential to continue outshining the broader market, CBRE said, in its Dubai Metro Report 2023.

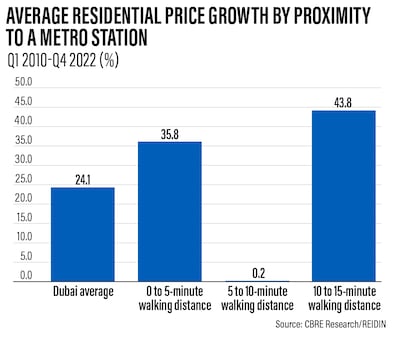

Average prices of residential units in Dubai, the commercial and tourism hub of the Middle East, increased by 24.1 per cent between the first quarter of 2010 and the fourth quarter of 2022.

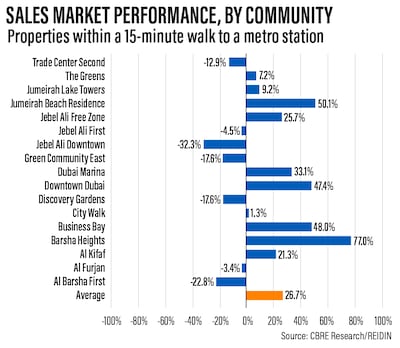

Over the same period, residential units within a 15-minute walk of a metro station recorded an average rise of 26.7 per cent, according to the CBRE report.

There are, however, differences in performance across the different proximity categories, with units within zero-to-five and 10-to-15 minutes' walking distance showing “marked levels of outperformance compared to the Dubai average”, with price growth rates of 35.8 per cent and 43.8 per cent, respectively, CBRE said.

Average prices for properties in the five-to-10-minute proximity category, however, increased by only 0.2 per cent, which the CBRE said was largely due to “lacklustre performance in price growth in secondary locations, which have tended to consist of affordable stock with limited amenities and urban infrastructure”.

However, residential communities within the five- to 10-minute distance from a metro station with modern amenities and quality urban infrastructure, such as Jumeirah Beach Residence and Dubai Marina, have bucked this trend and recorded price growth of 40.5 per cent and 35.9 per cent, respectively.

“Going forward, developers will have to increasingly focus on the provision of suitable urban infrastructure around their development, which will include, but not be limited to, walkable, scooter and cycle-friendly neighbourhoods and mixed use and non-concentric developments to help achieve similar performance levels,” said Taimur Khan, head of research at CBRE.

Apartments in Downtown Dubai that are within a 15-minute walk of a metro station recorded an average price increase of 47.4 per cent between the second quarter of 2010 and the fourth quarter of last year.

Average sale prices for apartments in the broader Downtown area reached Dh2,160 per square foot, while those within a 15-minute walk from the metro averaged Dh2,730 per square foot over the same period.

As Dubai continues to mature, the proximity factor will become one of the vital fundamentals in driving the outperformance in the future, Mr Khan said.

“We can already see this change in fundamentals being played out, where early evidence suggests that developments which have such conducive urban infrastructure and boast proximity to the metro are already significantly outperforming both on price and rental terms.”

The property market in Dubai has rebounded strongly in the past two years from the Covid-19 pandemic-driven slowdown and continues to expand this year.

The emirate recorded a 53 per cent annual growth in the value of real estate transactions in March to Dh34.2 billion ($9.3 billion) on resurgent demand amid a wider economic recovery, according to a report by real estate listings website Property Finder.

Dubai recorded 12,000 real estate transactions last month, a 45 per cent annual increase in volume compared with 8,344 deals during the same time last year.

The performance of the Dubai property market last year was described as “exceptional” by Crown Prince Sheikh Hamdan bin Mohammed, as the value of deals reached a new high of Dh528 billion.

The value of transactions in 2022 was up 76.5 per cent annually, while the number of transactions, at 122,658, rose 44.7 per cent year on year, the Dubai Media Office said in January.

CBRE evaluated 74,000 residential sales transactions between first quarter of 2010 to the last quarter of 2022 to compile the report, it said.

Within the rental market, the consultancy studied close to 112,000 Ejari rental contracts. However, since Ejari data is currently available only from the first quarter of 2018, it does not have the rental premiums or performance achieved since the inauguration of the Dubai Metro in 2009.

Average rents for properties within a 15-minute walk of a metro station increased by 5.7 per cent between the first quarter of 2018 and fourth quarter of 2022. In comparison, the average rent rate across Dubai decreased by 4.1 per cent during the same period.

“Another notable finding has been the level of outperformance key residential hubs have recorded,” CBRE said.

“Properties within 15 minutes of a metro station in City Walk, Downtown Dubai, Business Bay and Dubai Marina recorded average rental growth rates of 55.4 per cent, 49.7 per cent, 20.8 per cent and 15.1 per cent from Q1 2018 to Q4 2022, respectively,” the report said.

Although Dubai residents continue to prefer personal vehicles as their primary mode of transportation, as the city's population increases and it becomes more densely populated, “we expect that reliance on the Dubai Metro will only increase”, CBRE said.

“After a surge in population post-Covid, we have already seen ridership increase to 225.1 million, up 10.9 per cent from its 2019 total,” it said.

“Developers will have to look towards development opportunities in more nascent communities with TOD [transport-orientated developments] likely to become an increasingly key component going forward.”