About 55 per cent of UAE residents polled in a survey said they would have no problem switching to a new bank, a report by management consultancy Boston Consulting Group shows.

Sixty-six per cent of bank customers in the UAE are also actively looking for new offers, the research that polled more than 2,000 people in the Emirates this year found.

“In the UAE, we see that most customers have multiple banking relationships, which is understandable when one considers the significant expectations people now have of their banks,” Mohammad Khan, partner at BCG, said.

“Two-thirds of survey respondents proactively search for offerings that provide better value and over half would not be hesitant before opting for a different bank altogether.”

The rise of FinTech companies and an increasingly digital-savvy consumer base have forced banks globally to invest in digitalisation. The Covid-19 pandemic has further hastened the move to digital services as consumers opt for cashless payments and online shopping.

About 69 per cent of banks in Europe, the Middle East and Africa believe they will lose market share within two years unless they make significant progress in their digital transformation, a September report by cloud banking platform Mambu and The Financial Times Focus said.

More than 20 per cent of UAE consumers changed banks within the past 12 months, according to the BCG report. High interest rates, products not meeting personal needs and poor customer service were cited as the top reasons driving attrition among leading banks in the UAE, the report said.

managing director and senior partner, BCG

Alternatively, excellent customer service, superb digital experience and strong brand reputation were cited as the main reasons that would compel customers to recommend their banks to friends and family, the BCG research showed.

“With numerous factors behind consumers’ decisions to switch banks, there is unquestionably room for improvement,” Mr Khan said.

“Leading banks offering excellent service via digital have set the latest industry benchmark, and this is something those currently behind should aspire to emulate not only for customer retention and attraction purposes but also for brand development.”

About 88 per cent of customers in the UAE are also now willing to open a digital-only bank account, the BCG study found.

Meanwhile, bank branch visits declined by 5 per cent compared to a year ago, while mobile and online banking usage increased by 10 per cent since 2020, the study revealed.

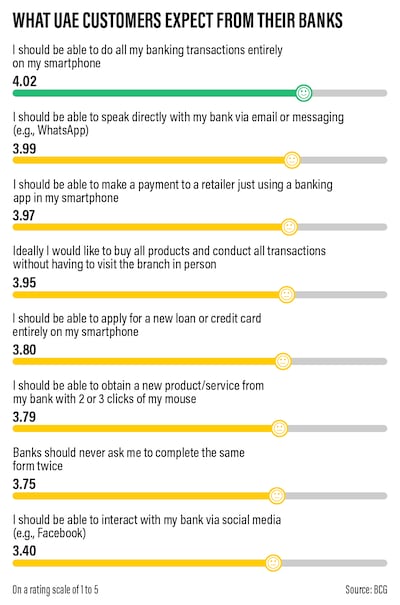

The most important features for digital banks are instant account opening, easy bill payments, personalised offers, instant online credit cards and peer-to-peer payments, the respondents said.

“Due to acceleration of digital transformation, consumers now expect empowerment and convenience through the provision of seamless services,” said Markus Massi, managing director and senior partner at BCG. “This is reflected by such a high willingness to open digital-only accounts, which is a trend we do not anticipate receding.”

Digital-only banks are not a new concept in the UAE. In 2017, Emirates NBD launched Liv.bank to cater to millennials. Mashreq, Dubai’s oldest lender, also unveiled Mashreq Neo the same year.

Abu Dhabi Islamic Bank, the biggest Sharia-compliant lender in the emirate, launched a digital-only bank called Amwali in August this year to tap into the UAE’s growing segment of tech-savvy youths aged between 8 and 18.

Independent digital banks are also entering the market, including Al Maryah Community Bank, which secured a licence from the Central Bank of the UAE in April this year.

This was followed by the launch of digital bank, Zand, which caters to retail and corporate clients.

ADQ, the conglomerate that owns Abu Dhabi government stakes in a range of businesses, also revealed plans last year to set up a digital bank in the UAE using a legacy banking licence held by First Abu Dhabi Bank.