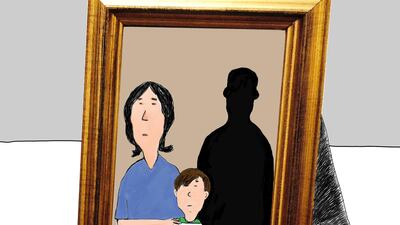

When, and how, do you tell a child their father killed himself. I don’t think anyone is ever ‘ready’ for this sort of news.

Considered a deliberate act, suicide begs so many questions – that will never be answered. I say ‘considered deliberate’ because people who commit suicide are often coping with mental illness and compromised cognitive capacity - which means just that - that they are compromised in their thinking and decisions.

Perhaps the worst thing for the children in this particular case is that, not only do they lose their father, but they’ll also lose their mother - to work. With two young boys at school, rent to pay, and life’s necessities to fund, she must find a job, and quick. She was not working prior to the death.

I wonder if her husband had life insurance – and if he did, whether it will pay out due to the nature of his departure.

What we do know is that this person had financial problems, was self-employed, and believed that his family would be ‘better off without him’.

A study by Southampton University in the UK found that people who commit suicide are eight times more likely to be in debt.

Insuring against death prematurely is important - I mean accidental, or due to illness. I hope suicide never features in your universe. Adequate provision upon your untimely departure means the remaining parent can be there for children during a time of emotional turmoil.

Unfortunately, seismic changes to family life are seldom contained or compartmentalised. It’s one thing to have to deal with something final - like death - and another to have to scramble to keep life ticking over financially. I go back to the line that children do not just lose the parent that dies, they lose the other to work - just when they need them most - even if they were working before. The parent left to care for the children needs to find the capacity to process and progress with a life that has changed so much. If they cannot afford to stay where they are, vital support networks and friendships are disrupted too.

_______

Read more from Nima Abu Wardeh:

A cautionary tale about hankering after a fairy-tale home

Give your child time and the right education rather than hard cash

It takes true grit and perseverance to achieve real financial success

We must prevent our children from being hypnotised by advertising

_______

It is not just death that has this impact. The D that is divorce has a similar effect in many ways. Not the finality of death, but the loss of both parents - in different ways.

I know of a situation where, in the interest of their child, the father agreed to pay for his former wife’s life expenses until the child finished school. The child has health needs that mean she cannot simply walk away and go to work after dropping off at the school gates. Add to this that she was the provider during their marriage, and wants her ‘turn’ as she puts it. She wants to be available for her child when and if needed. And to be present not only physically, but emotionally and mentally too.

The agreement has not materialised, as the father will not sign legal documents to the effect, nor does he provide enough to cover the cost of life.

The result: a mother who wants to provide for her child while he is young – not the monetary things, but the stuff that money can’t buy – like security, emotional safety and stability. She is scraping the very bottom of her savings barrel to do so.

The cruel irony is that her savings were depleted severely before the divorce – due to the then husband having his ‘turn’ - for a decade - and using it for what she was told was bonafide business. It wasn’t. The money has gone. Even if her savings had not been spirited away, I believe she should be provided for while she is the primary carer of her child.

These two stories are different. Death is not divorce, but they are similar in that, if the right provision is not made, this happens: children lose both parents.

I am not writing about how to seek help, and what you can do if you’re in debt. I’m focusing on the fallout from it if the parent raising children is left without enough money.

According to a study by Payoff, a US company that states its mission is to supports members in achieving financial wellness, a quarter of people living in the US experience extreme financial stress, and their symptoms mirror those of post traumatic stress disorder. It’s debilitating and a horrible way to live.

Don’t let the D of either death or divorce mean financial stress, or ruin, for the one left to look out for, and after, young ones. It’s not just about him or her living with PTSD or any form of financial stress, it’s also about the bonds and relationships between children and each parent, and the common case of self-blame children inflict upon themselves for parents not being together, or there for them.

When do you tell a child their parent cheated on the other. Financially and or emotionally.

When do you tell a child their parent’s death was by suicide.

When do you shatter a child’s world and their view of their parent as saviour, support and super hero.

Hopefully never. Telling a half truth is often seen as a way to protect, but it usually invites future problems. If we share what it means to be human, the truth – age appropriate, drip-drip or whatever fashion you believe best - they’ll learn they can love, be loved, and that the messy life of others isn’t their fault.

Nima Abu Wardeh is a broadcast journalist, columnist and blogger. Share her journey on finding-nima.com