The majority of UAE investors are optimistic about their domestic economy as well as local and regional stocks, according to a study by Swiss bank UBS, which found the Emirates the most bullish compared to all other countries and regions surveyed globally.

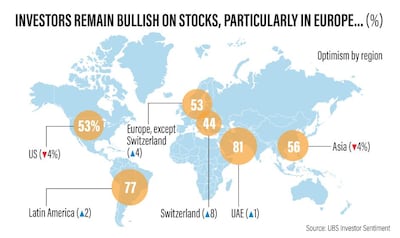

According to the bank's latest quarterly Investor Sentiment study from its global wealth management team, 84 per cent of wealthy individuals and business owners in the Emirates have a positive stance towards to the state of their economy, and 81 are bullish on regional stocks. The study, which polled more than 3,800 wealthy investors and entrepreneurs in 17 countries, was almost unchanged for UAE investors from the previous quarter's study.

Cedric Lizin, head of UBS wealth management Dubai, said the study shows clearly “that investors in the UAE are among the world's most optimistic when it comes to their local economy”.

“However, we believe it is now important to translate that optimism into actual market participation, as opposed to cash holdings," he said.

The International Monetary Fund cut its global growth forecast for 2019 for the fourth time since October last month, saying trade tensions and continued Brexit uncertainty could impede a “precarious” recovery next year.

Global economic growth, already at the lowest level since the 2008 financial crisis, is estimated to slow to 3.2 per cent in 2019, a 0.1 percentage point drop from the IMF’s 3.2 per cent projection last April, as lower inflation and softer growth projections of countries around the world point to weaker economic activity.

This is reflected in the UBS study, with investors globally expressing much lower levels of optimism towards their domestic economies and stock markets in the past quarter at 59 per cent and 55 per cent, respectively.

The US China trade war and local politics were the top concerns for 46 per cent of global respondents. Cyber security was the third most common worry for 43 per cent of those polled.

In the UAE, cyber security and rising healthcare costs were among the top concerns for 48 per cent of those polled.

While UAE investors were upbeat about the economy and regional stock markets, they remain reticent about putting too much of their money to work in the market, on average holding 21 per cent of their assets in cash.

Cash holdings in other parts of the world are higher, though. In Asia, investors hold 32 per cent of their assets in cash while the figure is 30 per cent in Switzerland and 28 per cent in Latin America.