Over the past 100 years, we've seen income, inflation, interest rates and investment returns being “boosted by a heady mix of demographics, debt and disregard for the environment”.

That's according to the recent The 21st Century Portfolio report from investment management firm Invesco, which says: "In short, we have been living beyond our means".

For the rest of this century, Invesco — which manages assets of $1.2 trillion (Dh4.5tn) globally — says four key factors will play a role in how to build the right investment portfolio: low bond yields, demographics, climate change and technological innovation.

The impetus for the research was to address the question "what would I put in a pension portfolio for somebody being born now?", Paul Jackson, global head of asset allocation research at Invesco and co-author of the report, tells The National.

The four themes are interlinked, he adds. For example, low interest rates make it easier to finance investments, but low bond yields penalise investors; investments can help develop technological solutions for climate change and decelerating populations, which otherwise would dampen economic growth.

“From an investment perspective, we have to get used to the idea that on equities and real estate, the returns are going to be lower than they have been. But also if we do nothing about climate change, you have to revise your ideas even more,” says Mr Jackson, who is also head of Emea ETFs' Research.

The bottom line? Invesco suggests a portfolio looking to the future has a core of equity and real estate assets — which give higher returns than fixed-income assets — and four satellite portfolios focused on Africa, carbon-reducing technology, carbon-removing technology and labour-replacing innovation.

Here we break down the factors that we, our children and grandchildren should keep in mind when investing over the next 80 years.

Low bond yields

Global negative-yielding debt peaked at $17tn last August, due to a bond rally triggered by fears of an economic slowdown. While a brighter outlook, with the recent phase one trade deal between the US and China and diminishing concerns over a no-deal Brexit, shrunk the amount a little, it now sits at $12.4tn on coronavirus fears, according to Bloomberg.

However, downside risks of global economic growth remain, according to the International Monetary Fund, which revised its growth estimates slightly downward to 3.3 per cent in 2020 and 3.4 per cent in 2021.

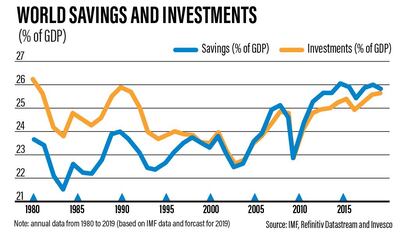

Some economists and investors have blamed the shift to negative interest rates on long-term factors, such as the ageing of developed world populations and an increase in savings versus investments following the 2008 global financial crisis. But they are also pointing fingers at the ultra dovish policy of certain central banks.

“The large developed world central banks have been throwing good money after bad,” Mr Jackson says.

The European Central Bank, the US Federal Reserve, the Bank of Japan and others have decreased interest rates in recent years in an effort to spur economic activity and get inflation up.

“They are going too far in this effort and I think that they just have to accept that inflation is going to be much lower than we have seen during our lifetimes,” Mr Jackson says.

Invesco’s report states that inflation will likely return to the 0 per cent to 2 per cent range that prevailed on average for much of pre-World War 2 history. “We also believe that developed world central banks will struggle to consistently meet the 2 per cent rate that many of them target,” the report says.

While some central banks, such as Sweden's Riksbank, have recently moved away from negative interest rates, Mr Jackson expects that if the global economy does go into recession in the next two to three years “they may have to revert to those negative interest rates for cyclical reasons”.

Portfolio recommendation:

“Even if you buy a 100-year bond … in most of the countries that you would think about investing in … the yield that you can get over 100 years is 1 to 1.5 per cent. Which, let’s simplify, and say that is zero in real terms,” Mr Jackson says.

“There is no role in those optimised, long-term portfolios for fixed income assets.”

Demographics

Global gross domestic product growth will slow to an annualised 2.4 per cent in 2100 from 3.5 per cent in 1960 simply because there will be less population growth, says Invesco’s report. Although the world’s population is expected to expand from the current 7.8 billion to 10.9 billion by the end of the century, it is growing at a much slower rate.

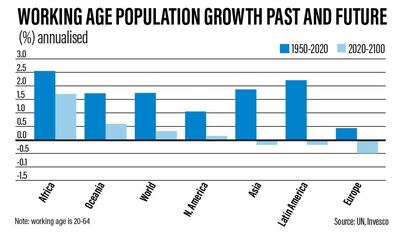

“If you look at world population from 1950 to the year 2000, it was unprecedented growth — 1.8 per cent annualised,” says Mr Jackson. Invesco projects, based on UN figures, that the average rate will go down to below 1.5 per cent by the end of this century.

The working age population, those aged 20-64, will decline in Europe, Latin America and Asia. For example, South Korea’s working age population will decline by around 60 per cent and that of Japan by 50 per cent.

Africa, however, is the only place where future working age population growth is close to what it has been since 1950. UN estimates suggest that Africa will account for more than 40 per cent of the world’s working age population by 2100, compared to 14 per cent today.

“So if a region has that large a share of the world’s working age population, it should also have a much bigger share of the world’s GDP than it does today,” Mr Jackson says.

Portfolio recommendation:

“In the shorter term — 10 to 20 years — India and Indonesia would get a boost from demographics. But over the full period of the century, then Africa … is really the only story in town.”

Climate change

Climate change is receiving growing attention, triggered by activists such as Greta Thunberg, policymakers, consumers, companies, investors and financial institutions. Global temperatures are on course for a 3 to 5 degrees Celsius rise this century, far overshooting the 2015 Paris climate conference goal of limiting the increase to 2C or less, according to the United Nations World Meteorological Organisation.

On the positive side, there is “an increase in the end client wanting to invest their money in an ESG-friendly manner”, says Mr Jackson. ESG incorporates environmental, social and corporate governance considerations.

He believes the financial industry has the responsibility to understand the consequences of climate change, educate others and try to “help channel investment to the solutions and away from the things that are causing the problem”.

While every individual should make changes to their own lifestyles, it will not be enough to counter the effects of climate change, which means technology is key. Investing in carbon-reducing and carbon-removing innovations at an early stage is one way individuals can make a difference, while contributing to overall economic stability and still generating returns.

“If we don’t adjust our path in terms of climate change, the economic consequences could be quite drastic,” says Mr Jackson, citing lower economic growth, mass migration and social welfare costs, among other potential effects.

Portfolio recommendation:

“At the very least we can say that you haven’t lost money by favouring ESG strategies, but actually in the last couple of years, there is reasonable evidence that you have got better returns on equity investments by focusing on ESG-type funds,” says Mr Jackson.

Technological innovation

“Technology can help us find the solutions for climate change, but it can also help us find the solutions to a lack of workers,” says Mr Jackson.

Countries with labour shortages, such as Japan and South Korea, as well as China, Russia and Italy, will likely be at the forefront of developing labour-replacing technology, according to the Invesco report.

Portfolio recommendation:

“The main beneficiary of the current Industrial Revolution [will be] the owners of the companies that are coming up with the technology,” Mr Jackson says. Therefore, investors would be wise to include such companies in their portfolios.

Above all, remember that “markets do kind of eventually carry on regardless”, Mr Jackson says. “Just be aware that things are changing.”