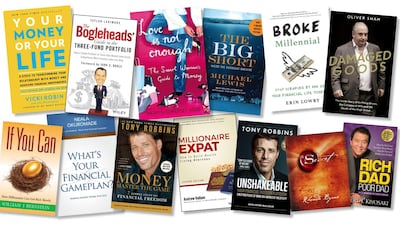

While summer offers a few precious weeks off with the family and some down time away from the searing heat, it can also give you time to catch up on that pile of books accumulating on your bedside table. But before you delve into some fiction, consider adding a personal finance book to your reading list; it could change your future.

When there are more than 40,000 listed on Amazon.com, though, how do you pick one? We asked a team of local and international personal finance experts for their summer book picks. Here are their choices:

Your Money Or Your Life

Any conversation about decent books on personal finance has to include this book from Vicky Robin and Joe Dominguez, says Jon Richards, chief executive of financial comparison site Yallacompare. It details nine steps that will help you transform your relationship with money and is not “preachy or condescending” says Mr Richards, just “simple lessons” on how money works, how banks operate and how you can get the best value out of your assets. A quick search on the book reveals “hundreds” of success stories from people who have eased themselves out of debt and amassed relatively large wealth, he says.

$13.60 paperback, published by Penguin

What’s Your Financial Game Plan?

"There is no shortage of self-help personal finance books (I have even written one myself) but this summer I am reading qualified accountant Neala Okuromade's book," says Heather McGregor, executive dean of Edinburgh Business School, the graduate school of business of Heriot-Watt university, and author of Financial Advice for Independent Women. It takes the stories of four different people and shows how their financial decisions affect their life outcomes. "There is a workbook to accompany, so I shall be getting out my pen and calculator," she adds.

$10 paperback, published by Brad and Adam

The Millionaire Expat

Sam Instone, chief executive of financial advisors AES International, Steve Cronin, founder of Deadsimplesaving.com, and Demos Kyprianou of the nonprofit personal finance community SimplyFi.org, all recommend Andrew Hallam’s latest tome. It was published this year and gives advice on building wealth while overseas from an expat teacher who became a millionaire. “Every expat in the UAE (and beyond) should read this book immediately,” says Mr Cronin, “as there is very little other practical advice for expat investors.” Over time, he adds, it is “likely to transform your finances” and give you a clear plan to help you make the most of your earning power in the UAE. Mr Instone calls it “indispensable” and “probably the best investment in time and money that anyone can ever make”.

$15.15 paperback, published by Wiley

__________

Read more:

Wise words for UAE expats on managing their money

Finance guru Andrew Hallam’s new guide for expats wanting to become wealthy

Book review: Personal finance simplified for everybody

__________

The Big Short

"My favourite book covering anything financial is The Big Short by Michael Lewis," says Keren Bobker, an independent financial adviser and senior partner with Holborn Assets in Dubai. It covers the build-up to the US housing bubble and subsequent market crash and is a "lesson in sticking to things that are real". "I read parts of it in disbelief when it came out," she adds. "The main point is, if you don't understand it, don't get involved. There were ridiculous deals and trades that led to the global financial crisis, which must never be allowed to happen again." If you don't fancy a long and "rather technical" factual read, she says, watch the 2015 Oscar-nominated movie, starring Brad Pitt and Ryan Gosling.

$10.24 in paperback, published by WW Norton & Company

Broke Millennial

Written by Erin Lowry, this book was released last year after the young New Yorker spent four years writing her blog of the same name. It is "as entertaining as it is informative", says Mr Richards of Yallacompare, full of "super-handy tips" for millennials and older generations too. "Sure, there's plenty on managing student debt or splitting dinner bills with friends," he says, but there are also true stories of financial recovery and "genuinely hilarious" real-life stories from the author.

$9.10 in paperback, published by TarcherPerigee

Damaged Goods

“It is always interesting to see how other people accumulate wealth,” says Ms McGregor. “Damaged Goods, by Oliver Shah, is not fiction but could easily double as your racy poolside read”. The story of retail tycoon’s Sir Philip Green’s rise to become the self-styled King of the High Street and the subsequent demise of British Home Stores, Ms McGregor says it gets her vote as “the best book of this genre since Barbarians at the Gate” (on the 1980s fall of RJR Nabisco). “At best, it is a page turner par excellence and, even if you don’t get as excited as I do by the details behind the creation of great wealth, you will learn a lot about why you should (or should not) invest in retail.”

$16.17 in hardcover, published by Portfolio

If You Can

Put aside a couple of hours for this book by William Bernstein, says Tuan Phan, an Abu Dhabi-based aviation meteorologist and board member of SimplyFi.org. Not as well-known as his classic tome, The Four Pillars Of Investing, this little book is just 15 pages long and was written as a personal letter for Mr Bernstein's grandchildren, containing his best advice, knowledge and wisdom. "Nowadays, when someone asks me where a novice investor begins, I simply send them this book," says Mr Phan. "What I really like is how easy the book is. The five hurdles mentioned, if the advice is heeded, will change most people's lives financially, as they did for me. I hope to instil similar advice for my own children when they are a bit older."

Available free as an e-booklet from his site, efficientfrontier.com

__________

Read more:

The best blogs to help millennials manage their money

Rich Dad, Poor Dad author spells out the importance of financial education

10 blogs to help you achieve financial independence

__________

The Bogleheads’ Guide To The Three-Fund Portfolio

This book by Taylor Larimore is the "distilled summary of the very best advice and research from all notable finance and investment books ever published", says Mr Phan. Nonagenarian Larimore, a World War II paratrooper, co-founded the Bogleheads group and shows how a simple portfolio, with just three index funds, "will beat more professionals' portfolios", says Mr Phan. "What I like is how easily and eloquently it is able to demystify the entire investing process. Most people should be able to finish it over a weekend." On a similar theme, Mr Cronin recommends The Coffeehouse Investor, by Bill Schultheis as an introduction to DIY investing.

$18.54 in hardback, published by Wiley this year

Love Is Not Enough: A Smart Woman’s Guide to Money

Written by Merryn Somerset Webb, this book is aimed at women who often find financial topics “a bit off-putting”, says Ms Bobker, who found the book around 10 years ago while looking for a guide to recommend to clients. It is “not at all girly” but full of “sensible” advice to encourage women to take control of their finances - including negotiating a pay rise - from a former banker and financial editor. “The broader subjects should be relevant to anyone, anywhere,” she says.

$17.95 in paperback, published by HarperCollins UK

Money - Master The Game

No financial book list would be complete without old favourites, such as Tony Robbins. Rasheda Khatun Khan, a wealth and wellness planner, and Mr Cronin of Deadsimplesaving.com, recommend different books by life coaching king Tony Robbins: Money - Master The Game and Unshakeable ($13.71 in hardback, also published by Simon & Schuster). "Money - Master The Game is not a light read but is a knowledgeable one," says Ms Khatun Khan. "Lots of policies are sold with high fees, especially in this part of the world, and this book tells you to get rid of them and gives you questions to ask for the type of adviser you want. I've been reading it since the beginning of the year." Mr Cronin says he wasn't "expecting much" of Unshakeable but was converted by the "accessible and well-structured book", which dives straight into the "strange hang-ups we all have" about saving and investing.

Money - Master The Game - $13.72 in paperback, published by Simon & Schuster

Unshakeable - $13.71 in hardback, also published by Simon & Schuster

Rich Dad, Poor Dad

Ms Khatun Khan and Ambareen Musa, chief executive and founder of finance comparison site Souqalmal.com, both recommend this 20-year-old classic by Robert Kiyosaki. Ms Musa says it gave her an “entrepreneurial mindset” and made her realise the importance of financial literacy, making her a “strong advocate” of financial independence, while Ms Khatun Khan says she first read it in her twenties and often gives it to clients, advising them to pass it on to their children after reading it. “The story is about what parents teach their children about wealth and what he learned about it as a child,” she adds. “There’s even a version for teenagers now.”

$7.19 in paperback, published by Plata Publishing

The Secret

A surprising choice for a list of personal finance books, but Ms Khatun Khan recommends reading the 2006 bestseller, by Rhonda Byrne. “It reminds you how to attract things into your life - and everyone wants to attract more finance,” she says. “This is almost the foundation when it comes to financial planning: not how much money you have but how you decide to spend it that makes a difference to the quality of your life.”

$12.98 in hardback, published by Atria Books/Beyond Words