Abu Dhabi sovereign wealth fund ADQ has detailed a bold blueprint for building the “backbone” to drive sustainable growth in tomorrow’s economies and overcome investment gaps.

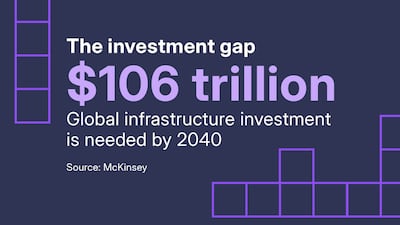

A new whitepaper from ADQ forecasts that at least $100 trillion in global investment will be needed by 2040 as the world pursues rapid economic transition alongside growing demand for resilient infrastructure.

The traditional definition of infrastructure – the foundation upon which nations build their future – has expanded beyond physical assets such as ports, power plants and road networks to include digital systems and clean-energy grids.

The report outlines a pioneering model centred on pillars of partnerships and platforms, long-term patient capital and clustering company strengths.

It says global investment in infrastructure is flourishing, driven by demand for new and upgraded systems and investment capital from institutional investors. The two forces come into sharp focus in Gulf Co-operation Council countries, where demand for infrastructure investment and the supply of capital converge.

However, investing in infrastructure is not always straightforward. Large-scale project complexities, lengthy timelines, significant capital requirements and the pace of technological advancements present obstacles.

Meanwhile, governments often lack fiscal space to finance new developments and commercial banks have faced stricter capital requirements since the global financial crisis. This potentially limits the impact of economic growth and societal advancement.

Infrastructure central to ADQ mission

Sovereign wealth funds, particularly in the GCC, are increasingly shaping this landscape as capital providers and development partners. GCC sovereign investors now control $7.3 trillion in assets – expected to rise to $10.2 trillion by 2030 – and are emerging as formidable players in the global investment landscape, says the company report.

Infrastructure has been central to ADQ’s mission since it was established in 2018. Its strategy has increasingly focused on projects that reinforce the economic fabric of Abu Dhabi while delivering value to the country, partners, and the global community. It is disciplined in deploying capital where it can strengthen resilience, advance self-sufficiency and support transition to a more sustainable and diversified economy.

In ADQ's whitepaper, the organisation cites figures highlighting the scale of opportunity and intensifying competition for capital, setting the stage for ADQ’s distinctive approach to long-term strategic investment, with partnerships key to infrastructure.

- $106 trillion investment is needed globally to meet demand for new and upgraded infrastructure by 2040 (McKinsey)

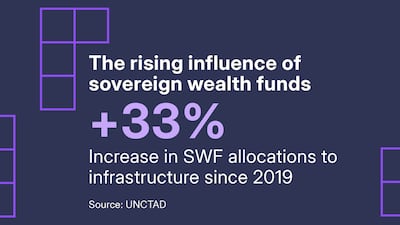

- 33 per cent-plus increase in sovereign wealth fund (SWF) allocation to infrastructure since 2019 (UNCTAD)

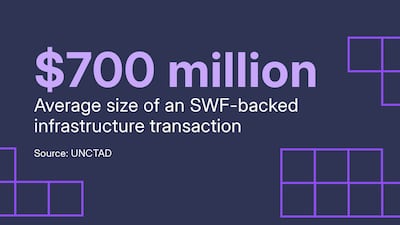

- $700 million is the average size of an infrastructure transaction involving SWFs (UNCTAD)

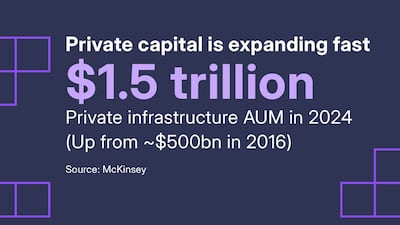

- $1.5 trillion in private infrastructure assets under management in 2024, up from $500 billion in 2016 (McKinsey)

- $121.5 billion raised by closed-end infrastructure and energy funds in H1 2025 (Realfin)

- 63 per cent of Mena capital-project and infrastructure specialists' financial performance is their top KPI, up from 46 per cent in 2022 (PwC)

- 11.3 per cent is the average annual return of infrastructure funds between 2016 and 2022, projected to drop to 10.9 per cent to 2028 (World Bank Infrastructure Monitor 2024)

Warwick Taylor, group head of strategy and corporate development at Plenary Group, says privately financed infrastructure developments have delivered outstanding assets and economic outcomes for governments and communities over the long term.

“The scale of the infrastructure gap is creating new investment opportunities globally across asset classes,” he says in the report.

As a strategic partner to the Government of Abu Dhabi, ADQ’s infrastructure investments are aligned with the UAE’s long-term goals – Abu Dhabi’s Economic Vision 2030 and UAE Centennial 2071 provide comprehensive frameworks for transitioning to a diversified, knowledge-based economy.

ADQ has become a pivotal steward of the emirate’s critical assets, from energy and utilities to ports, aviation and food and water systems.

Hamad Al Hammadi, deputy group chief executive at ADQ, says: “Our success in developing and managing critical infrastructure in Abu Dhabi across energy, water, transport and waste management has provided deep operational expertise. We are now leveraging that experience in global markets through strategic partnerships.”

ADQ’s report recognises large-scale strategic infrastructure development as essential to building world-class transport and logistics capabilities that connect markets and enable trade, while investments in digital connectivity, financial infrastructure and robust social infrastructure in areas such as health care and education are equally important.

The ADQ philosophy

Central to ADQ’s strategy are global partnerships and co-investment platforms designed to accelerate project delivery, de-risk investment and attract advanced technical expertise.

“The platform model enables us to identify, develop and deliver infrastructure projects more efficiently by pairing ADQ’s long-term capital with the capabilities of specialised partners,” Dr Jaap Kalkman, ADQ’s group chief investment officer, says in the report.

ADQ’s philosophy, that long-term value is created not only by capital, but by combining the right capabilities at the right scale, is reflected in two landmark partnerships announced this year: a $25 billion investment partnership with Energy Capital Partners, targeting new power-generation capacity for data centres and industrial growth in the US; and a co-development platform with Australia’s Plenary Group focusing on social and public infrastructure across the Middle East and Central Asia.

This approach also enhances risk management by distributing responsibilities among banks, contractors, developers, technology companies and government agencies in an era when infrastructure projects are increasingly complex. It also provides resilience to meet rising demand in sectors such as digitalisation, sustainable mobility, and renewable energy

Infrastructure also requires the strategic advantage provided by patient capital, capital invested during long development cycles that can endure fluctuating markets. The ADQ report says SWFs are uniquely positioned to do this, given their long-term mandates and comparatively flexible investment horizons.

“We focus on building scalable platforms that deliver long-term value while balancing financial performance with strategic impact,” says Mansour AlMulla, also ADQ’s deputy group chief executive.

“ADQ’s investment structure avoids the incentives that often lead to excessive financial engineering, ensuring that our focus remains on creating tangible and lasting value. This patient and purposeful approach is a key differentiator that enables us to invest at scale and with conviction.”

Investment model

The report says the model has delivered strong results for ADQ across key portfolio companies.

Abu Dhabi Airports recorded 15.8 million passengers in H1 of 2025 (up 13.1 per cent year-on-year), while AD Ports Group achieved a 17 per cent YoY increase in container throughput, and Taqa increased revenue and continued expanding its global utility footprint with investments in flexible generation and desalination.

The report says the successes demonstrate how long-term investment, combined with operational discipline, strengthens the resilience of national infrastructure and creates sustainable value.

Clustering is another distinctive feature of ADQ’s investment model. Instead of treating them as isolated assets, ADQ groups portfolio companies into interconnected ecosystems across sectors, with each cluster structured to capture synergies between upstream and downstream activities, linking production, logistics, and end markets.

This enables joint investment, promotes efficiencies and accelerates innovation commercialisation.

ADQ's report includes examples such as digital innovations in data centres driving demand for advanced cooling and renewable energy, and green-hydrogen and solar technologies developed through Taqa and Masdar, shortening innovation cycles.

The report cites AD Ports Group as a compelling ADQ success story. Transferred into its portfolio in 2019, it underwent a sweeping transformation guided by the fund’s asset-transformation playbook, resulting in a shift from domestic port operator to publicly listed global logistics powerhouse operating across 40-plus countries.

Investments in digitalisation modernised trade flows and positioned Abu Dhabi as an emerging logistics hub, while major partnerships and acquisitions across the Middle East, Africa and Central Asia strengthened regional trade corridors.

The transformation illustrates how ADQ’s blend of governance reform, long-term capital and cross-sector integration can elevate national champions on to the world stage.

“Infrastructure underpins every aspect of economic growth and diversification,” says Roderick Mathers, ADQ’s senior executive director for infrastructure. “Sectors such as health care, finance and technology depend on reliable energy, advanced logistics and robust digital connectivity.

“Going forward, we will focus on energy transition, sustainable mobility and digital infrastructure to support Abu Dhabi’s competitiveness and position as a global investment and innovation hub.”

This page was produced by The National in partnership with ADQ