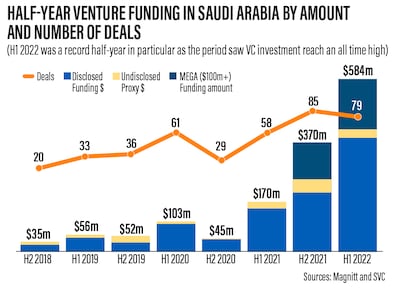

Venture capital funding in Saudi Arabia surged more than threefold to $584 million in the first half of 2022, surpassing the total for the whole of 2021, as the kingdom continues to accelerate its digital transformation projects, a new report has indicated.

The 244 per cent jump in total VC funding in the Arab world's biggest economy through the end of June 2022 resulted in investments that were 8 per cent higher compared to 2021's total, backed by a record 88 investors who funded Saudi start-ups, according to start-up data platform Magnitt's Venture Capital Report in collaboration with Saudi Venture Capital (SVC).

The performance allowed the kingdom to maintain its second position in overall funding in the Middle East and North Africa region for the third consecutive half-year, behind only the UAE, which remained on top with $699m. Egypt with $307m, Bahrain ($116m) and Tunisia ($36m) rounded out the top-five markets for funding.

Saudi Arabia also ranked second in the number of deals closed, growing 36 per cent to 79, surpassing Egypt, which fell to third with 78 deals. The UAE topped the charts with 85 deals, a growth of 10 per cent over the first half of 2021.

The recent availability of venture debt and the increasing number of high-quality accelerators are the critical factors contributing to the growing Saudi VC ecosystem, Khaled Alsuraisry, head of co-investment in start-ups at SVC, wrote in the report.

"It is all starting to come together for the Saudi ecosystem" Mr Alsuraisry said. "Exits are being materialised, investors across the globe are flocking to the market and regulations are continuously changing to accommodate disruptive start-ups, all signaling for a breeding ground for start-ups that is Saudi Arabia."

Technology is a strong pillar of Saudi Vision 2030, the national strategy aimed at diversifying the country's economy and steering away from dependence on oil. Riyadh is encouraging entrepreneurship and seeking investment from both local and foreign entities to develop the sector.

The world's top oil exporter is projected to spend about $33bn on ICT development in 2022, the International Data Corporation says. The sector grew 8 per cent between 2019 and 2021.

Saudi Crown Prince Mohammed bin Salman this month unveiled a new programme for the research, development and innovation (RDI) sector, which aims to add 60 billion riyals ($16bn) to the kingdom's gross domestic product by 2040.

The National Aspirations and Priorities for RDI initiative will entail an annual investment equal to 2.5 per cent of the country's GDP in 2040, creating “high-value” jobs in science and technology.

Saudi Arabia is also developing Neom, the $500bn futuristic mega city that is being built around technology and innovation, a critical part of its Vision 2030 strategy.

"The entire business community in the kingdom is embracing the digital revolution. Large corporates and investors alike recognise the critical role of ventures in the development of the digital ecosystem," Yousef AlYousefi, managing partner S3 Ventures, said in the Magnitt report.

"These phenomena, combined with the massive rise in local and global investor interest, a shortage in talent and the strong desire of established corporates to participate call for innovative solutions that are designed to unlock further potential in the Saudi venture capital ecosystem."

The food and beverage sector led the VC funding in the kingdom in the first half of 2022, surging almost sevenfold to $187m compared with the year-ago period. It was driven by the $170m Series C investment in Riyadh-based aggregator Foodics, which was Saudi Arabia's second mega round, or funding with a value of more than $100m.

Other top funding rounds were from e-commerce platform Nana ($50m), logistics provider Trukker ($46m), IT solutions company Master Works ($40m) and finance gateway Hyper Pay ($37m).

Financial technology, the erstwhile No 1 category, slipped to the second spot, but funding still rose 137 per cent to $95m, followed by transport and logistics, which surged more than tenfold to $67m. E-commerce ($66m) and IT solutions ($42m) comprised the rest of the top sectors.

FinTech led in terms of deals, closing 17 deals to grow 31 per cent compared to the first half of 2021. Transport and logistics with 12 deals, and e-commerce and enterprise software sectors with eight deals each, all grew by at least a third, while deals in F&B doubled to six.

A total of 78 Saudi Arabia-based start-ups received funding in the first half of 2022, Magnitt said.

The number of active investors, meanwhile, grew 12 per cent, with global oil major Saudi Aramco, Saudi Venture Capital Company, Riyadh-based Seedra Ventures and Impact 46, and Abu Dhabi's Shorooq Partners the top funding entities with six or more deals.