Clutching my €1,000 (Dh5,236) Burberry handbag, I strolled into class for my first day as a political science student at Sciences Po Paris. As the students around me gazed at my stylish adornment in amazement, it quickly dawned on me that this was not the standard accessory for a first-year student - particularly one who had earned a scholarship to be there. This was the first indication that how I spent my monthly allowance was a world away from a typical undergraduate in Europe.

I remember being almost shocked how the other students diligently counted every penny they had. They not only knew how much they had to spend, but also how much to save. While calculating exactly how much they had to spend on groceries and books was completely normal to them, I had already spent two-thirds of my first monthly allowance on a luxury bag.

Being the eldest child of a middle-class family from Saudi Arabia, I was often spoilt by my parents. They bought me almost everything and anything I wanted, and while I had to do the occasional chore to earn the item I wanted, in most cases I simply asked.

In Saudi Arabia it is perfectly normal for a teenager to count financially on their parents and, like other girls my age, I never thought twice about what I spent it on. Saving was also an alien concept, hence all the money given to me by my parents was immediately frittered away at the mall.

In Paris, my careless attitude towards money became apparent by the frugal natures of my new friends. Their parents would never let them spend so much money on a bag. While my father wouldn't have been happy about my fashionable purchase either, my lack of financial knowledge meant that saving rather than spending simply did not enter my financial vocabulary.

Over the next three years I started to become more responsible as I learnt to manage the monthly scholarship allowance I received from the Saudi government and pay my own bills. For the first time I understood the value of my bank balance and stopped spending it on whatever I fancied. I was only 17 when I left home, and despite the fact I was over indulged, my parents were not spenders - always putting money away for my, and my siblings', future. But they were doing all the money managing for me, rather than encouraging me to learn for myself.

Three years on from those early days in France and I am working in the UAE as an intern and can see similarities between the frivolous spending habits of the young people here and those growing up in Saudi Arabia. In Europe, teenagers, students and young adults know how to save. They feel responsible about money even though they're not always the ones working for it. Parents there teach their children how to spend wisely and to work for money so they can learn its value. In this region, young people only need to ask for money to get it. Asking or, in some cases, begging parents for a new BMW or a new Prada purse is sadly the norm. They take it for granted that the money will always be there, without learning how to work hard for it. I have a friend in Saudi who asks his dad for a new car almost every year! And what is surprising is that his father actually listens to him.

Although this scenario differs between one financial class and another, and rich kids are spoilt the world over and not only in the Gulf region, here even the middle-class offspring only seem to know how to spend recklessly.

My cousin recently graduated from high school in Abu Dhabi, and, thankfully, has always been taught about the value of money by her mother. For her friends and classmates, however, the situation is very different. There are 17-year-old girls whose sole concern in life is what to wear. Last week, one of my cousin's friends decided she was bored with her newish (they were a few months old) pair of sunglasses and begged her mother for some new Ray-Bans. The same week, my cousin's sunglasses broke and she took them back to the shop to be repaired. It's a simple example but clearly demonstrates how important it is for parents to educate their children in financial literacy.

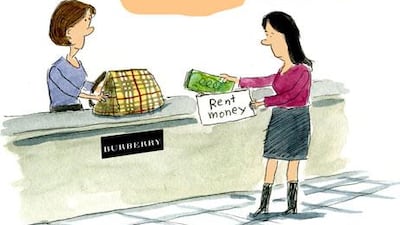

I'm not saying I was any better at 17 but I learnt a very quick lesson in money management during my first year in France. I remember receiving my first allowance, heading straight to the mall and being totally broke before the month was out. In my quest for the perfect bag, I hadn't factored in food or living expenses and had to ask my landlord for a rent extension. In the second month, I paid all the rent upfront, opened a savings account and started to save.

Today, I still save a third of my allowance and three years on can safely say I am no longer the spoilt kid with the Burberry bag. A heads-up on what was coming might have been useful. Parents take note.