When Mohammad AlMheiri and Badr AlBadr founded Splintr, their buy now, pay later (BNPL) start-up in Dubai in 2019, their aim was to encourage financial inclusion and help users to learn smart money skills to better manage their finances.

However, taking the traditional BNPL business model — which typically allows consumers to make online purchases instantly and spread payments over a series of interest-free instalments — to the next level was also at the forefront of their ambitions to stand out from what has begun to become a crowded market in the Middle East.

While Splintr will offer customers the typical BNPL payment model, it will also feature a “try now, buy later” option and not charge late fees for missed payments, says Mr AlMheiri, the Emirati chief executive of the start-up, who has a background in FinTech and e-commerce.

“We think of ourselves as a bit different from what exists currently on the market,” he says.

“The second payment experience is a try-before-you-buy experience, where you get to buy whatever you want online, pay a fraction of the total amount, and then get the order shipped to your home, keep what you want and return what you don't without being charged for the whole product.”

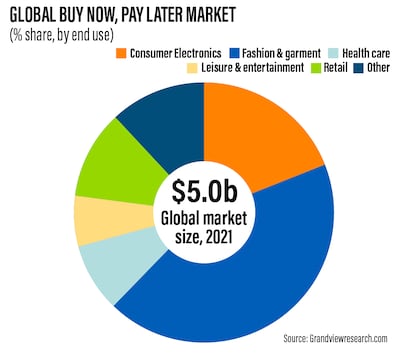

The global BNPL sector has boomed since the Covid-19 pandemic began in 2020, as consumers switched to shopping online during movement restrictions.

In the UAE, the BNPL sector is expected to surge about 89 per cent on an annual basis to reach $1.8 billion in 2022, according to a report by Research and Markets.

“This shift in the overall consumer behaviour, along with the rise of digital payment solutions, is resulting in buy now, pay later becoming one of the fastest-growing payment methods in the country,” the report says.

About half of all consumers in the UAE expect to shop online more often while 60 per cent of respondents prefer digital payment channels rather than cash on delivery, according to a survey by Checkout.com.

Established BNPL players in the UAE include Mubadala-backed Tabby, which raised $150 million in debt financing last month, as well as Postpay, Cashew, Spotii and Tamara.

The world’s biggest BNPL companies include Sweden’s Klarna, Australia’s Afterpay and the San Francisco-based Affirm.

Apple has also hitched a ride on the BNPL bandwagon, announcing at its annual Worldwide Developers Conference in June that Apple Pay Later will be built into Apple Wallet and come with the iOS 16 iPhone operating system, which is expected to be released next Wednesday.

____________

Watch: Here are Apple's newest innovations from WDCC 2022

While the global BNPL sector has faced challenges this year due to the global economic uncertainty, the industry is expected to grow 10 to 15 times its current volume by 2025, topping $1 trillion in annual gross merchandise volume, according to a report by New York data research consultancy CB Insights.

“This growth trajectory has incumbents paying close attention and increasing their efforts to improve the digital user experience,” the report says.

Meanwhile, global BNPL transaction values are projected to grow to $576 billion by 2026, from $120bn in 2021, according to data analytics company GlobalData.

The BNPL sector accounted for 2.3 per cent of the global e-commerce market in 2021, with $2 out of every $100 spent going towards a BNPL transaction, the report said, with millennials and Generation Z driving the adoption of BNPL payments.

The market is “extremely huge” — and there is room for new BNPL companies that offer something different from established players, Splintr’s Mr AlMheiri says

“I give credit to the first wave of BNPLs that are raising that level of awareness, but I think now it's our turn to introduce BNPL in its pure form — as a finance management tool,” he says.

“Our road map, essentially, is designed towards building a payment solution for the customer; we can do this not only with e-commerce, but across different verticals.”

Mr AlMheiri and Mr AlBadr initially bootstrapped Splintr, which is an amalgamation of the words “splinter” and “transaction”.

Since then, however, they have raised an undisclosed seven-figure-dollar sum through their network of angel investors, family and friends, which has been used to build the app and hire a “very talented team”.

The partners expect to launch Splintr, which is licensed through the Dubai International Financial Centre, in the next few weeks in Saudi Arabia and across the UAE, the Arab world’s two largest economies.

Its revenue model is based on charging merchants for transactions, while customers can choose either three, four or six monthly instalment plans.

Splintr is avoiding signing up big-name retailers to the platform, instead choosing to focus on working with small to medium merchants to offer an “excellent level of service not only to the customer but also to the merchant”, Mr AlMheiri says.

“Our approach to merchants was quite a bit different … currently, we have a decent number of merchants. It is growing on a weekly basis — the uptake is unbelievable,” he says.

Through the launch of Splintr, Mr AlMheiri is also hoping to inspire the BNPL industry to cut its late fee penalty charges and change how it markets itself.

co-founder and chief executive of Splintr

“BNPLs shouldn't be marketed as ‘buy what you can't afford’,” he says.

“It should be marketed as plan your finances better, split those payments over whatever period works best for you.

“[They] should also build a true transparent solution for customers — when you say no hidden fees, that means no late fees. Splintr is the only one that doesn't charge fees and I encourage everyone else to do the same … customers get to enjoy our services at no cost at all.”

Meanwhile, the long-term goal for Splintr is to become the region's next Apple Pay, Mr AlMheiri says.

“I think what Apple Pay did to payments is unprecedented, regionally and globally. And I do aspire to become the Apple Pay of belief,” he says.

“I want Splintr to grow in a way where it is essential and it is used by every customer purely for convenience, something you trust, you believe in and you use in your everyday life.”

Q&A with Mohammad AlMheiri, co-founder and chief executive of Splintr

Who is your role model?

My late father has to be my first role model. He enlisted in me most of the values I go by today. He was fortunate enough to be one of the few men to work closely with His Highness Sheikh Rashid bin Saeed Al Maktoum in the early days of Dubai, so a big chunk of my childhood was hearing stories about how Sheikh Rashid conducted himself, how he conducted the people around him and Sheikh Rashid just kept on delivering on that role model I look up to.

_____________

Watch: Tributes mark Sheikh Rashid's 30th death anniversary

What was the biggest lesson you have learnt in setting up Splintr?

People are a crucial part [of start-ups] and that is not being spoken about in the founder ecosystem. You think it's the money, you think it's the tech, you think it's the market, but it's the people. You have to have the right people around you … and the right network. You also need to have the ability to learn how you might choose the wrong people to work with initially.

If you had a chance to do it all over again, what would you do differently?

I don't think there is anything specific or different. I feel we are positioned exactly where I want us to be positioned.

There were many things out of my control — working 10 hours, the shift in the venture capital culture that we had, that generous period.

Now everyone, to an extent, is becoming more conservative, looking for true value in their investments. I think this is excellent for us as now we are entering a phase with both the venture side and the start-up side that is way more realistic, which works to our benefit, [with] clear goals and a clear path to profitability.

Did the pandemic affect your business?

It definitely had a good impact on the ecosystem in terms of acceleration. But that acceleration was way too fast and will now slow down over the next couple of years. The pandemic definitely changed me. I wasn't — let's say — a big believer in remote work but I have been working from my home office since the pandemic started.

My entire team is distributed internationally, not only locally. So, I think that the pandemic changed my mind.

Where do you see the company in the next five years?

I would love for us to be — and I believe we will be — the next Apple Pay in the region. We will be as convenient as Apple Pay. But that's way beyond five years.

Our goal is to build something that would last for 100 years … I know that is too ambitious but that is where we have to set the goal. Credit cards were introduced back in the 1930s. They still exist today and it's a relatively simple [payment method].

We are on a track to change the way payments are done. That is what we want to achieve and hopefully we will, inshallah.