Renewable energy became the world’s largest source of electricity in the first half of this year, marking a crucial turning point in the global energy transition.

It is the first time clean technologies, such as solar and wind, have overtaken coal, which has been the dominant source of energy generation for more than 50 years, according to the International Energy Agency.

The shift underscores the success of the energy addition strategy, which focuses on developing new sources of power to balance rising consumption with the need for secure, sustainable and affordable systems.

In what the IEA calls ‘the age of electricity’, the world must meet expanding energy demand to fuel economic development, tackle record heat levels in a warming world and support the rise of new industries such as data centres. Global electricity demand grew 4.3 per cent in 2024, up from 2.5 per cent growth in 2023, the IEA said, and the expansion is expected to continue over the medium term.

Meeting that scale without accelerating emissions requires what the agency’s Net Zero Roadmap calls a “build big” mentality: new and smarter infrastructure networks, large quantities of low-emissions fuels, technologies to capture CO2 from smokestacks and the atmosphere, more nuclear power and large land areas for renewables.

Industry discusses wider global energy mix

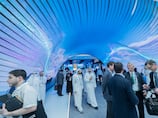

The issue will naturally top the agenda when the global energy industry comes together at Adipec 2025 next week. The world’s biggest annual energy event takes place between November 3 and 6 at Adnec in Abu Dhabi this year, bringing together more than 205,000 attendees from across the sector, as well as more than 2,250 international exhibitors and more than 1,800 speakers in 12 conference programmes.

The event reflects global policies that seek to widen the global energy mix, said Christopher Hudson, president at dmg events, which organises Adipec. “Adipec’s intelligent, multi-layered approach to advancing energy transformation is a direct reflection of the UAE’s Net Zero 2050 strategy and the broader energy transitions underway across the GCC, like Oman, Qatar and Saudi Arabia, where national strategies prioritise clean energy, collaboration and creating knowledge economies,” he said.

“Just like those strategies, which integrate energy, data, technology, human capital development and climate considerations, Adipec addresses the interlinked needs and processes of the entire energy ecosystem,” he said.

The show’s inclusive agenda centres on new and emerging technologies from renewables to nuclear energy. Its new Low Carbon & Chemicals Exhibition showcases innovations and advances in hydrogen, ammonia, methanol, energy storage, chemicals and clean energy.

The exhibition builds on the success of Adipec’s Decarbonisation Zone, which has brought together policymakers, investors and industry leaders for several years to spotlight the real solutions driving system-wide transformation toward emissions reduction – from new energies and storage to carbon capture, infrastructure and utilities.

Likewise, Adipec's newly established Hydrogen Conference programme explores how regulatory clarity, demand certainty and risk frameworks are moving the promising new energy technology from production to trade. It tackles infrastructure strategies, including how repurposing pipelines, ammonia carriers and shipping vessels can lower costs and accelerate scale-up.

That kind of platform is essential if the sector is to meet its demand targets. Electricity transmission and distribution grids need to expand by around 2 million kilometres each year to 2030 to meet the IEA's Net Zero Emissions by 2050 Scenario (NZE).

But as the agency indicates, the tools exist to enable a more rapid expansion. When it published its NZE in 2021, the agency said half the necessary reductions in greenhouse gas discharges would come from new and undeveloped technologies that are not yet on the market at a commercial scale. Two years later, it reduced that figure to 35 per cent, citing capabilities from sodium-ion batteries and hydrogen electrolysers.

Baseload reliability meets intermittency

Last week, the clean energy company Masdar and Emirates Water and Electricity Company, the emirate’s major utility provider, broke ground on the world’s first giga-scale round-the-clock renewable energy project. The $6 billion facility integrates a 5.2GW solar photovoltaic plant with a 19 gigawatt-hour battery energy storage system.

The largest and most technologically advanced system of its kind, it is engineered to supply 1 GW of continuous power output by 2027 while overcoming the intermittency issues that are a feature of renewable energy. Mohamed Jameel Al Ramahi, chief executive of Masdar, said the project was a “blueprint for the world” that would set a standard for renewable energy development and support other nations in delivering on their clean energy objectives.

“By overcoming the challenge of intermittency, we can provide sustainable power to meet fast-growing demand from advancements in artificial intelligence and other technologies,” he said.

The UAE's approach illustrates how operators are combining technologies to meet demand around the clock. The Barakah Nuclear Energy Plant, which achieved full operations in 2024, now provides around 40 TWh of clean electricity annually – approximately a quarter of the nation’s total electricity needs. Nuclear generation reached a record high globally in 2025, and the International Atomic Energy Agency projects that global nuclear operational capacity could reach 992GW by 2050, more than 2.6 times the 2024 level, with small modular reactors playing a pivotal role.

Abu Dhabi-based Masdar has also established a strong presence in the battery energy storage system sector, with investments in the US, UK and elsewhere, including the world's first storage system connected to a floating offshore wind farm, and also has projects in operation and development in a number of countries. It is targeting an overall project portfolio capacity across clean energy technologies of 100 GW by 2030.

Similarly, Saudi Arabia's ACWA Power, 50 per cent owned by the Public Investment Fund, has grown into one of the largest renewable energy and water desalination companies globally, developing projects across Asia and Africa. Global energy investment continues to expand and will grow by $3.3 trillion in 2025, with twice as much investment in clean energy as in fossil fuels, the IEA says. The figure, which includes investments by Middle Eastern players, represents a 2 per cent rise over 2024.

Solar energy remains the dominant technology, with combined spending on utility-scale and rooftop solar projected to reach $450 billion. Nuclear investment has grown 50 per cent over the past five years, expected to top $70 billion, with growing interest in small modular reactors.

LNG, meanwhile, is emerging as the bridge fuel that underpins energy security, with a coming wave of production capacity set to transform market dynamics over the medium term. A record 300 billion cubic metres per year of LNG export capacity will augment global energy systems by 2030, primarily supported by liquefaction capacity additions in the United States and Qatar.

Commercialisation depends on strategic asset planning

However, as capital flows accelerate across new sub-sectors, getting asset planning correct from the get-go is crucial, according to US-based engineering, construction and consulting firm Black and Veatch. “A more sophisticated asset improves all their critical metrics. Specifically, with the right up-front investments, it will cost significantly less across its useful life, operate more effectively (ie produce more), be more profitable and ultimately have a much longer operating life,” said Charlie Sanchez, president of infrastructure advisory Black and Veatch. For example, BESS facilities, which require complex dynamic orchestration, use AI to forecast demand and control charging in real time, maximising their value on the grid, he said.

The firm is currently building or commissioning 365 MW of green hydrogen electrolysis, with three projects in the US, and has also started construction on five energy storage projects in Europe.

“At Adipec 2025, we will showcase how intelligence powers energy resilience. We’re highlighting advanced digitalisation, AI and IoT solutions that optimise performance and strengthen security across complex energy systems, from strategic planning and cybersecurity to data-driven LNG, hydrogen and ammonia projects,” Mr Sanchez said.

Another key part of the energy demand solution is ammonia, which has a 17.65 per cent hydrogen content and can be liquefied at low pressure for easy global transport. Methanol, already liquid at ambient conditions, is simpler to handle. Over long distances, both are viable hydrogen carriers and can be used directly as fuel or cracked for hydrogen. Fertiglobe, the Abu Dhabi-listed producer, completed the world's first shipment of ISCC PLUS-certified renewable ammonia using renewable hydrogen from its Egypt electrolyser.

Ahmed El-Hoshy, chief executive of Fertiglobe, will address Adipec’s Hydrogen Conference on infrastructure policies and investment are essential to accelerating production strategies, including repurposing pipelines and building ammonia carriers and shipping vessels.

With the energy sector at a tipping point, the energy addition strategy offers the clearest pathway to meeting 4 per cent annual electricity growth. Deploying every scalable low-carbon technology in parallel can strengthen grid security, building a sector that is resilient, inclusive and equipped for the next era of progress.

This page was produced by The National in partnership with Adipec.