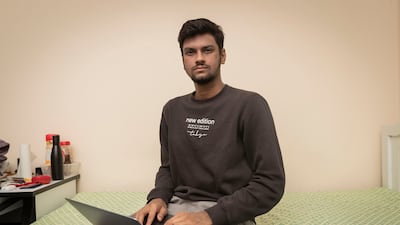

Abdul Taiyyeb, 28, works as a content creator in Dubai. He is originally from Mumbai and lives in Al Barsha, Dubai.

AT, as he prefers to be called, worked in the advertising industry in India after graduating with a degree in mass media with a specialisation in advertising.

He’s been in the UAE for 18 months and has a golden visa in the creative category.

He has no financial dependents since his parents passed away. His father was an accountant and his mum was a homemaker.

How much did you earn in your first job?

My first job was as a receptionist while I was studying in college. The job paid me 5,000 Indian rupees ($60) a month. It was a summer internship and I worked there for two months.

My first actual job was as a copywriter in an ad agency in 2017, just after graduating from college. I earned a monthly salary of 15,200 Indian rupees. I worked there for less than a year.

After that, I moved on to freelancing as a content writer. The income I earned from this job was very up and down. I never made the same amount every month.

I gave up a permanent job for freelancing because it offered me freedom and allowed me to function on my own time. I did this for almost three years.

Did you move to the UAE with a job?

For the past seven or eight years, I’ve wanted to move to the UAE, specifically Dubai.

My experience was in advertising and content writing. So, I applied for jobs in those industries. I tried a couple of times and got a few interviews, but nothing worked out.

So, I went back home. Then I came across this opportunity to work as a game master at a board game cafe in Dubai. I was recruited from Mumbai.

My job was to teach people board games. I've been interested in board games for a decade.

I thought this job was the perfect opportunity as it would allow me to live in the city of my dreams.

My cousin recommended me for the role and they were looking to hire someone on an urgent basis as the summer months were very busy at the cafe.

I was earning Dh2,500 ($680) for the game master role. I worked there for 11.5 months, but after four months, I decided to work part-time because I was able to monetise my content creation skills.

What does a content creator’s role involve?

I am not trying to influence anybody to do or buy something. I’m just trying to create my own content. I became a full-time content creator in June this year.

Why did you decide to quit a permanent job?

I had a small disagreement with my boss and got fired.

What is your income now?

My income has been up and down since I quit my permanent job. When I was working part-time as a game master over the weekend, I was earning Dh1,500. That helped me to pay rent and meet basic necessities.

But since then, it’s been very variable income. On average, I earn about Dh2,000 a month or between Dh2,200 and Dh2,500 during a good month.

I work with brands and that’s my sole source of income.

What kind of content do you produce?

I mainly make vlogs of my daily life in Dubai. I have collaborated with hotels, instant shopping and delivery apps, telecommunication companies and cloud kitchens, among others.

My content creation journey started with watching videos on YouTube. I felt that even I could put something out that people would want to watch.

I never wanted to be a vlogger. I initially tried different genres like tech and gaming.

How do you deal with the ups and downs in your finances?

I don’t think there is such a thing as a bad day or a bad month. It’s all part of the journey.

For instance, last month, I was down to Dh140 or Dh150. But I was hopeful because a couple of companies were yet to process my payments which were getting delayed.

I wasn’t stressed but did worry sometimes. When it comes to such a situation, you automatically go into survival mode and cut down on whatever you feel is unnecessary.

My absolute necessity is food. If I don’t need to go to a place urgently, I walk to save Dh3 to Dh5 on the Metro.

What are your future plans?

I would like to try to find a way to sustain myself as a content creator. I need to stay motivated because it’s not consistent income. It’s like riding a roller coaster.

Do you own property?

I have inherited my father’s studio apartment in Bhindi Bazaar, Mumbai. I haven’t rented it out since there are far too many memories associated with the place.

Do you have any debt?

I do not have any personal loans or credit cards, but I owe money to a family member. I’ve already paid some portion of this debt.

I use a debit card in Dubai and used a credit card in India. But I was very thorough about paying it off at the beginning of every month. My father always warned me against getting into a cycle of debt.

Even if I use my credit card now to pay bills in India, such as my phone bills to keep my number active, I pay it off immediately.

Have you ever inherited a sum of money?

I inherited some money from my father. I used some of it to pay off my debt.

I tried not to use it as much as I could because I thought it would be useful later. I tried to rely on the money I was making.

Were you taught how to handle your finances as a child?

Yes, my parents, especially my mum, taught me the basics. They taught me not to spend on anything I did not need.

When I was a teenager, I had the temptation to buy things impulsively but tried to manage as best as I could.

After my father passed away, I've been trying to be careful and mature about handling money because I don't have anybody to fall back on.

What are your major monthly expenses?

In Dubai, my biggest expense is the rent.

I know that Dh2,500 is considered to be a low income here. But the good thing that came out of it is I learnt how to manage my expenses very carefully.

I have tried to save and only invest in things that would help me improve my content creation. For instance, I invested about Dh5,000 on my golden visa, then my iPhone and MacBook. I recently purchased Air Pods on an impulse, but they were not very expensive.

How do you budget your monthly income?

I try to set aside Dh500 for my monthly expenses, take my rent out and the remaining goes toward savings.

It has worked out well for me because after I started working part-time, I only had money for necessities.

So, even during months I did not get paid, I still had my savings to fall back on from earlier months.

I do not have any savings in the UAE. I make money, spend it on my necessities and try to reinvest what is remaining into my content creation business, as I want to sustain myself in this profession.

Is it important to have some savings to fall back on?

It depends on your mindset. It doesn't bother me that I do not have savings. I am ready to deal with whatever comes.

A responsible adult would say yes to that question, but I care most about my dream.

When do you want to retire?

If I'm creating content, I do not want to retire. If I'm doing something else, then I might want to retire by my late 40s.

content creator

Do you worry about money?

I do not care about money. It’s just a tool to get you things, for some, it might be happiness or travel.

For me, living as a content creator and trying to sustain myself for the rest of my life in Dubai is what I care about.

What are your financial goals?

Long term, I want to be more financially healthy and have some savings and an emergency fund.

The next thing I would like to do is get a driver's licence and perhaps get a car. It would help me be more efficient, so I’m looking at it as a business expense.

What is your idea of financial freedom?

Having the liberty of a slow morning on a Monday or Tuesday.

Do you want to be featured in My Salary, a weekly column that explores how people around the world manage their earnings? Write to pf@thenationalnews.com to share your story