Financial independence is the new catchphrase in the personal finance blogosphere. It’s about being able to retire early or to have enough money in the bank to buy a home outright, to choose whether to work or not and how many holidays to take in a year.

The Financial Independence world, often referred to as FI, is a tightknit community with dozens of bloggers keen to reveal their path to early retirement and to pass on tips for those seeking their own financial freedom.

Dubai-based Sébastien Aguilar, founder and president of the non-profit community SimplyFI, a non-profit community of personal finance and investing enthusiasts, says that FI blogs are a great way to complement his learning and give a “unique view without the constraints that come with writing a book or a newspaper column”.

Find blogs written by people similar to you, he advises. “You can then better relate to their stories and learn from their experience.” But make sure that they are not trying to sell you products and services, he warns.

It was reading blogs like the Mad Fientist and Mr Money Mustache that inspired Mr Aguilar to work on his own financial independence.

“I went from trying to figure out how to fill my pension gap, due to my move to the UAE, to realising that working until 65 was only compulsory if you let the government or society in general decide how much you should set aside for retirement,” he says. But having enough money to have the choice to retire early is, he says, “the real freedom”.

Here are 10 of the top blogs about financial independence and early retirement:

1. Mr Money Mustache www.mrmoneymustache.com

“This blog was born in 2011 out of exasperation,” says Mr Money Mustache (the pseudonym of Peter Adeney, a Canadian software engineer who retired in the US at 30). He was already then six years into early retirement, yet sick of friends complaining about how broke they were while constantly dining out and buying brand-new cars. He blogs about how to create a life “better than your current one, that just happens to cost 50 to 75 per cent less”. He spends around $24,000 a year and documents his exceedingly frugal ways, from DIY solar power to the cost of building a garden studio. He also features guests who have achieved their own financial independence.

Blog highlight: Killing your $1,000 Grocery Bill - Mr Money Mustache breaks down his $365-per-month food cost for three (a cost per meal of $1.33).

2. I Retired Young www.iretiredyoung.net

Dubai-based former accountant David Cox retired last year aged 47, although his wife still works as a teacher. This blog of a "pretty average guy" sets out monthly costs, the "decisions and choices" that gave him his financial freedom, and what daily life looks like now he has retired. His independence has come thanks to a portfolio of 12 properties, which help provide the Coxes with an income of £5,500 (Dh27,969) each month. Every month, Mr Cox publishes an analysis of what he spends: in February, his day-to-day costs came to £2,381. In 2017, he over-spent his £44,400 budget by £5,700 - or 11 per cent - but his target is kept deliberately conservative. A relevant blog for UAE expats with lots of data for the number-crunchers.

Blog highlight: Investing Nightmares - Don't Do What I Did! The investment mistakes that cost Mr Cox £427,000.

_______

Read more:

Dubai blogger behind 'I Retired Young' on how he achieved financial independence

Lessons learnt from 'keeping up with the Joneses' in the UAE

20 tips to get your finances back on track in the UAE

The financial lessons I've learnt after a decade in the UAE

_______

3. Mrs. Frugalwoods frugalwoods.com

This pair of “frugal weirdos”, Elizabeth and Nate Thames, write about “simple, joyful, luxurious frugality”. Mrs Frugalwoods details how the young couple saved two-thirds of their income to retire to a 66-acre homestead in Vermont, US, with their two daughters and dog in their early thirties”. From the “gear you actually need” for a baby to how to eat frugally, the writer delights in providing the ultimate penny-pinching homebody’s top money-saving tips in a hefty blog (and now book).

Blog highlight: Uber Frugal Month: The Ultimate Guide To Saving More Money Than You Ever Thought Possible. Sign up for this month-long challenge to save money and "restructure your consumer mindset".

4. The Mad Fientist madfientist.com

This blogger will help you work out the date you will achieve financial independence. One of the first blogs totally dedicated to the topic, American Brandon retired at 34 two years ago and moved to Scotland to be with his wife. He says if you can save 25 times your annual expenses, you’re set for life. There’s a great piece on his philosophy of the hierarchy of financial needs, riffing off Maslow’s pyramid: at the base, survival and sustainability, moving into accumulation (saving for the future) and then independence. But above financial independence is a further need, he says - utilising that freedom to spend or save for a greater “life purpose”, such as charity or heirs.

Blog highlight: The Safe Withdrawal Rate - why you should aim to withdraw no more than four per cent of your portfolio every year.

5. Mr Free at 33 mrfreeat33.com

A college dropout who frittered away a $60,000 inheritance, Jason Fieber then decided he wanted “a life, not just a job”. He has been blogging for seven years and moved from Florida to Chiang Mai, Thailand, to become a ‘dividend expat’ and financial independence coach last year. Living below your means can allow “even someone with seemingly few resources to eventually amass great wealth”, he says. Mr Fieber’s previous blog, Dividend Mantra, documented how he achieved financial freedom; this blog is the “what” and the “why”, focusing on being a dividend expat and the happiness resulting from his freedom.

Blog highlight: Unlike most FI bloggers, who remain coy about their actual wealth, Mr Free at 33 publishes full details of his "meticulously" crafted portfolio. It was worth $348,506.57 in March, with 110 companies - including Apple, PepsiCo, Unilever and Exxon Mobil - and is expected to generate $12,322.79 in dividend income over the next year.

6. Go Curry Cracker gocurrycracker.com

This blog is written by a husband-and-wife team, Jeremy and Winnie, who saved 70 per cent of their income for a decade until they were able to live completely off their investment income and become “location-independent”. They now slowly travel the world (they intend to spend 60 years doing so), documenting every penny they spend. Why is it called Go Curry Cracker? The blog is named after the couple’s favourite snack, which became a “rallying cry” while on a 150-kilometre trek. One caveat: the site makes its money from affiliate links to credit cards.

Blog highlight: Renters For Life. Jeremy explains why he chooses to rent. While his index fund has doubled in 10 years, he says a house gain of $100,000 in the same period drops to just $13,000 after costs and actually loses money when you factor in inflation.

7. Andrew Hallam - Millionaire Teacher, Millionaire Expat andrewhallam.com/

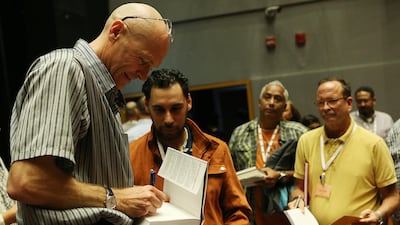

Andrew Hallam is the Canadian blogger, author and formerly Singapore-based teacher who first piqued The National's interest in financial independence when he came to Dubai and Abu Dhabi

to warn against investing in fixed-term investment plans with hefty fees and commissions. He retired before he turned 40 and travels the world with his wife Pele. Many people, he says, are not comfortable talking about money so his blog is an attempt at a conversation-starter. Unlike many others, Mr Hallam's blog is not focused on documenting his journey to financial independence but lays out many of the key principles - as do his books - to do so.

Blog highlight: Smart Index Fund Investing in United Arab Emirates. This post lists the companies UAE expats can use to build an index fund portfolio.

______

Read more:

Finance guru Andrew Hallam’s new guide for expats wanting to become wealthy

Dubai resident: 'I retired at 37 after achieving financial independence in two years'

Plan for early 'freedom from work', not retirement

Invest like a Boglehead and build a low-cost portfolio of index funds

______

8. Quietly Saving quietlysaving.co.uk

Quietly Saving is one of the rarer British financial independence blogs; Weenie, a “SINK” (single income, no kids) woman in her late 40s is based in Manchester, England. She paid off her credit card debt and finally started to save when she turned 40. She aims to stop working full-time by 2025 and is documenting the journey in a plain-looking blog that offers interesting personal financial details. In 2018, she aims to save 50 per cent of her income and earn £3,000 from dividend income. She is also experimenting with buying and selling a basket of shares in 10 FTSE companies; it only made a one per cent gain last year, but she blames that on the market.

Blog highlight: Investment Strategy. From cash to peer-to-peer loans, crowdfunding and exchange tracker funds (ETFs), Weenie documents her strategy.

9. Dubai Personal Finance dubaipersonalfinance.com

Matt Nobles, a local finance coach, believes that “a solid personal finance education” will drive “thoughtful financial choices”. His blog does not contain a personal story, but it is focused on financial freedom. It includes a directory of resources for Dubai residents and an exceedingly handy cost-of-living index, which compares Dubai to other cities around the world. On average, he calculates, Dubai is more expensive than Miami and Kuala Lumpur but cheaper than London, New York or Singapore. Refreshingly, Mr Nobles asks, when a money-for-time trade-off is worthwhile, happily outsourcing his food shopping, cleaning and laundry as a result.

Blog highlight: 10 Ways Financial Planning Has Made Me A Happier Person – a thoughtful post on giving better gifts, donating more and ensuring his family is provided for.

10. Think Save Retire thinksaveretire.com

When 35-year-old Steve, a former IT director, sees a BMW driver on the road, he thinks: "Delayed retirement; how sad." He and his wife instead live in an Airstream caravan after retiring recently with around $1 million, mostly invested in the stock market. Now he wants to 'pay it forward' with advice and tips for financial independence. After all, he says, none of us were built to work up to 10 hours a day for 75 per cent of our lives, and few really need a 2,000 square foot home (the median size in the US). Articulate and incisive, Think Save Retire is an inspirational read.

Blog highlight: It’s Easy To be Retired Early When The Market Is Great, Huh? Steve explores whether $1 million is enough to retire on - what if the market tanks?