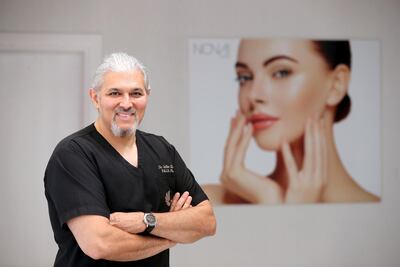

Dubai plastic surgeon Dr Jaffer Khan is medical director and head consultant of Aesthetics International and Nova Clinic. Originally from Pakistan, where he trained as well as in Ireland and England, he moved to Dubai 20 years ago, where he says he has acquired a reputation as the "king of Botox". Now 59, Dr Jaffer lives in Emirates Hills with his wife, one of their three daughters and a Labrador.

How did your upbringing shape your attitude towards money?

I was born in Karachi. I’ve got one younger brother, now a banker, and two sisters. We moved a lot; my father was an international banker. He went to open the first branch of National Bank of Pakistan in Hong Kong, then to New York, opening the first branch on Wall Street, in 1965. In 1969, we moved to the Philippines. I went to boarding school in England at 16 so got a stipend, Dh193 a term. I saved it to buy gifts to go back with. Mum was a housewife who saved. We were never fabulously wealthy but had enough. We got pocket money. My father and mother were generous with us, when you needed it. I was well grounded.

How much were you paid in your first job?

My first salary, when I finished medical school, was Dh50 a month, in 1984, in Karachi. I bought my parents a little silver gift with an inscription.

What brought you to Dubai?

The situation changed in Pakistan, as there were law and order problems. I decided to go back to the UK and stopped in Dubai to play squash with my buddy, an Emirates pilot. I stayed a few days and Welcare Hospital wanted someone to open its plastic surgery section. They offered the post and after two years I decided to go into private practice. I borrowed money from my mother to set-up. There were only three plastic surgeons in Dubai in 1988. Now we’ve 330 in the Emirates Medical Association. I went purely private in 2006.

Are you a saver or a spender?

Spender. I’m working pretty hard and don’t get much time off. When I do, I spend on holidays. The father of a friend used to say: “If you don’t spend, God’s not going to give you any more.” You should spend on yourself. What you owe your kids is a good education, if you want to leave a nest egg that’s up to you. I don’t think anyone should be born with expectation.

Where do you save?

I never focused on saving. I do Forex trading, structured products. You have to find ways to diversify yourself; invest in stock indexes or structured notes. They return a certain percentage; it’s guaranteed, there’s a coupon every quarter and your risk is only if markets drop by 50 per cent. If that happens, everyone’s in trouble.

__________

Read more:

Money & Me: 'I don’t care about the car I drive or the labels I wear'

Money & Me: 'I spend up to Dh5,000 a month on beauty and pampering'

Money & Me: 'Getting on the property ladder gave me peace of mind'

Money & Me: 'I have two start-ups to manage - my business and my baby'

__________

What is your best investment?

I talk to friends about money; we’re trying to work out the best investments. The best for me is what I understand - and that is what I do. So opening a new clinic or investing in new technology is sensible … investing in a business that’s returning to you daily. Wealth creation, for most of us, has been from property appreciation. I have a house in the UK. I invested here as well, delving into property in Dubai.

What is your philosophy towards money?

Modesty is very important. As you grow older you don’t want to be discussing what you have. I’m a strong believer in karma and nature. When you start talking about yourself in a way that you appear arrogant, or show off, that has negative impact on you. When you’re moving in certain segments of society, people spend a lot of time doing that. I like to spend time with people who are giving me stimulation in my brain, rather than hear about their next Bentley. Anybody who has been successful, 80 per cent has been luck. A few happen to be in the right place at the right time.

Is philanthropy important to you?

If you don’t give back you don’t get. That I believe very strongly. Philanthropy is something one shouldn’t really discuss; do it quietly and get on with your life. I like to do it. You can’t take it with you.

What is your most cherished purchase?

Always, when I’ve bought a car for myself. The first one I was able to afford was here in 1998, a Land Cruiser Prado. I only had the down payment. When I heard the engine … that was a memorable moment. Ten years later I bought a far more expensive car; I didn’t get the same feeling.

What are you happiest spending money on?

Travel. Most of my friends, people who are successful, are retiring and just want to see the world. It’s a radical change as you’re approaching 60. People want to spend more quality time with friends, family and less being seen somewhere. When you travel to a new country, nobody knows who you are or what you do.

Do you prefer paying in cash or by credit card?

Credit card because it’s convenient, but I pay (it off) every month.

What car do you drive?

A Rolls Royce Ghost, when I go the gym on Fridays. I don’t drive it to work; it doesn’t send the right message. My driver drives me in a BMW 7 Series, which gives me time to read notes, catch up and read the paper.

Are you wise with money?

I have some very smart friends. I learned a lot from talking to people, emulating what they do. It’s nice to learn from other people’s mistakes rather than your own. I’m still standing, so something must be right. For me the finance world is as equally interesting as what I do. If you’re smart about money, you can use your funds to generate more; a parallel income. There’s no point having a nest egg, which doesn’t do anything. If you understand the nuances, you’re more likely to be successful.

How vulnerable is your business to changing spending habits?

We, as doctors, are technically selling every day; selling ethically. Someone sits in front of you as a patient, looking for an operation …they could see five other people. There’s got to be a sales pitch in there somewhere. People who want so-called luxury services are largely doing something that is ‘extra’ anyway. It makes them feel good. They still want to feel good. At this moment, I can’t see a dip in business.

Do you plan for the future?

The nice thing about our business is you still have your patients and can work 50 per cent, travel 50 per cent. That’s something I want to do in the next two or three years. We’re trying to build this international brand, coming out of Dubai, perhaps; through international contacts, people individually successful in their own country, trying to bring them together, 30 worldwide clinics under one banner. That’s more a passion than requirement.

What would you raid your savings for?

Probably a holiday home; we go on family holidays every year. You give it first and foremost to immediate family who need it. I give to causes I think are good, but if my dear friend comes to ask for cash I have to give it to him.