More than one in four UAE residents consider recruitment companies the least trustworthy, according to a new study.

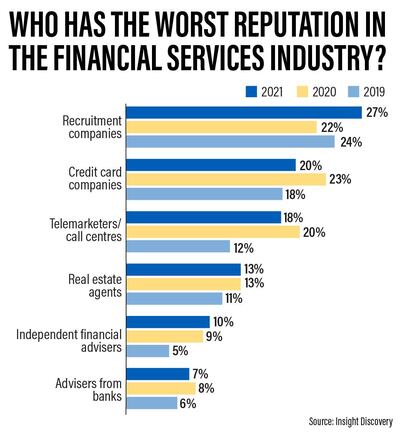

Twenty-seven per cent of UAE residents perceive recruitment companies as having the worst reputation, according to the survey by market research consultancy Insight Discovery, which polled more than 1,222 individuals in the Emirates. Credit card companies took second position in the poll, telemarketers ranked third, real estate agents fourth and financial advisers fifth.

“The past 12 months have been exceptionally challenging in lots of ways, especially in relation to job security for many individuals across all types of sectors,” Nigel Sillitoe, chief executive of Insight Discovery, said.

“Recruiters don’t seem to have responded by showing the right professional support or guidance for candidates who needed it.”

Border closures and movement restrictions during the Covid-19 pandemic affected the global jobs market in 2020, leading to salary cuts and redundancies, particularly in sectors such as aviation, events, hospitality and tourism.

The lack of trust in recruiters has become more evident over the past 12 months – in the 2020 survey, they placed second, behind credit card issuers, the report said.

Recruiters are the least trusted across all four age groups (18 to 24, 25 to 34, 35 to 44 and above 45 years) as well as each income bracket (earning up to Dh10,000, between Dh10,001 to Dh25,000 and above Dh25,000) covered by the survey in 2021.

Recruiters can improve their reputation by acting in a transparent way, Mr Sillitoe said. They need to be responsive and give clear guidance to individuals who are looking for a new job or changing their career, he added.

The reputation of credit card companies has improved over the past 12 months, with 20 per cent of those polled perceiving the profession badly compared with 23 per cent in 2020. This was followed by telemarketers at 18 per cent and real estate agents at 13 per cent, the survey found.

While independent financial advisers occupied fifth position in the survey for the third year in a row, 10 per cent of UAE residents now consider them to have a poor reputation compared with 9 per cent in 2020.

“Tough market conditions are often the best time for any wealth or financial adviser to differentiate themselves and prove their value to clients,” Mr Sillitoe said. “Now, they are more closely regulated in the UAE, consumers should expect to be able to place more trust in the profession as a whole.”

The UAE Insurance Authority's new regulations on life and family takaful insurance implemented in October last year are expected to reduce mis-selling of life insurance products and increase policyholder confidence in the market. As part of the regulations, the IA has capped the overall commission payable on a policy over its entire course and increased disclosure requirements for financial advisers.

While UAE residents cited recruiters as having the worst reputation, western expatriates voted for financial advisers as the least trusted group, Mr Sillitoe said.

“For their image among western expats to improve, I sense cold calling needs to stop,” he added.

“A ban is only likely to become reality if the local regulators introduced fines for the small number of regulated firms who continue to cold call. They also need to get tougher with unscrupulous unregulated firms, who are tarnishing the reputation of firms who take regulation and qualifications seriously.”