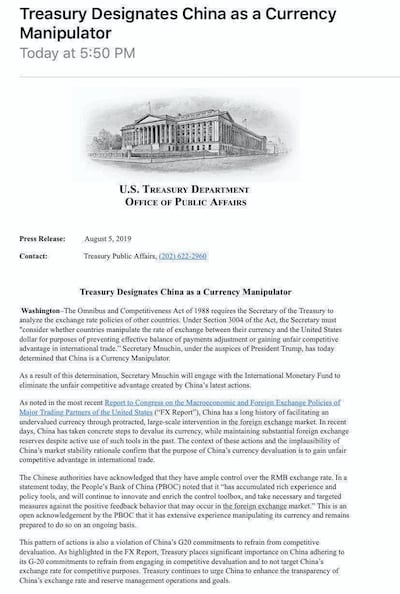

US President Donald Trump's announcement to slap 10 per cent of additional tariffs on $300 billion (Dh1.1 trillion) of Chinese imports in September and the subsequent decision by Beijing to let the yuan depreciate past the 7 yuan mark against the dollar (its lowest level in 10 years) prompted the US Treasury to designate China as a currency manipulator on Monday, jolting markets and wiping out billions of dollars.

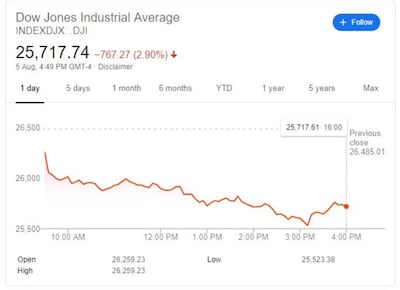

The S&P500 fell 2.9 per cent, the Dow Jones shed 2.9 per cent and the Nasdaq tumbled 3.4 per cent, raising concerns that the world's two largest economies are not any closer to resolving their trade differences that have crimped global economic growth.

Mr Trump added fuel to the fire by upping the pressure on the Federal Reserve to act to offset China's alleged currency manipulation.

Below are the reactions and assessments of analysts on the latest developments that also led the world's wealthiest 500 people to lose 2.1 per cent of their collective net worth on Monday as US stocks plunged in their biggest drop this year:

The World Bank's country director for China Bert Hofman tweeted the US decision to designate China as a currency manipulator was not justified and did not meet the criteria of a manipulator.

Mohamed El Erian, chief economic adviser of Allianz and former chief executive of Pimco, said Mr Trump's reaction is consistent with his expectation of further escalation of trade tensions and of global monetary easing.

Nobel Prize winning economist and New York University professor Nouriel Roubini said the latest developments do not bode well for the global economy and suggest the US-China trade war will escalate. "This is the beginning of de-globalisation and balkanisation of the global economy and de-coupling between the US and China. No wonder we are back in risk-off mode markets are sharply down. Even Fed easing cannot backstop markets hit by a double negative supply shock: trade and tech war," he said.

Former US Treasury Secretary and Harvard professor Lawrence Summers said the rising tensions between Washington and Beijing "may well be at the most dangerous financial moment since the 2009 financial crisis".

"Our assessment of Mr Trump's latest trade salvo [10 per cent tariffs on remaining $300bn of goods] is that it represents a fundamental miscalculation on his part. Contrary to his belief that levies are the best way to make Beijing comply with US demands, the Chinese leaders are only likely to harden battle lines as a result to avoid appearing weak. Consequently, the odds of a partial trade resolution before the 2020 US elections have decreased," said Eli Lee, head of investment strategy, Bank of Singapore.