Personal finance author Andrew Hallam has travelled the world giving investment talks and seminars since retiring from his job as a Singapore high schoolteacher in 2014. While every country is different — from the financial products available on the market to the range of advisory fees charged — he says there are two mistakes that investors worldwide make: they follow their emotions and they pay fees that significantly eat into their returns.

"That's why I say to people 'close your eyes, close your ears'. Follow a well-defined, diversified, low-cost plan … ignore all forecasts. And you will beat 90 per cent or 95 per cent of investment professionals over your lifetime," Mr Hallam, the author of Millionaire Teacher and Millionaire Expat, tells The National.

The Canadian says this is particularly important in the UAE, to which he travels at least twice a year, where financial advisory fees can be very expensive. Millionaire Expat is the second top-selling personal finance book on amazon.ae after Robert Kiyosaki's Rich Dad Poor Dad.

Mr Hallam advocates following “three simple rules for effective investing”. Firstly, build a globally diversified portfolio of low-cost index funds or ETFs (exchange-traded funds). ETFs track a particular set of equities in a chosen index, country, region or commodity. They come with no upfront costs apart from the brokerage’s dealing charges and annual fees, which are far lower than traditional mutual investment funds.

Secondly, maintain a constant allocation. That means no speculating or adjusting based on forecasts.

Thirdly, while you’re working, add money every month. For example, adding $100 (Dh367) monthly over the long term will multiply faster than less frequent deposits due to compound interest. Compound interest is basically interest on interest — whereby interest in the next period is earned on the principal sum plus previously accumulated interest.

These are the principles Mr Hallam, 49, has followed since age 19, when he met a mechanic who happened to be a millionaire. He learnt that he, too, could grow wealthy on a middle class salary.

So why is it so difficult for many investors to follow these “simple” rules?

“Some will say: it can’t be real, there’s got to be a way to find active managers that will beat the market. And there’s a whole army of sales people spreading that rhetoric,” Mr Hallam says. “So it’s easy for people to fall into that ideology or belief that they can beat the market — when in reality, almost nobody does.”

Here we break down how to rein in the human emotions jeopardising investments and avoid the high fees cutting into returns.

Emotions

Investors would say there is plenty to worry about in the world: Brexit, the US-China trade war and a slowing global economy dominated the headlines last year and now coronavirus — all spreading fear of a lasting economic impact.

“It’s fear that holds people back from investing at all,” says Mr Hallam. “When markets fall, they capitulate, they give up … then they get back into it again when the markets have risen.”

Daryl Hulse, a wealth associate at UAE robo-advisory platform Sarwa, says she has seen this first-hand.

“When I talk to clients, a lot of the time, they find it really, really hard to sit tight and stay in the market when everything seems to be getting out of control and market prices are falling,” she says.

She says the twin drivers of greed and fear lead people to buy at the top of the market and sell at the bottom “which is the exact opposite of what you should be doing”.

Sarwa is a hybrid automated platform that invests in ETFs, with wealth advisers to help over the phone or in person if a customer needs financial planning for specific goals. Founded in 2017, it was one of the first players to enter the UAE market and now has 10,000 registered users.

Sarwa’s management fees range from 0.85 per cent for $500 minimum balance to 0.50 per cent for $100,000 minimum.

Mr Hallam says robo-advisories are “great” as they “allow people to get into a diversified low-cost platform where there is no speculating” — keeping in mind that those fees will be higher than do-it-yourself ETF investing.

The important thing is to stay the course. Over the 30 years between 1987 and 2017, investors in US funds got average returns of 3.98 per cent, according to Dalbar’s Quantitative Analysis of Investor Behaviour. Meanwhile, the US stock market average returns over that period was 10.16 per cent. That means $10,000 would have grown to $32,247 in the first scenario, but $182,271 in the second.

Perhaps the biggest proponent of passive, long-term investing is Warren Buffett — also known as the “Oracle of Omaha”. With a current net worth of $89.4 billion, Mr Buffett, who runs holding company Berkshire Hathaway, is the world’s fourth richest person behind Amazon chief executive Jeff Bezos, Microsoft founder Bill Gates and LVMH chairman Bernard Arnault, according to the Bloomberg Billionaires Index.

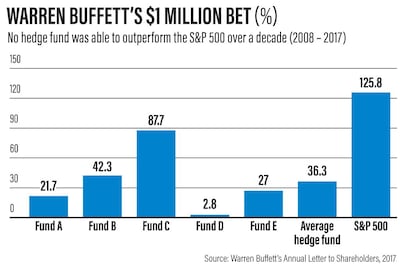

In 2008, Mr Buffett made a $1 million bet that an index fund tracking the S&P 500 would outperform a hand-picked portfolio of hedge funds over 10 years. He stayed put in the fund, even during the financial crisis, and on December 31, 2017 he won that bet.

Passively investing in the S&P 500 delivered cumulative returns of over 125 per cent, while the next closest fund gave returns of around 87 per cent and the average hedge fund about 36 per cent. The bet proved two points: that passive investing works better than active investing most of the time and high fees take out a big chunk of returns.

High fees

The late American investor Jack Bogle, who founded Vanguard Group in 1974 and built it into a giant mutual fund company, is credited with introducing the first index fund for individual investors. The Vanguard 500 Index Fund, which has over $543bn in assets, has an expense ratio of just .14 per cent. Since inception in 1976, it has delivered average annual returns of 11.13 per cent, simply by tracking the S&P 500.

An index fund and an ETF both track the same market; for example, the iShares S&P 500 ETF holds the same 500 stocks that Vanguard’s 500 Index Fund holds. The difference is that investors can buy index funds directly from a fund company, while ETFs are purchased directly from a stock exchange through a brokerage that usually charges commissions. However, the expense ratio for ETFs is as low as .02 per cent.

In the UAE, Mr Hallam warns people should avoid insurance-linked investment products called "premiums" that are sold by financial advisory firms. The UAE Insurance Authority released new regulations last year in response to "an alarming amount of complaints" over how savings, investment and life insurance policies are sold in the Emirates.

The measures include a commission cap of 4.5 per cent for lump sum investments and fixed-term contractual plans — in contrast to previous commission payments of up to 10 per cent.

That is still exorbitantly high, says Mr Hallam. “Once you’re paying into one of those things, you know for sure that your first 18 months’ worth of contributions are basically gone. They will go towards compensating the adviser for the commission,” he says.

In the long term, for a financial product with a 4.5 per cent fee, assuming a 6 per cent annual return, investors would be giving up 75 per cent of pre-fee profits.

Should investors ever use a financial adviser? Mr Hallam says advisers can be useful for complicated tax and investment matters, as long as they too are using an evidence-based approach.

“A passive, diversified index fund approach is statistically speaking and academically speaking that which will give you, the investor, the best odds of future success,” he says.