Purchasing a car is one of the biggest personal finance decisions a household can make and when it comes to buying a new motor in this region, many choose quickly.

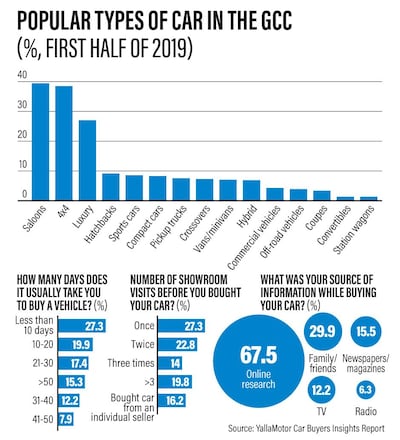

According to the Car Buyers Insights Report by YallaMotor, a subsidiary of job site Bayt.com, close to 65 per cent of GCC car buyers make their decision in less than a month, whereas in other markets such as the US or Europe, it usually takes buyers three times longer. Around 27 per cent in the region make their decision in less than 10 days. The online poll surveyed nearly 4,000 car buyers, including more than 1,500 respondents from the UAE.

“It comes to the nature of the population. We have a lot of expats who come to this country and they need their car for transportation, so that pushes them to make a decision faster,” said Jorge Bialade, general manager of YallaMotor, which started in 2012 and has an audience of over 1.3 million users per month.

Reasonable minimum salary requirements, as low as Dh3,000 per month, and access to financing also make it “a lot easier to buy in this part of the world", he added.

The GCC is an important market for global car makers with Saudi Arabia's decision to reverse a ban on women driving a year ago expected to spur car sales in the kingdom.

The YallaMotor survey found 67 per cent of GCC car buyers use online research to make a decision. That figure is even greater in the UAE at around 75 per cent.

The most trusted online sources in the GCC were third-party/unbiased portals at 35 per cent. Social media came in second with 25 per cent, distributor websites in third with 22 per cent and online magazines/blogs in fourth with 18 per cent. It differed slightly when looking specifically at women, who ranked social media first with 30 per cent, followed by third-party websites at 28 per cent.

“Online research is one of the most important factors when purchasing a vehicle…then it comes to friends and family,” Mr Bialade said.

The influence of family and friends played a main role in car-purchasing decisions in about 30 per cent of cases in the GCC and approximately 27 per cent in the UAE. Traditional mediums such as newspapers and magazines, TV and radio were much less significant, together sharing around 30 per cent in the GCC and 25 per cent in the UAE.

When it came to which model to choose, Toyota came in as king of the road among GCC car buyers, followed by Hyundai and Nissan.

The study analysed the number of page views within the first half of this year, during which more than 6 million people browsed YallaMotor.

“This information is coming 100 per cent from real car buyers, so people who effectively own a vehicle or are in the market to purchase a vehicle,” said Mr Bialade.

In looking at the showroom experience for customers, the report found that 27 per cent of car buyers only visited the showroom once and 23 per cent twice. When asked if anyone from the dealership stayed in touch throughout the sales process, 31 per cent said “not at all” and 27 per cent said “to some extent”. Only 45 per cent said they would recommend the dealer they purchased their car from to a friend.

The lack of follow-up from dealers is “astonishing", Alan Whaley, founder and chairman of Amena, the region’s first automotive association, said in the report.

“Every enquiry, be it digital or physical, must be followed up and a robust process must be put in place to decrease lost sales and ensure every opportunity is explored,” he said.

Of the three most popular brands in the GCC, Toyota had nearly double the audience of second place Hyundai, followed by Nissan. The second and third positions varied by country. For example, in the UAE Nissan came in second place and Mercedes Benz third. In Saudi Arabia, third place went to Mercedes Benz, instead of Nissan.

On the model level, the Toyota Land Cruiser is the most popular car in the region, based on the number of page views, followed by the Nissan Patrol and the Nissan Kicks. It again varied by country. In the UAE, the Range Rover came in third place instead of the Nissan Kicks. In Saudi Arabia, the crossover Kicks came in first, with the Patrol second and the more economical Honda Accord third.

The popularity of the Land Cruiser and the Patrol is no surprise, but “apparently the Kicks is making its way up,” said Mr Bialade. “You have the best of both worlds. It’s fuel efficient and cost effective – something that has become very important for buyers.”

Among the 1.33 million users in the first half of this year belonging to the in-market buyer segment - those identified as actively looking to buy a car rather than just browsing - the three most popular categories of cars were saloons at close to 40 per cent, 4x4s at around 39 per cent and luxury cars at 27 per cent. The hybrid market was small at around 7 per cent, but gaining traction.

According to the study, Chinese brands such as MG Motor, Geely and GAC are also gaining popularity in the market, capturing a 5.6 per cent interest share within the GCC car-buying community.

“More Chinese brands have launched in the UAE and in the region … and once the Chinese brands come, they come strong,” said Mr Bialade. “Their products are becoming a lot more interesting when it comes to quality.